Ag Fundamentals:

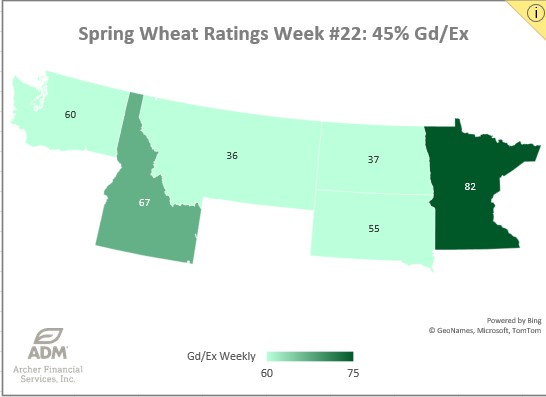

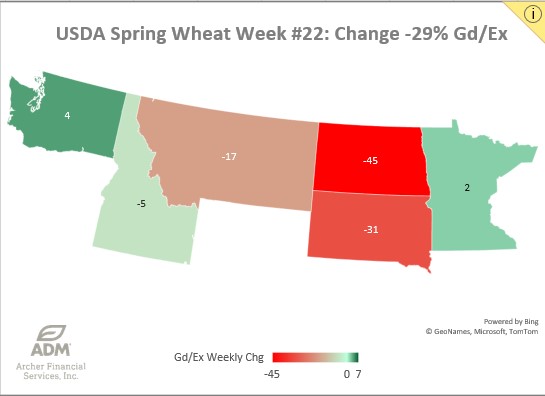

The crop production report yesterday, relieved some troublesome pockets in the eastern corn belt. Some are now speculating the likelihood of corn acres coming up shorter than expected and soybean acres taking their place, specifically in Ohio. June 5th is the last day to plant corn in Ohio for crop insurance coverage. Ohio is still needing to plant over 40% of their expected corn acres in a week’s time. They will most likely come up short. Ohio was expecting 3.25 million corn acres and 5.1 million bean acres according to the USDA’s most recent report. For the last 9 of the last 11 years the acres have shifted towards corn from the March intentions to the June acres report. Seems like this year might be the opposite. Both corn and beans took a hit on the board today. November soybeans closed below the 20-day moving average for the first time since the beginning of May. Bottom line is still we are ahead of planting pace and soybean emergence is 10% further along than the 5-year average while we are getting consistent rains. Spring wheat planting progress is at 87% following yesterday’s report, up 5% from the prior week. The spring wheat crop conditions were only rated 45%, this time last year spring wheat was 74% good/excellent. Spring wheat emergence is at 60%, which is 7% ahead of the 5-year average. Minneapolis wheat nearby futures were up 7¢ today.

Spring Wheat Crop Conditions: 45% Good/Excellent. This time last year the USDA reported 74% g/e.

Spring Wheat Crop Conditions Change from this time last year. 45% vs 74% LY

EXPORT & WORLD NEWS

Iran is believed to have purchased an unknown volume of animal feed corn. Algeria issued an international tender to buy up to 120K MT of animal feed corn.

Malaysian palm oil futures were up 31 ringgit overnight, now at 3899.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.