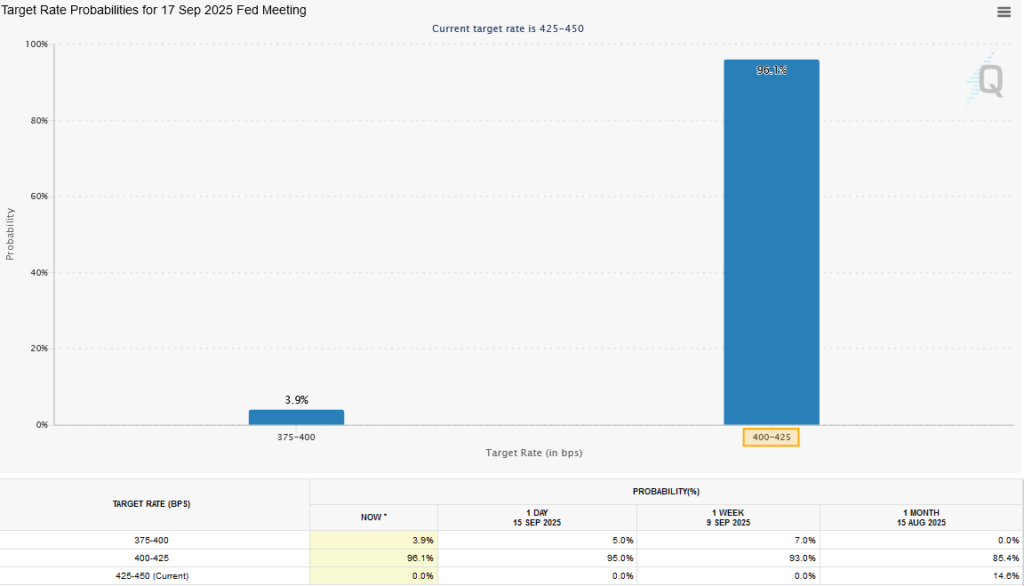

FedWatch Website now has a 96.1% chance of a -0.25 point rate cut after tomorrow’s fed meeting. Tomorrow (9/17) at 1:00pm CST the decision will be announced and 1:30pm CST is when Jerome Powell will speak and a press conference.

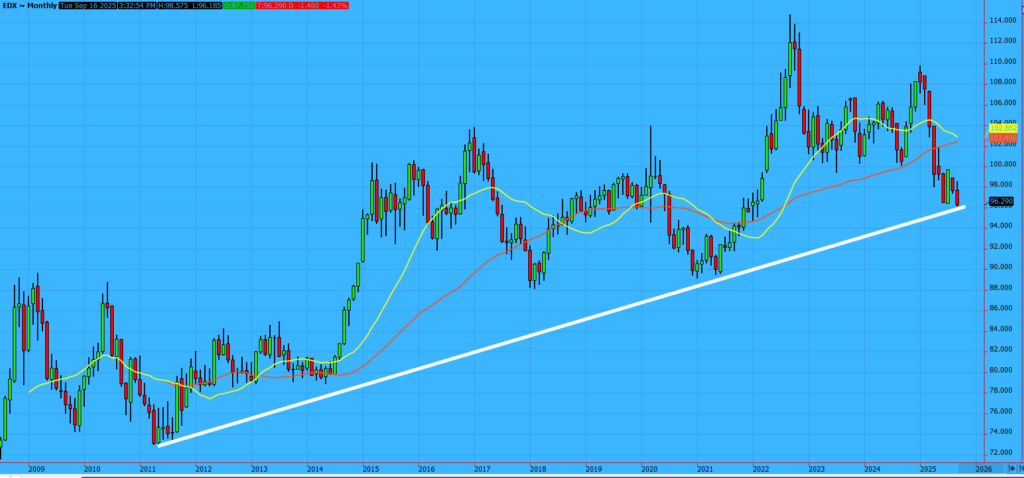

The US Dollar has continued to weaken. Year-to-date the index has dropped around 13.5 points. Tough to imagine what the price of corn would look like with the dollar at 110. Weaker dollar does keep us competitive in the global marketplace.

The US Dollar Long-term Chart suggests we are sitting near a support level and a potential settling or even reversal point.

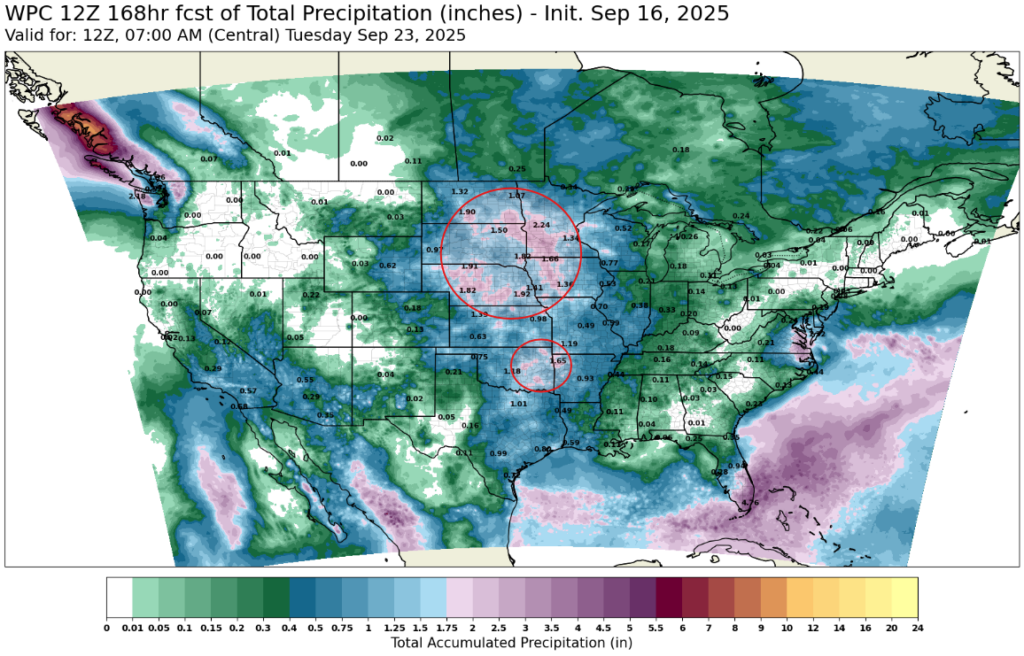

Rain is hitting the Upper Mississippi River Valley, but is lacking in the Ohio River Valley where rain is needed to lift river levels on the lower Mississippi.

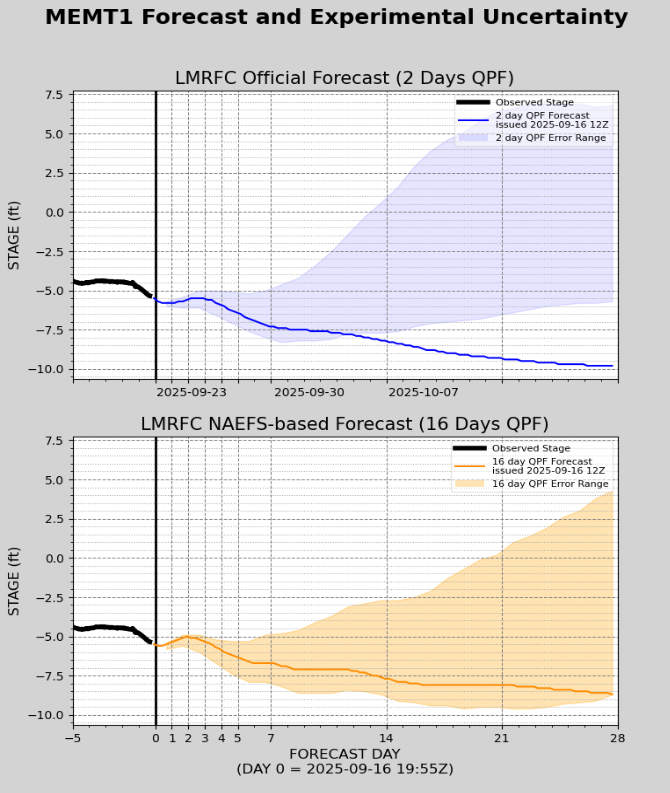

Mississippi River Level at Memphis, TN

The Top chart accounts to the next 2 days and the bottom chart extends to included the 16-day forecast. Barge drafts have moved as low as 10’0 ft near Memphis. Compared to full drafts, barges are currently carrying about 10-15K bushels less per barge.

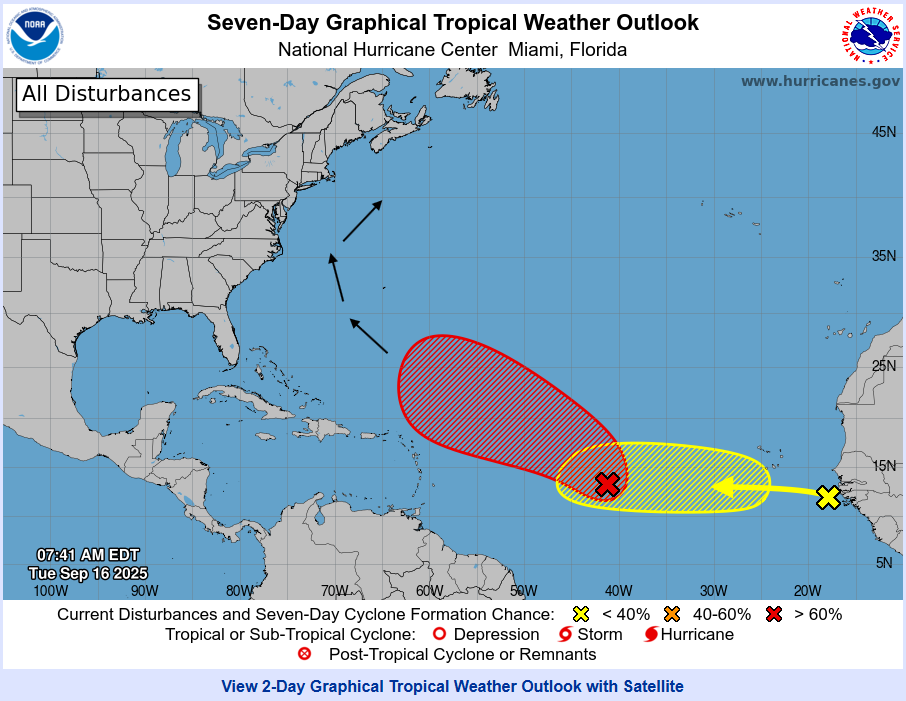

Two Systems off the West Coast of Africa are not expected to threaten the Gulf or southern regions.

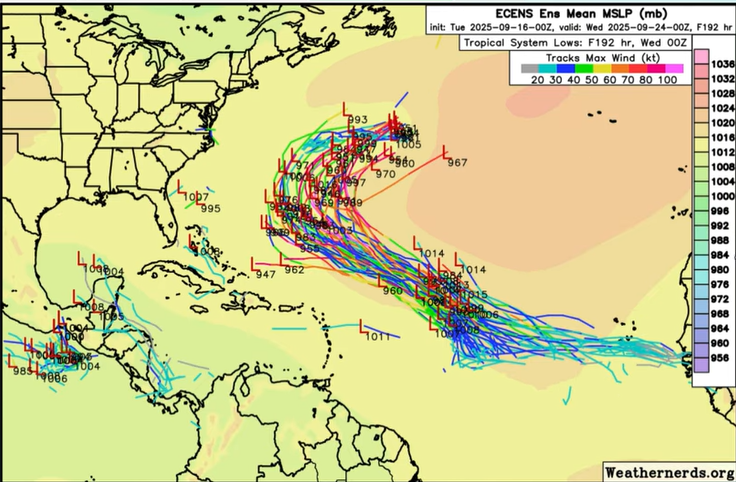

Below are the Likely Paths the storms will take between now and September 24th.

Calendar Spreads and Cost of Carry

|

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Futures Settlements & Technicals

Symbol | Close | Chg | High | Low | Support | Resist | 20-Day | 50-Day |

CZ25 | 429 1/2 | +6 1/4 | 431 1/4 | 423 | 415 | 430 | 416 1/4 | 413 3/4 |

CH26 | 447 | +6 | 448 1/2 | 440 1/2 | 430 | 450 | 434 | 431 1/4 |

CK26 | 456 3/4 | +5 1/2 | 458 1/4 | 450 1/2 | 440 | 460 | 444 1/4 | 441 1/2 |

SX25 | 1049 3/4 | +7 | 1052 1/2 | 1041 3/4 | 1020 | 1070 | 1041 1/4 | 1024 1/2 |

SF26 | 1069 1/4 | +7 1/2 | 1071 3/4 | 1061 | 1030 | 1080 | 1060 1/4 | 1043 |

SN26 | 1107 | +7 1/2 | 1109 1/2 | 1098 1/2 | 1110 | 1050 | 1097 1/4 | 1080 1/4 |

MWZ25 | 576 1/2 | +4 3/4 | 578 | 567 1/2 | 570 | 598 | 578 1/4 | 596 1/4 |

MWH26 | 596 3/4 | +4 1/4 | 598 1/2 | 590 | 585 | 610 | 598 1/4 | 616 3/4 |

WZ25 | 534 | +9 | 534 1/2 | 524 | 515 | 540 | 525 1/4 | 539 1/4 |

WH26 | 551 3/4 | +9 | 552 1/4 | 542 | 525 | 555 | 542 3/4 | 557 1/2 |

KWZ25 | 523 1/2 | +9 1/2 | 523 3/4 | 512 1/4 | 500 | 550 | 515 1/2 | 531 |

KWH26 | 544 1/4 | +9 1/2 | 544 1/2 | 533 | 520 | 565 | 535 1/2 | 551 |

SMV25 | 285.8 | +0.60 | 286.7 | 284.5 | 275.00 | 290.00 | 285.20 | 281.00 |

BOV25 | 52.69 | +0.93 | 53.37 | 51.7 | 50.00 | 55.00 | 51.99 | 53.37 |

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.