MORNING COMMENTS

Geopolitics:

A Russian missile struck a civilian grain vessel in the Black Sea early Thursday. The vessel was caring wheat from Ukraine to Egypt and it was the first attack on a civilian vessel since the the start of this conflict in February of 2022. This incident happened not too far off the shores of a NATO allie, Romania. Russia’s President Putin recently stated that if the NATO allies provide Ukraine with longer range weapons, it would be considered an at of war against Russia. Ukraine’s Zelensky continues to ask for more weapons and more assistance from the West. I suspect NATO will continue to tip toe around this war hoping it resolves itself without too much bloodshed. Wheat prices are up on the news this morning.

Macroeconomics:

Members of the International Longshoreman’s Association are tossing around the idea of a strike across 13 of the United State’s major East Coast and Gulf Cost ports. Billions and billions worth of goods including agriculture products could be affected by this strike. 43% of all US imports fall under their umbrella and this would be a bad time of the year for a strike to take place. Harvest is starting in the Midwest and logistics are already tight, not to mention the strike has the potential to disrupt companies wanting to stockpile goods before the holiday season a couple months away.

Ag Fundamentals:

It’s that time of year again! Harvest is here and we are starting to hear yields coming off the combine. The Delta region had a good growing season with very few weather complications through the summer. Tennessee had been dry at times, but the Mid-South is expecting an average to an above average harvest and they are seeing yields reflecting that sentiment. The Delta, Mid-south, and into parts of the southern half of the Midwest are reporting average yields. 160-165 bushels per ace in TN/AR/MS. Southern Indiana, Kentucky, Southern Illinois, and southeast Missouri are also seeing average corn yields at 170-175 bushels per ace. I think we won’t start hearing about bin-busting yields until harvest begins in the northern portions of the I-states. Managed money covered shorts across the agricultural space last week and i suspect this week’s COT report will reflect the same. Mexico is nearing record corn imports and with reports of Latin American economies doing well, Mexico is expected to import another record amount of corn next year too.

Weather:

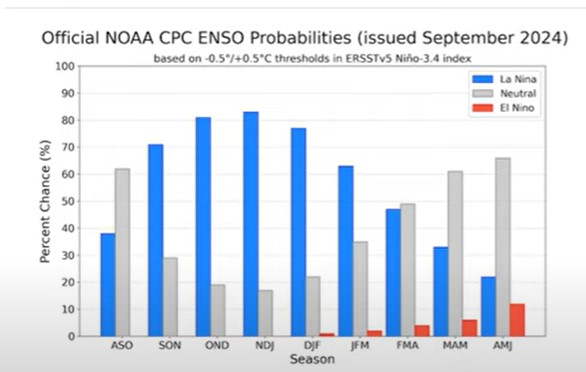

Temperatures are expected to range from 65 to 85 degrees across the Midwest and northern plains this weekend into next week. Rains from Francine will not reach higher than the southern tip of Illinois. La Nina is expected to return and be the driving force behind weather here and in south America. Below is a chart of the probability of the La Nina pattern over the next year. With this being the case, we can expect drier than normal conditions in the southern half of the country and average to slightly above average precip in the north. Brazil may be in trouble. We will start to hone in on their weather through the rest of September and into October when the monsoon season could help ignite their planting season.

Export & World News

There is a Reuters rumor that Egypt bought 430K MT of wheat from Russia for October shipment in a private deal.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.