Macroeconomics:

BLUF reading this might make you depressed. The “Great Wait” Economy is the term being thrown around as investors are confused and generally unsure of the future of the US economy short term. Job reports have underlined the weaknesses in the labor market, inflation continues to put pressure on the consumer, not to mention: uncomfortable housing, two wars that we are helping fund, increasing debt, lower household savings, and the lowest fertility rate since 1979. We can put some blame on the 2020 global pandemic for the world’s general step back, but we should also include weak foreign policy, running out of ink printing money, and not cutting government spending. On the other hand, the stock market has recently hit highs and if you ignore last week, equity markets are still doing great. Boomers that own houses and contributed to a 401K for the last 40-50 years are able to retire on time no problem, but that is only a fraction of the generation. 1 in 4 older workers in the workforce today are nearing retirement without a penny in savings. Basically, I’m just pointing out that today’s economic atmosphere is great for some, but tragically difficult for others.

Ag Fundamentals:

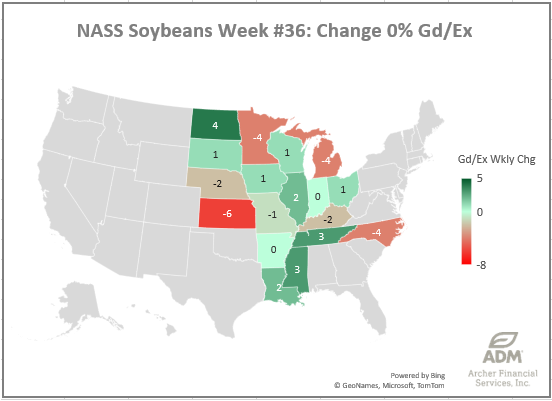

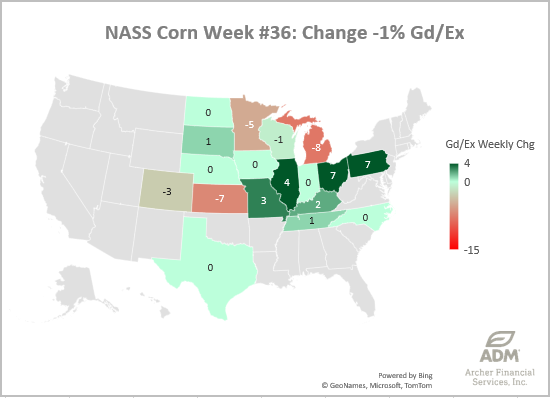

The NASS Crop condition ratings and changes from the previous week are pictured below. Soybean good/excellent ratings are unchanged at 65% and corn is -1% down from last week. The 30-40 day forecasts for South America are showing signs of hope that October will be wet enough to get the soybean crop planted on time. They won’t have an very early plant, but typically South American farmers only put about 10% of their seeds in the earth by the first week of October anyway. There are plenty of days between now and crunch time. October is an important month. 80% of the planting activity in Brazil takes place in October.

Weather:

Tropical Storm Francine is at the top of the current weather conversation as it gains strength in the Gulf of Mexico. The last recorded hurricane was Ernesto on August 24th which tracked over Cuba and up the east coast of the US. Only one other recorded hurricane in August, Debby; so the season has been relatively calm compared to the original forecasts. Today we are hitting the peak historic time frame for Hurricane season. The likelihood for strong storms to develop starts to weaken from September 14th forward. With that being said, we also have 2 more depressions making their way across the Atlantic, both with over 60% probabilities of developing into cyclones in the next 7-10 days. |