STOCK INDEX FUTURES

S&P 500: The market managed to absorb Tuesdays steep gains with a consolidation on Wednesday and even though the market closed lower, the trend remains up with plenty of optimism and plenty of pent up demand in the market. At this point, while a bit overbought there does not seem to be a need for long liquidation. Uptrend channel support off of the November lows comes in at 3605.60, with 3668.00 and 3729.60 as next upside targets for the December E-mini S&P. There is plenty of longer-term optimism for the market to absorb and plenty of money on the sidelines to propel stocks higher over the near-term. Keep 30,465 as next target for the Dow.

CURRENCY FUTURES

The Dollar index is finding mild pressure coming into this morning’s action, but it continues to hold in a fairly tight range just above Wednesday’s 12-week low. While Wednesday’s large set of US data showed mixed results, the higher than expected jobless claims readings and lower than forecast personal income result generated the most market headlines. In addition, the FOMC meeting minutes pointed toward the Fed purchasing more long-term Treasuries, and that should also weigh on the Dollar going into the weekend. Near-term resistance for the Dollar is at 92.25, and we suggest traders sell rallies in the December dollar back to 92.55 as we are expecting the market to fall below 91.75 and reach a 2020 low during the weeks ahead. While there are no US economic numbers to digest today, improving global risk sentiment could be the catalyst for the Dollar to reach a new 12-week low this morning.

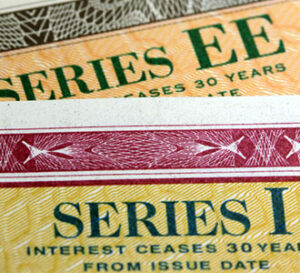

INTEREST RATES

Treasury prices continue to see coiling price action as they were unable to hold onto early support and finished Wednesday near unchanged levels, but they have regained their strength and are posting moderate gains coming into this morning’s action. Initial weakness on Wednesday was rejected through a sizable US scheduled report slate which was highlighted by a second week of disappointing US claims readings with ongoing claims higher than forecast while initial claims posted a surprise uptick. Although there were better than expected results from durable goods, personal spending and new home sales, those data points were offset by weaker than forecast results from personal income and consumer sentiment. When combined with Wednesday’s midmorning slide in equities, this may have prompted some fresh speculative buying. Even with US equity markets below Wednesday’s high, they are finding mild support this morning with the Dow Jones and S&P holding in close proximity to recent highs, and that could weigh on Treasuries going into the weekend.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.