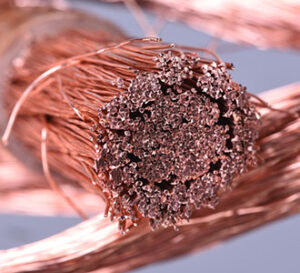

COPPER

Apparently, the copper market has shifted sentiment with respect to China, as the country announced it would reduce its bank reserve ratio requirements with that news a bullish surprise. However, the announcement is the first substantial stimulus applied by the government in many weeks. It is also likely that the Chinese stimulus announcement has lifted most physical commodity markets this morning and could continue to lift commodity prices ahead. More importantly the ratio reduction has lifted the Chinese currency and in turn weakened the US dollar. The market is also deriving speculative buying interest from chatter that the Chinese government might have further stimulus action in the pipeline. In fact, there are news reports that that Chinese government was considering a “sizable” stimulus package for their equity markets which led to a sizable rebound in Chinese stocks yesterday and has sparked more gains this morning. A chain of gains in Chinese equities will provide carryover support to the copper market as that may lead to stronger Chinese copper demand in the second half of the first quarter of this year.

GOLD / SILVER

With outside market forces of lower US rates and a weaker US dollar, both gold and silver start the Wednesday trade with a relatively strong bid. In fact, as of this writing the dollar sat just above a downside breakout and a six-day low which could result in gold and silver adding to the early noted gains. For a change, the silver market could take a leadership role with Fresnillo projecting 2024 silver production to be 7 million ounces below 2023. Unfortunately for the bull camp, Fresnillo also posted a 13% year-over-year increase in silver production for 2023. Furthermore, yesterday silver ETF holdings jumped by more than 15.9 million ounces in what was probably a bet by a fund or a large investor. It is also possible that metals and other commodities are drafting fresh lift from improving global macroeconomic sentiment as global equity markets continue to rise sharply and in turn improve psychology among consumers. While the recent increase in Indian gold and gold findings duties will negatively impact Indian consumption, J.P. Morgan forecast increased investment demand for gold this year which should partially offset the bearish Indian news. Unfortunately, the best projection for gold price action today is for further coiling with today’s US economic report slate mostly third tier data points and risk on in equities merely cushioning gold and silver demand hopes instead of ratcheting them higher.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.