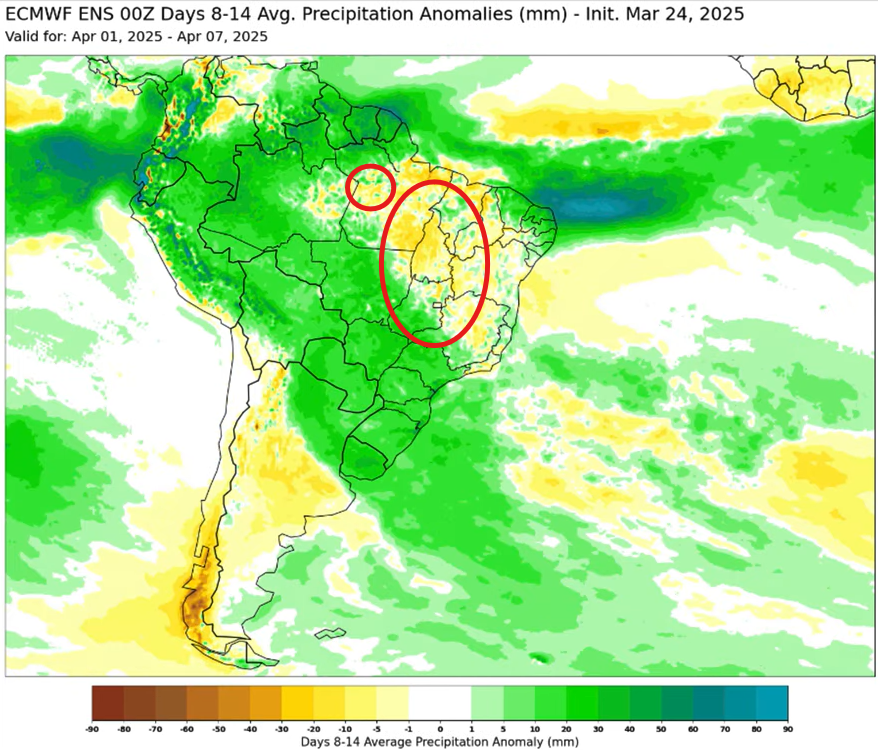

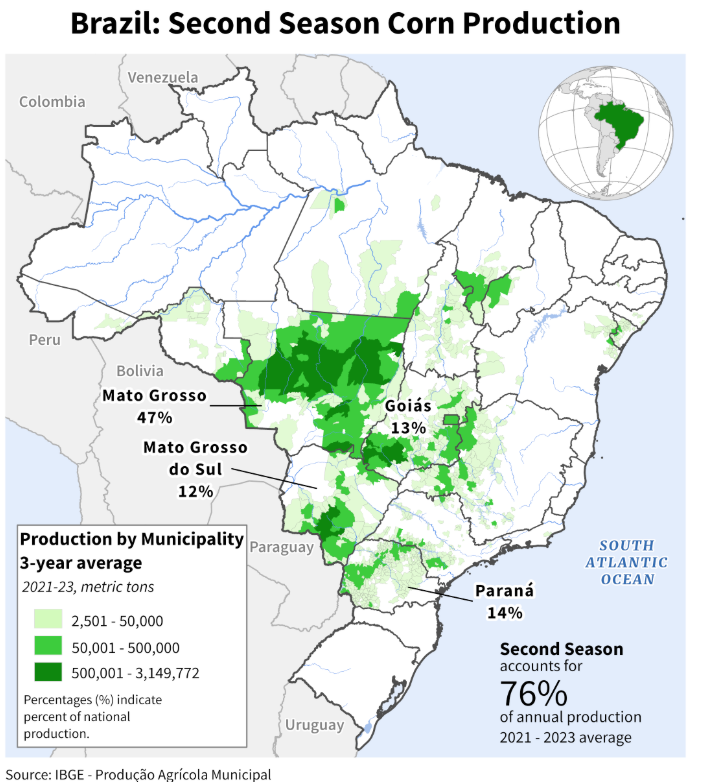

Ag Fundamentals: The second corn crop in Brazil may see some northeastern areas lack normal rainfall in the next 10-14 days. They are about a month into their growing season and moisture is critical. Brazilian corn prices have increased sharply over the last few weeks due to higher domestic ethanol demand and extreme weather concerns. Most of the Brazilian major 2nd corn crop growing areas will see above average rains the first 7 days of April. US weekly corn exports were on the high side of the estimate range, and still above pace to meet USDA corn export expectations. Wheat and soybean weekly export sales were near the bottom of the estimate range. Soybean meal was in line with expectations and soybean oil was reported double the high side of the estimate range at 44.5K MT. Tomorrow and Monday morning the market will be placing their bets on Monday’s stocks report, releasing at 11:00am CST. Today according to Bloomberg, the average estimate for corn acres is 94.4M, soybean acres 83.8M and all wheat acres at 46.5M acres

Precipitation Anomalies for the First 7 days of April has some of the northeastern Brazilian 2nd corn crop growing regions expecting lower than normal precipitation.

Weekly Export Sales Estimates (for week ending 3/21)

|

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.