MORNING AG OUTLOOK

Grains are mixed to lower. US stocks are slightly lower. US Dollar is slightly lower. Crude is slightly higher but near $68. Gold is slightly higher.

SOYBEANS

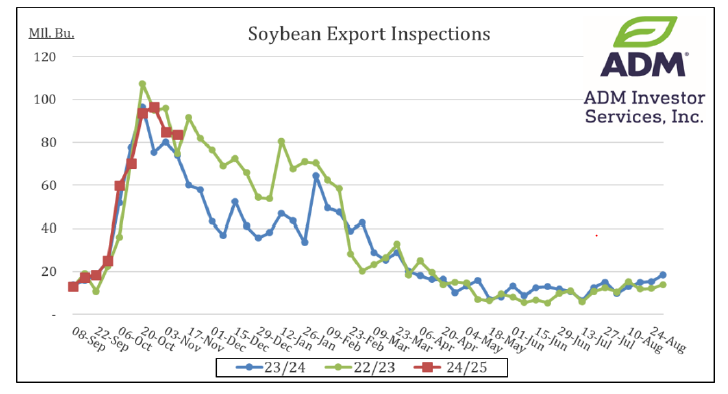

SH is near 10.21. BOH is near 46 cents. Dalian soybean, soymeal futures were lower. Dalian soyoil and palmoil were sharply lower as collapse in World vegoil prices are correcting overbought tech picture. US exports are up 6 pct vs ly and vs USDA up 8. C/N Brazil seeing rains. S Brazil next week. Argentina dry. Bears are still looking for lower soybean futures due to record high South America supplies and lower China demand for US soybeans. China crusher est total soybean imports at 100 mmt vs USDA 109. Jan-Mar soybean spread at 4.40 largest carry in 14 seasons. Nearby soybean futures never traded over 9.00 during previous Trump Presidency and averaged 8.00.

CORN

CH is near 4.40. Dalian corn futures were higher. Some look for nearby corn futures are near key resistance. US exports are up 34 pct vs USDA up 1. US and Ukraine export prices lower than Brazil. N/C Brazil weather remains favorable for crops. S Brazil could get rains. Argentina weather drier. Futures have rallied on a need to buy cash corn for increase US export and ethanol demand. CZ-CH spread is firmer. US domestic processors bids are firm. USDA announced 110.5 mt US corn to Mexico.

WHEAT

WH is near 5.65. KWH is near 5.59. MWH is near 6.00. US exports are up 35 pct vs USDA up 17. Good rains have fallen across US HRW plains. This has increased US HRW farmer selling. Higher US Dollar, Australia and Argentina harvest offers resistance. 11.5 Argentina wheat lowest export price. Australia futures are lower and testing recent lows. Nov Russia exports could be down from Oct but season to date pace near or above record. Russia 12.5 pct price near 224 lowest export price. World destination buying is slow. USDA rated US winter wheat crop 44 pct G/E vs 41 last week and 47 last year. KS 47 vs 40 last week, OK 28 vs 31, MO 74 vs 61.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.