OPENING COMMENTS

Macroeconomics:

Equity Market futures fell this morning when President Trump put out on social media he will put a 25% tariff on Apple products made outside of the US. Recently we saw Apple shift from China to India manufacturing, but that is not good enough for Trump. He also recommended a 50% tariff on European Union products due to the trade deficit. He said these would start on June 1st. Last night the US and China held their first phone call since their meeting in Switzerland when they dropped 115% tariffs. Maintaining communication is a good sign for a imminent deal.

Ag Fundamentals:

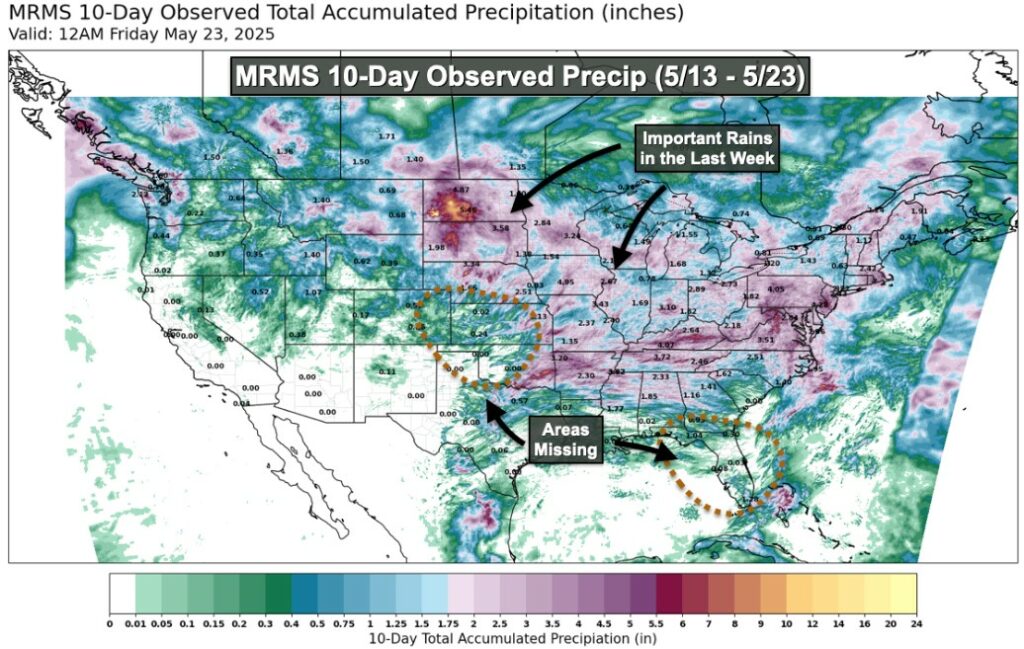

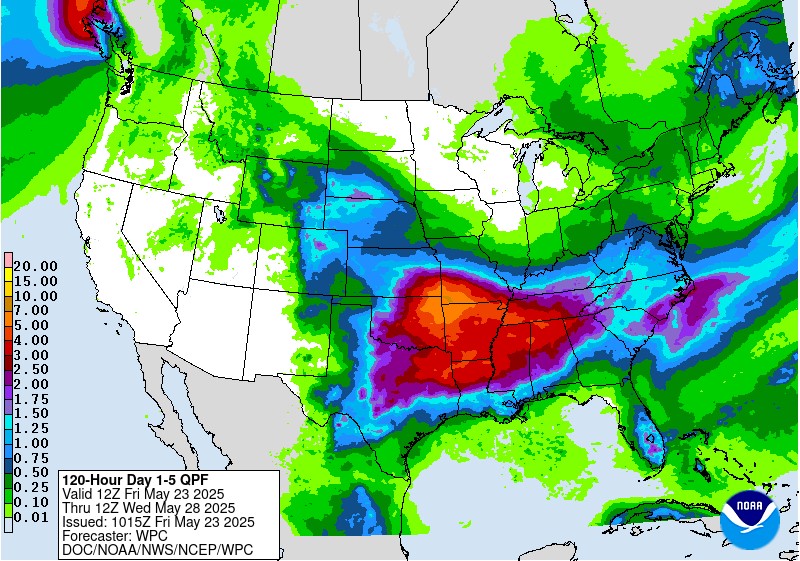

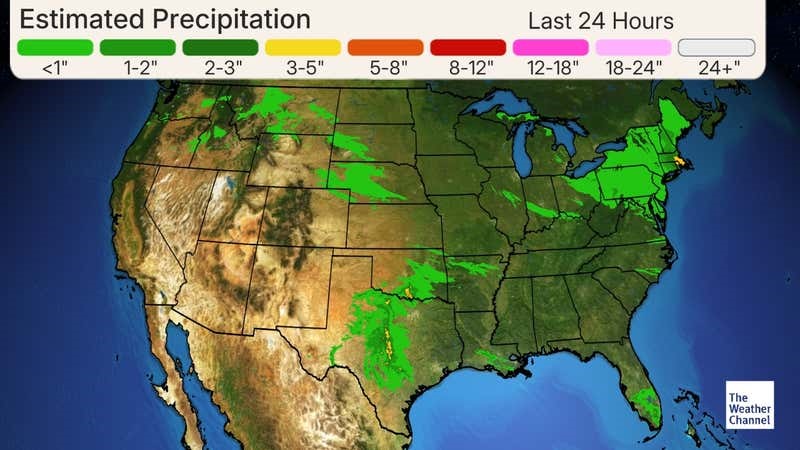

Grains are slumping into this Friday morning as rains covered most of the Midwest and will continue this weekend to soak the mid south and delta regions. Lower than normal temperatures in the northern growing regions are concerning those who have already planted most of their crop. Soil temps getting too low can cause issue with emergence next week. River levels are in good shape. We will have a first look at corn crop conditions on Monday’s crop progress report. I expect planting did not progress as much this last week and we’ll still have 10-15% left to plant for corn and 25% left on beans. Export sales are mixed, but mostly neutral to bullish. Corn continues to outperform on exports, but soybeans and soybean meal came in with higher than expected old crop exports. The CFTC Commitment of Traders will be out later this afternoon. Focus on if managed money has continues to widen their short position in both corn and wheat and possibly increase their soybean length.

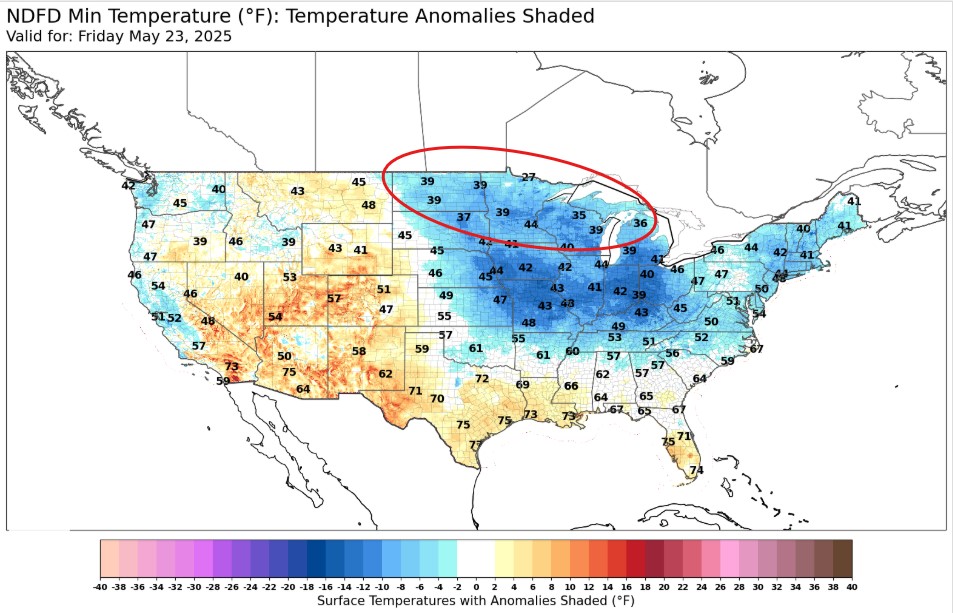

Minimum temps in the northern growing areas is slightly concerning. No frost, but soil temps may cause issues with emergence.

Last 10 Days of Precip:

Weekly Export Sales

|

Export & World News

Jordan is looking to buy up to 120K MT of animal feed barley. Algeria is in the market to buy up to 80K MT of animal feed corn.

Malaysian palm oil futures were up 5 ringgit overnight, at 3825.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

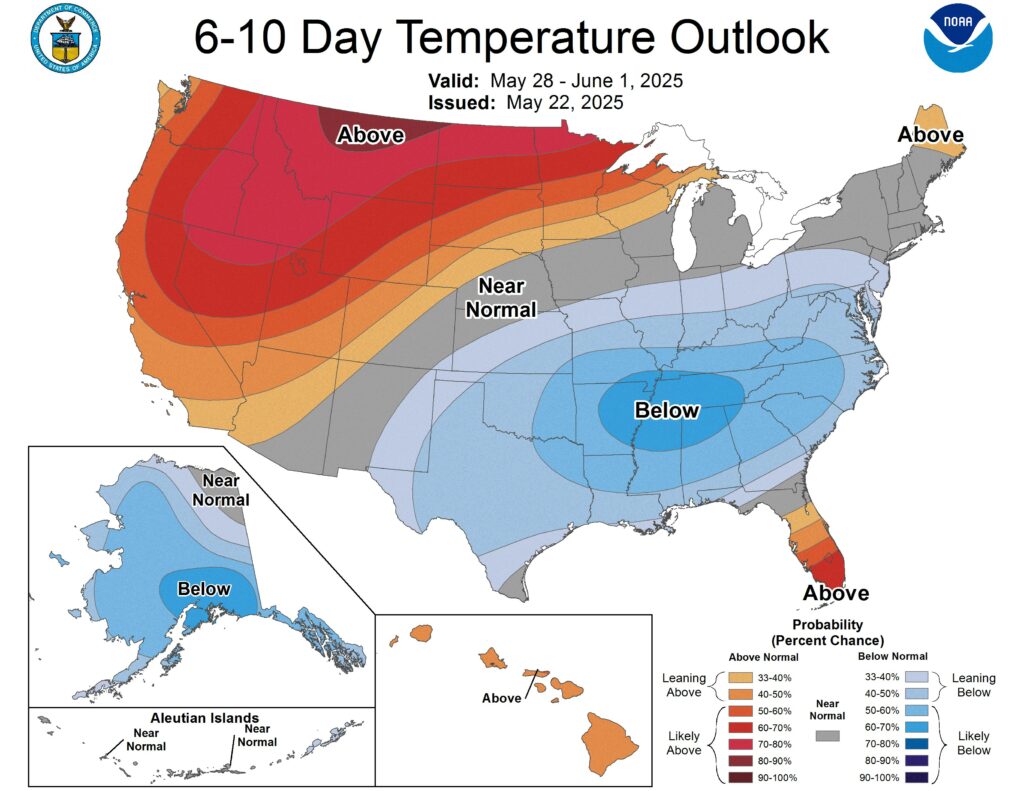

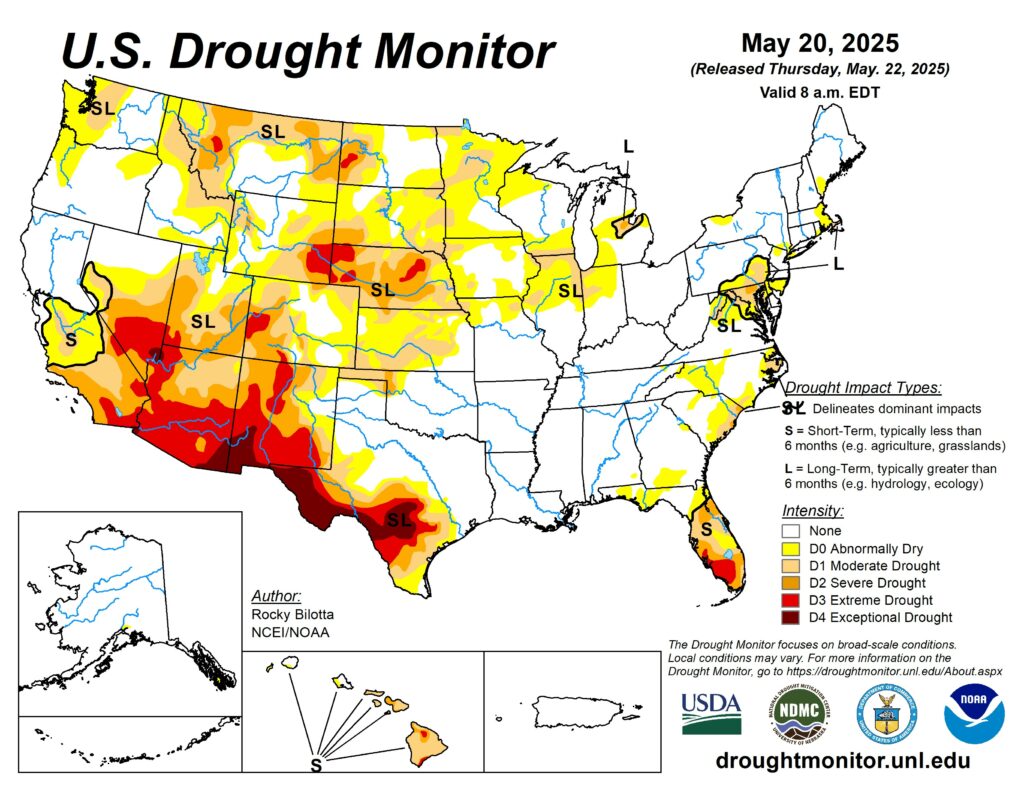

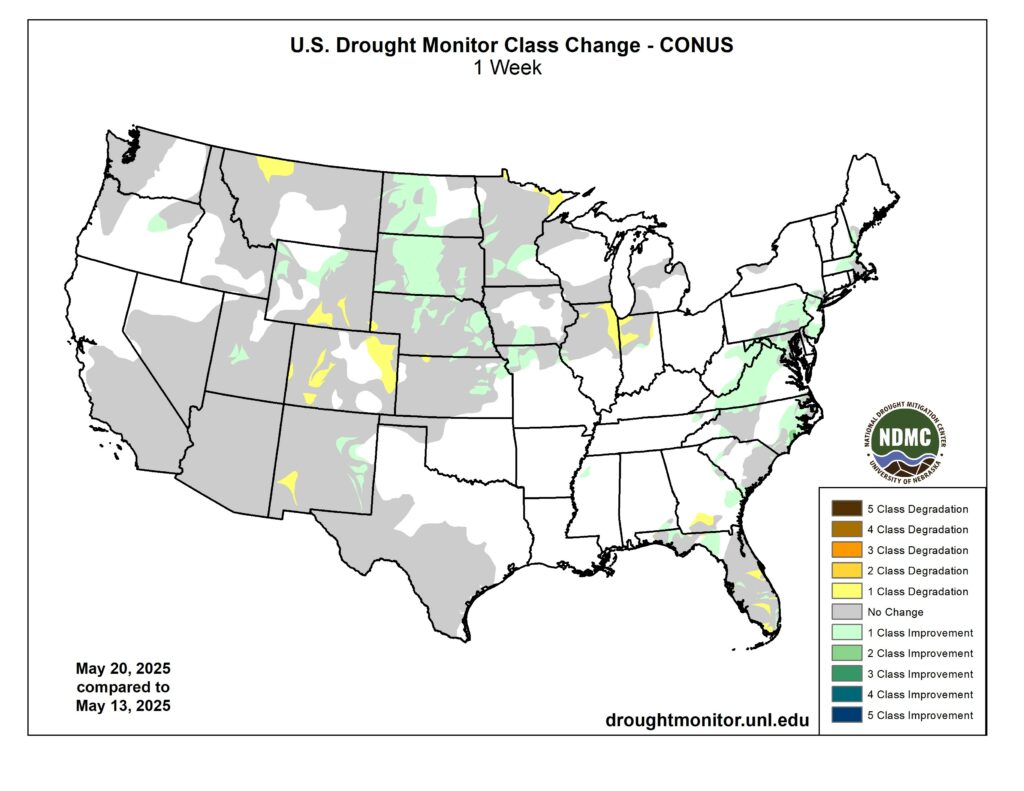

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.