OPENING COMMENTS

Ag Fundamentals:

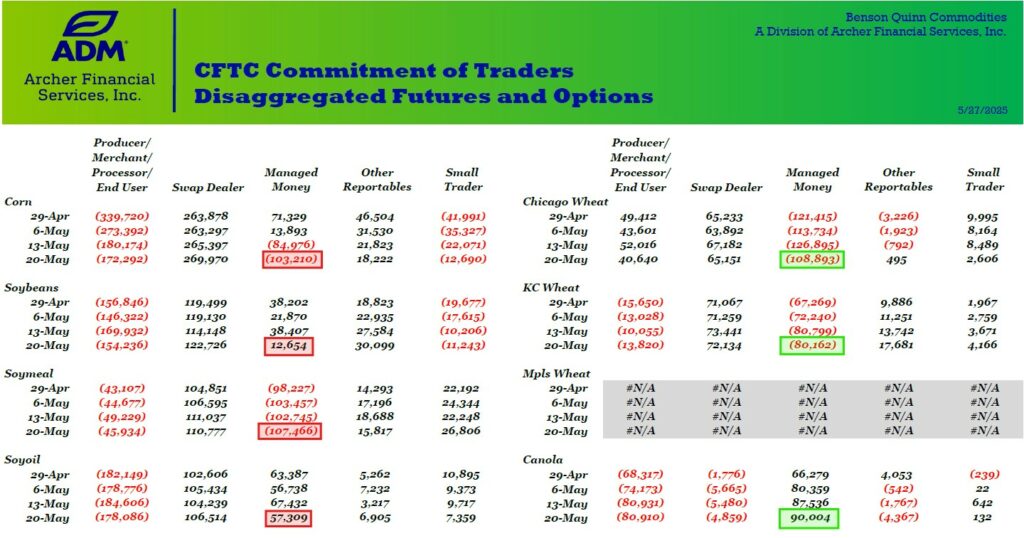

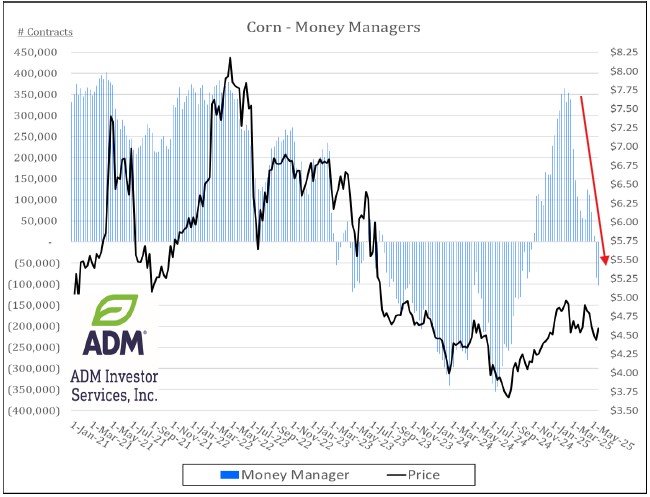

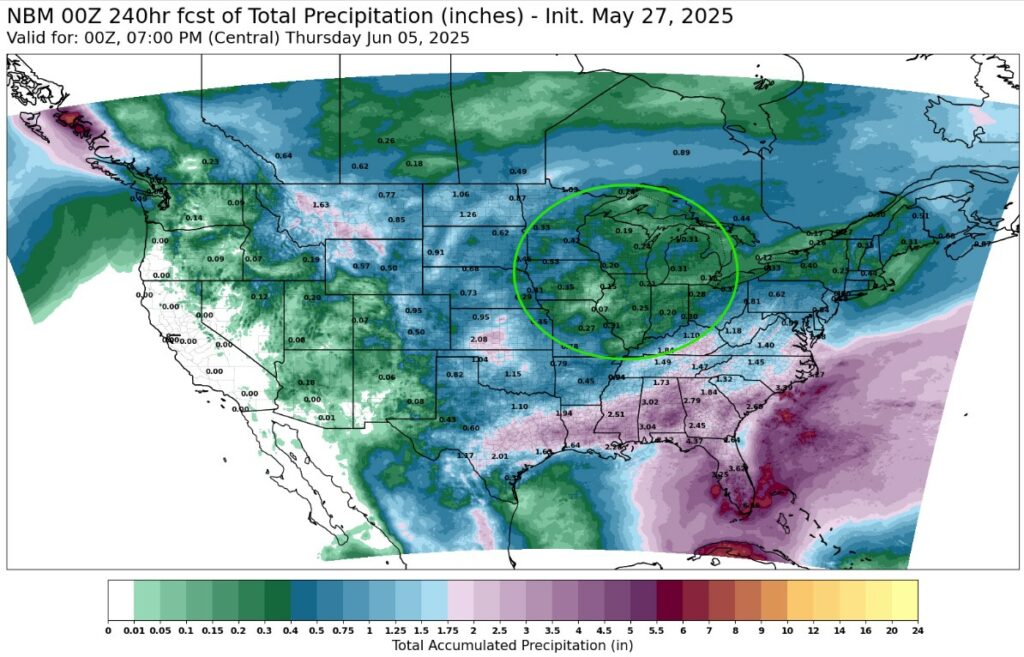

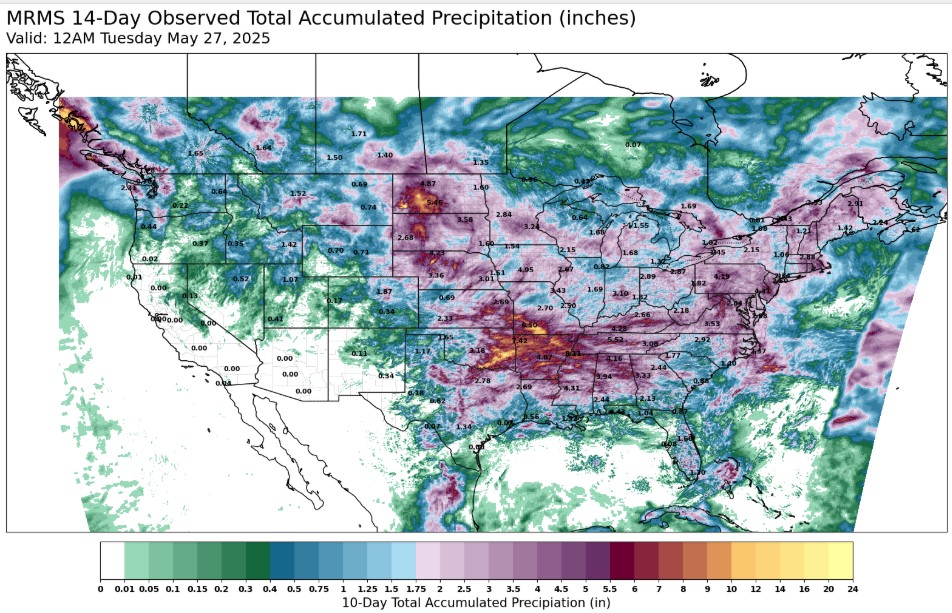

The CFTC Commitment of Traders Report on Friday had Managed Money selling corn and the soybean complex while they were net buyers of wheat an Canola. Soybeans had the last move lower on their positions as news of the biofuel policy in Washington was pushed back further than expected while planting progress and spring weather has been favorable. The MM corn position has made the biggest move since the beginning of this year. Their position has moved over 450K contracts from long +350K to short over 100K contracts. Corn export demand and consistent usage for ethanol is not enough to rally futures. The weight of a potential bummer crop can be felt when looking forward at corn supply. Crop progress report will be out later this afternoon. Most of the US growing regions were hit with some precip over the last 14 days and the next 7 has rain focused on the mid south and delta regions. Planting progress should wrap up in many northern and central areas by this time next week. The crop progress report will also include crop conditions for corn and spring wheat in this afternoon’s report.

The CFTC Commitment of Traders Report

Change in Managed Money Positions

Corn: -18,234

Soybeans: -25,753

Soybean Oil: -10,123

Soybean Meal: -4,721

Chi Wheat: +18,002

KC Wheat: +637

Canola: +2,468

Corn MM Position went from +350K contracts in January to -103K contracts today.

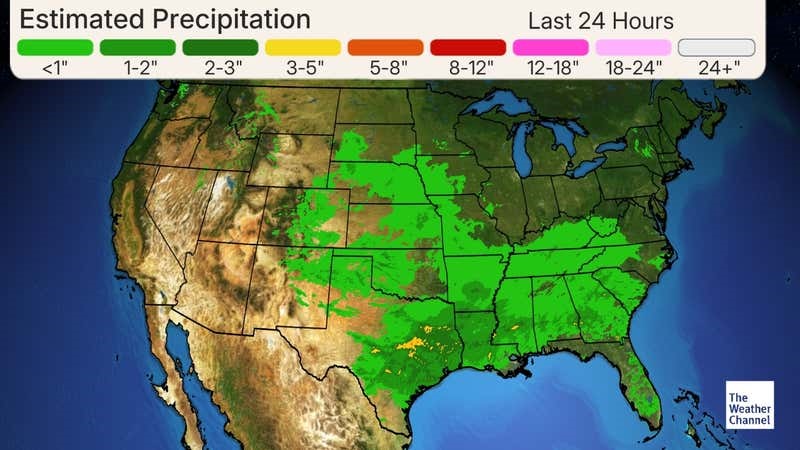

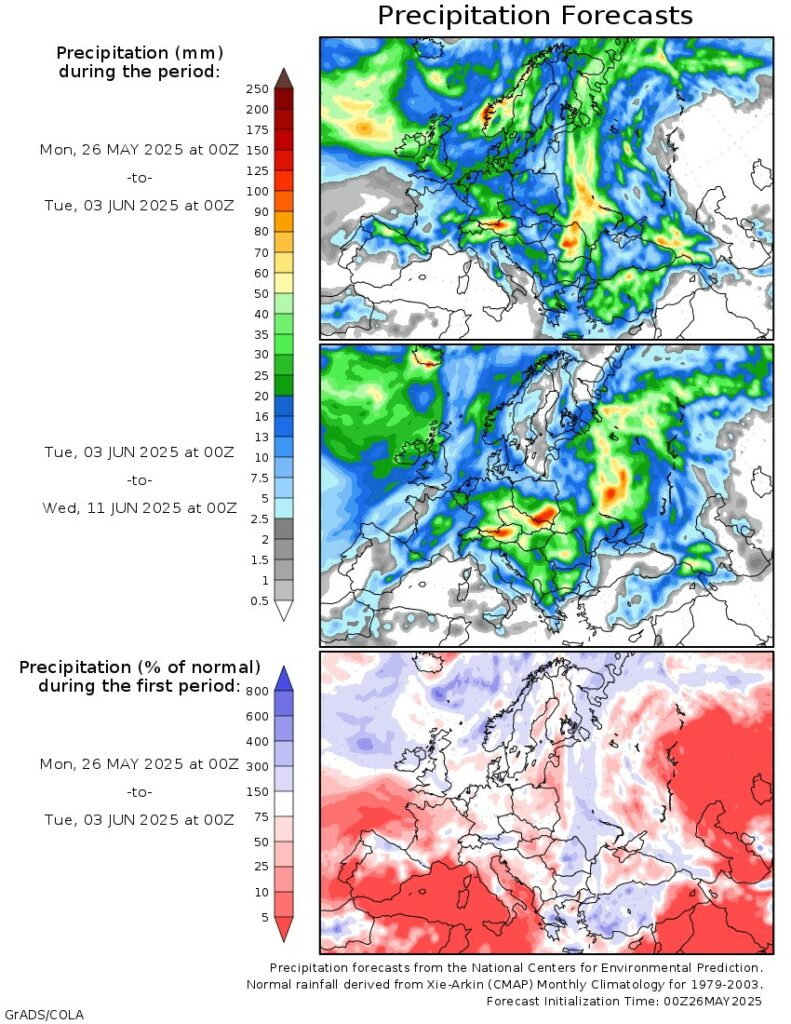

7 Day Precipitation: Midwest producers will have a wide open window over then next 7 days to finish up planting.

The Last 14 Days of Rain hit most of the US growing regions. Rain Makes grain despite the plating delays in some areas.

Export & World News

Taiwan issued an international tender to buy up to 65K MT of animal feed corn to be sourced from US, South America, or South Africa. This is in addition to the 80K MT of animal feed corn that Algeria is looking for.

Malaysian palm oil futures were up 35 ringgit overnight, at 3868.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

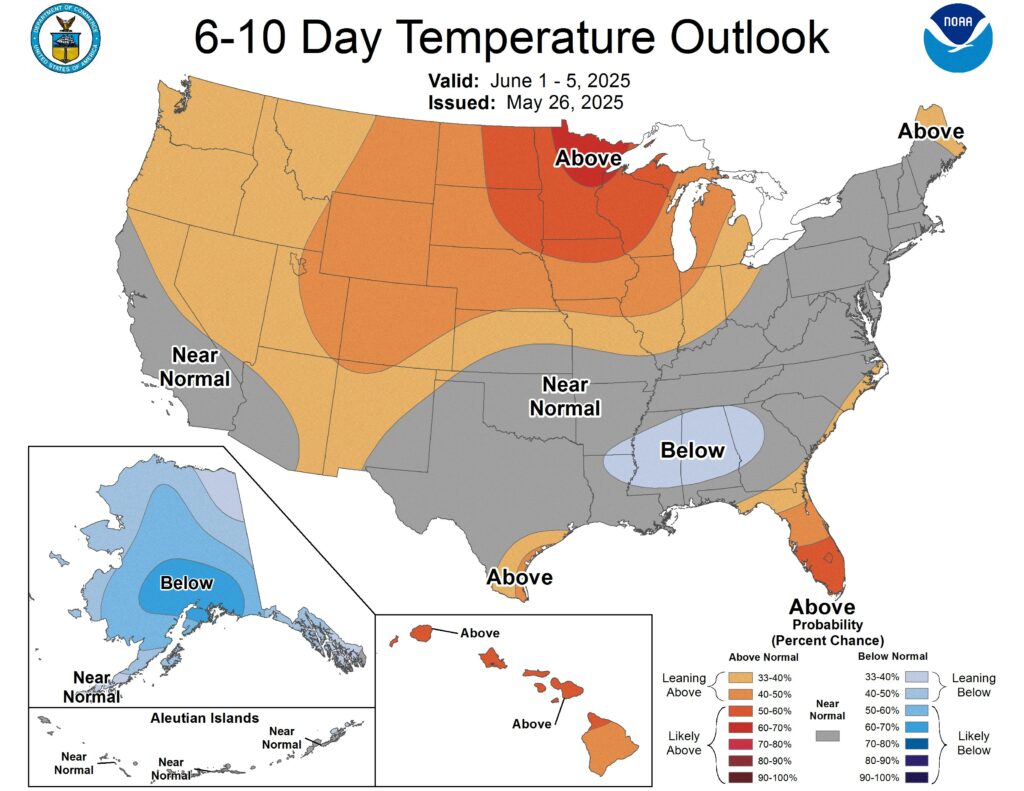

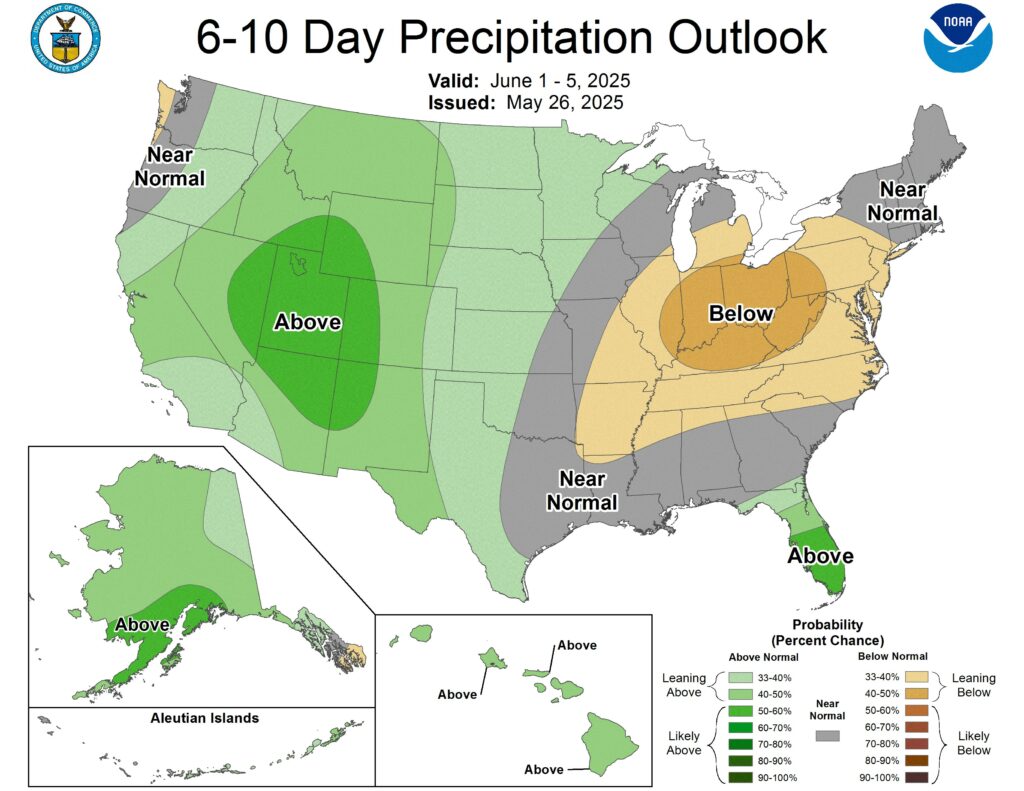

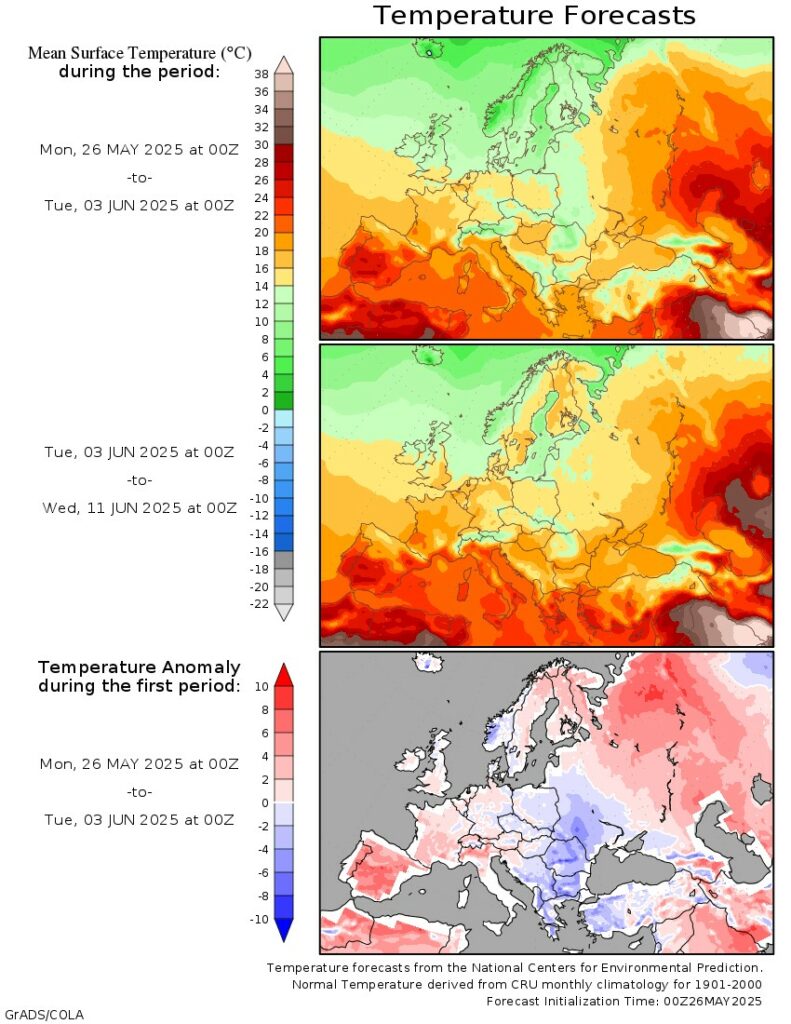

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.