MORNING COMMENTS

Macroeconomics:

Crude oil is higher again today, jumping $4 on news of Israel possibly targeting Iran’s oil assets. Crude finishing the day at 73.85 per barrel, up 5.35% on the day and +6.75% over the past month. $80 per barrel and higher have entered the conversation among some traders, thinking that if the right steps are not taken we could see $100 per barrel by Christmas. For months the market has traded oil with a bearish outlook on low demand from the US and Chinese wavering economies as a well as hope for an increase in production from OPEC. While the fight in the middle east was most recently localized between northern Israel and Lebanon, missiles fired by Iran into Israel has changed that bearish tone to bullish. When asked about the potential strike on Iranian oil assets, President Joe Biden said, “We’re discussing that. I think that would be a little – anyway.” I don’t think we can count that as an official statement from the White House, but prices jumped higher immediately following that statement. If Iran’s assets are struck that is taking 4% of the world’s global supply off the table. Below I have included bar charts of the top producers and importers of crude oil. On a side note, Libya ended the political conflict between the Central Bank of Libya and their leadership which will allow them to restart their production of 1.2 million barrels per day.

Ag Fundamentals:

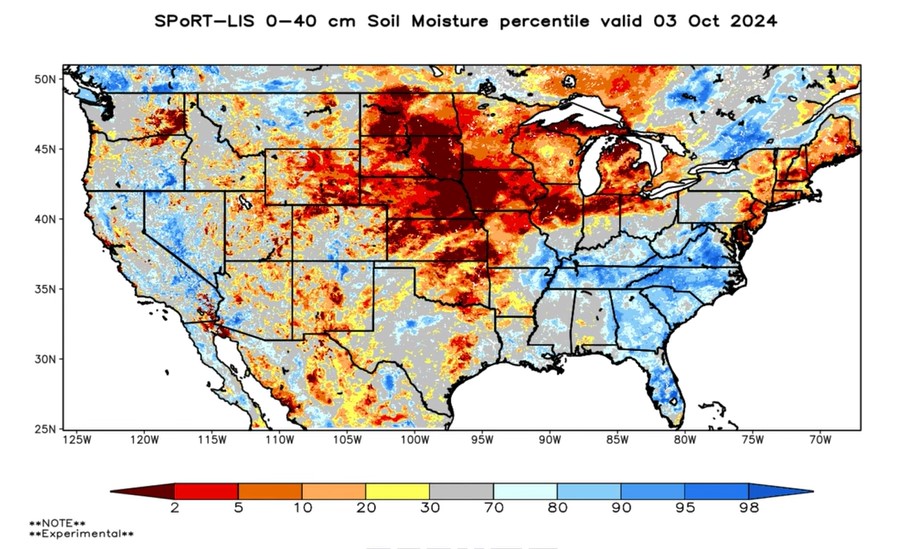

Row crops are all lower today due to a combination of expectations of rain in Brazil late next week and fair harvest weather in the US allowing for farmers to cut and sell crops earlier than expected. 80% of the soybean crop in Mato Grosso is planted in October. Upcoming rain covering this region will allow for planting progress accelerate during the last half of the month. Keep this in mind, too.. There is a saying here in the US “Plant in the dust, and your bins will bust.” That saying may also hold true in South America as well. A scenario with high oil prices, weakening supply chains, and a large Brazilian bean crop paints a bearish picture for both the US economy and soybean prices. Speaking of dust, the soil moisture map is not looking great for this time of year. We need rain to restore soil moisture reserves before we enter winter or rains in the Spring season will have a lot of work to do to make up for the last couple months of dry weather. Long term climate forecasts for winter are showing most of the precipitation east of the dry areas.

The US Soil Moisture Map is most concerning in the Missouri River Valley that stretches from South Dakota down through western Iowa into northern Kansas.

For precipitation this December, January and February is showing drier than normal south and wet across the eastern corn belt. Precip over the winter will be important for next year’s soil moisture levels.

European Model 10-Day forecast for total rainfall in Brazil is showing thunderstorms over central regions. Rain in those areas will arrive after Thursday next week.

GFS Model 10-Day forecast for total rainfall in Brazil. Showing slightly less rain than the European, but they have been behind the European for weeks on this.

Calendar Spreads

Spread | Last | Chg | Full | % of FC |

CZ24/CH25 | -17 3/4 | – 1/4 | -30 1/2 | 58% |

SX24/SF25 | -18 1/2 | – 1/4 | -26 3/4 | 69% |

SX24/SN25 | -57 1/2 | -1 | -106 1/4 | 54% |

MWZ24/MWH25 | -21 | 0 | -30 3/4 | 68% |

WZ24/WH25 | -23 | -1 | -24 1/4 | 95% |

KWZ24/KWH25 | -16 1/2 | -1 1/2 | -24 1/4 | 68% |

Cost of Carry

News of rain in Brazil has widened the carries in both corn and beans. Brazil will most likely have a successful October planting season and a good start to their new growing season.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.