OPENING COMMENTS

Macroeconomics:

Jerome Powell signaled on Wednesday afternoon that the US economy will start to feel the costs of tariff related inflation in the next few months. Remembering many retail companies front-loaded imported products in preparation of increased costs. The Fed lest rates unchanged at 4.25-4.50%, but the market is still pricing in 2 cuts by year-end. those two cuts most likely coming in September and December according to the CME Fedwatch probability site. Economists are expecting “stagflation” to be the result of the tariffs over this summer/fall with some predicting a rocky equity market to fall back violently by Thanksgiving. The Brazilian Real continues to surge against a weaker dollar. Crude oil down over $3/barrel from its recent highs -spiked after the Israel/Iran conflict hit headlines last week.

Ag Fundamentals:

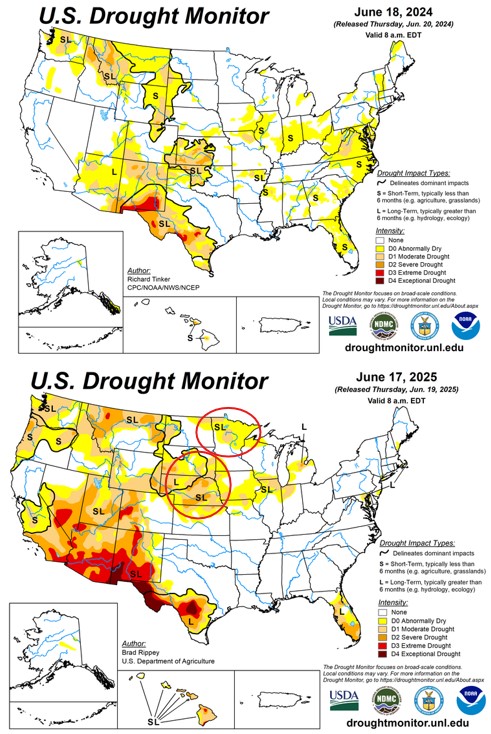

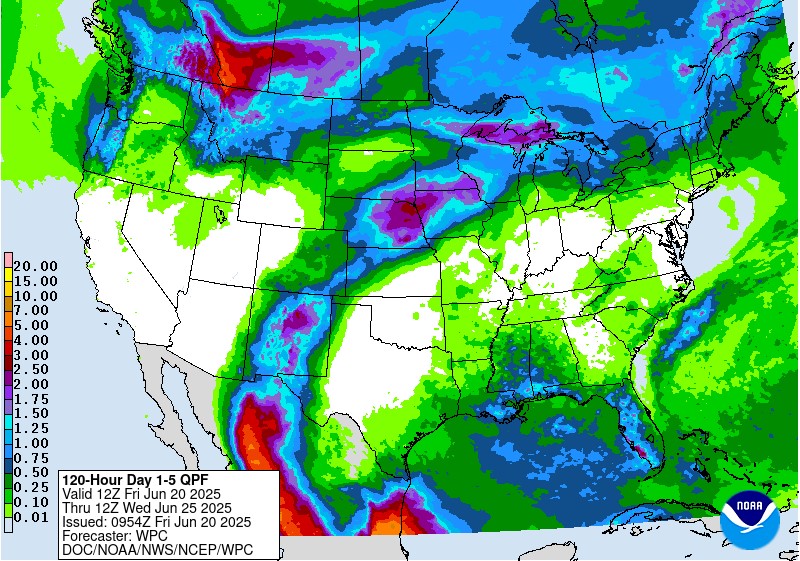

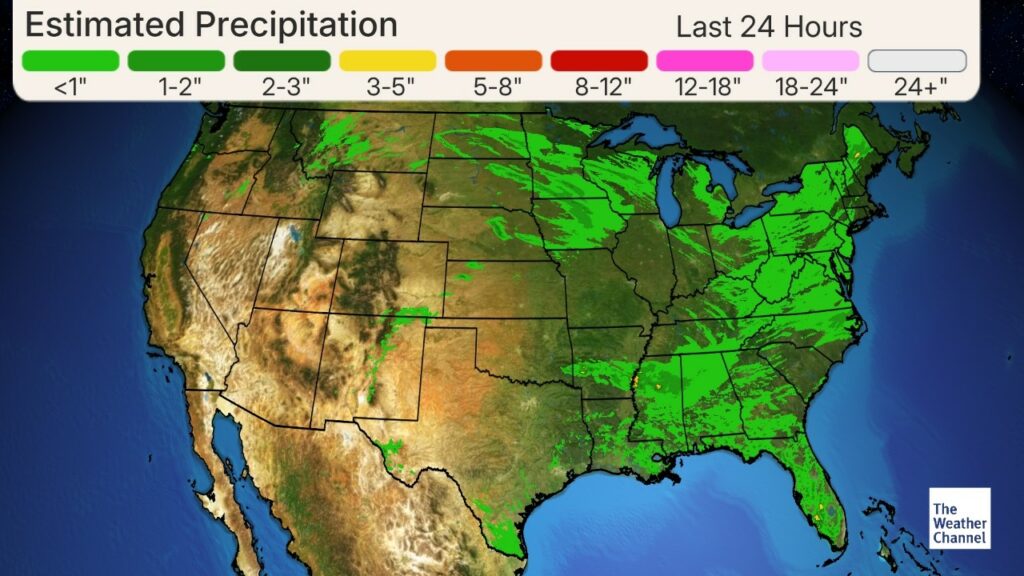

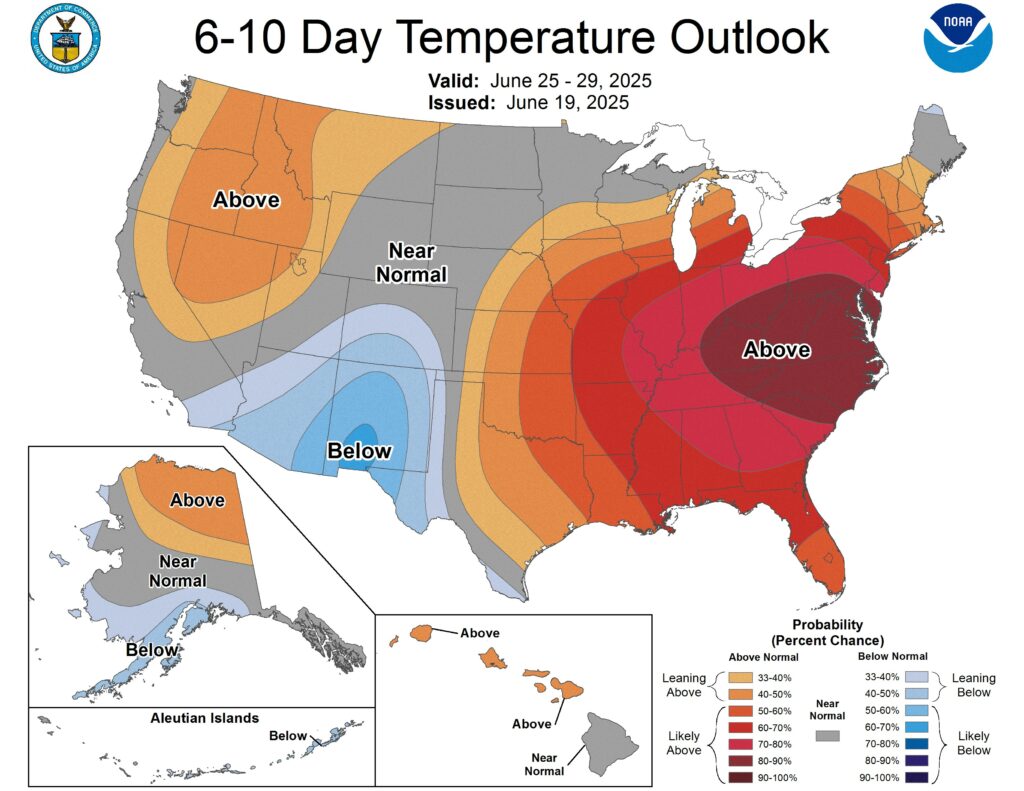

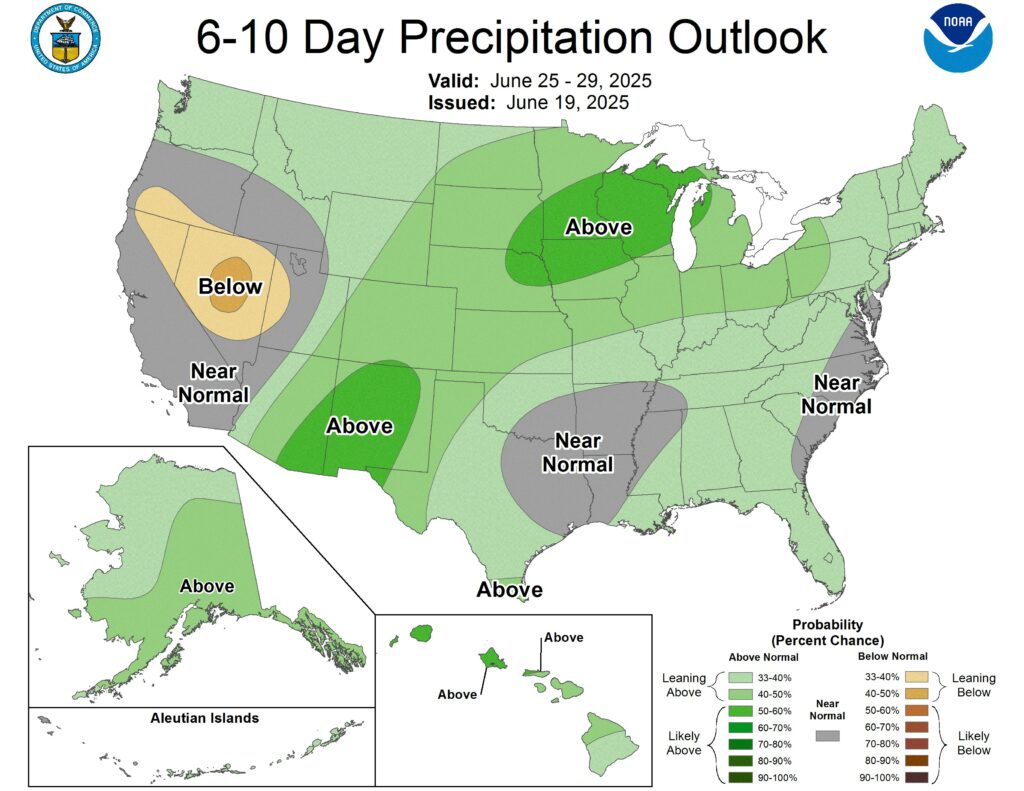

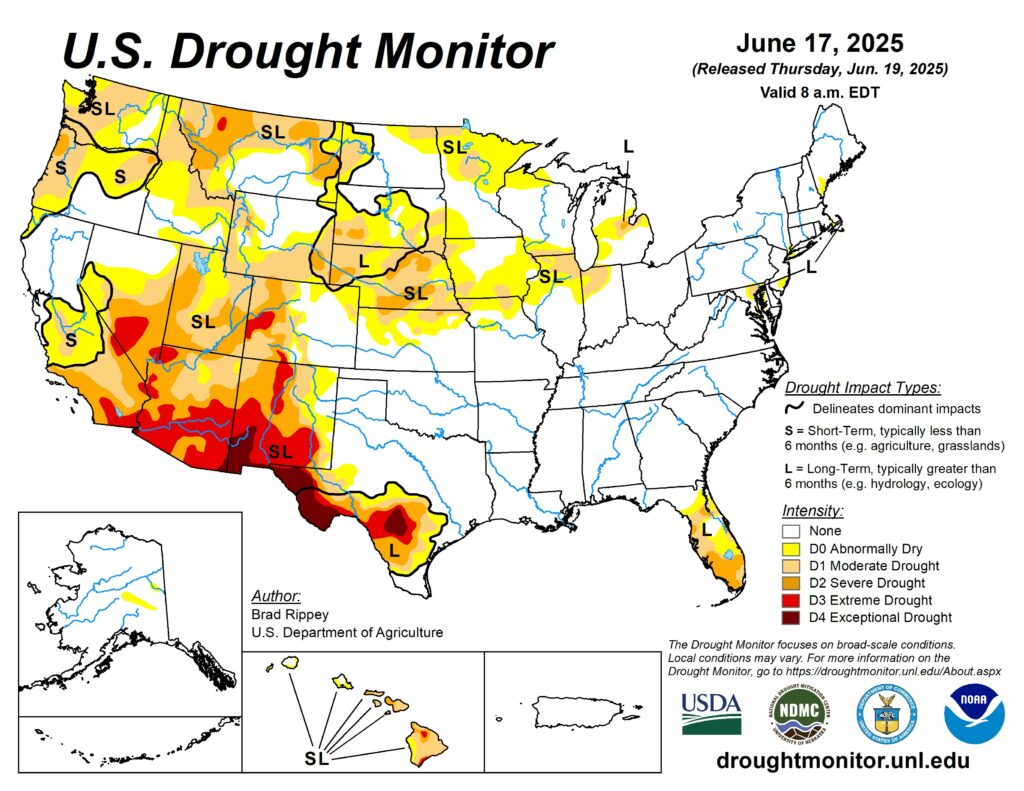

This morning’s export sales numbers were weaker than recent reports, but that is typical for this time of year. Old crop corn, old crop meal and new crop wheat having the strongest presence. The USDA reported a flash sale of 124K MT of corn to unknown destinations this morning for the 24/25 crop year. Despite overall strong corn export demand, due to a large corn crop last year, corn prices are sitting near 2025 lows. Ethanol production is about 5% better today than this time last year. It is hard to catch a rally when most of the US growing areas have seen 1-5 inches of rain in the last 14 days. Most of the recent rains have been concentrated in the mid-south and the lower wheat belt. The northern plains have seen the least rainfall in the last two weeks. I am hearing there is concern about uniform emergence in the northern growing areas due to low temperatures following planting as well as some areas missing rain. the next 7 days should take care of areas in Minnesota, but the Dakotas could still use another good shot of rain before the summer heat hits. Heat is spiking this weekend, but many believe it will be good for the crops to feel some stress to lock in root growth. Max temps this weekend will hit over 100 degrees in Nebraska and parts of southern South Dakota and western Iowa. This temperature spike will be somewhat short -lived, in the northern plains, seeing max-temps will drop back down to 75 degrees by Tuesday/Wednesday. The rest of the Midwest and southern regions will continue to see upper-80s and 90 degree temps all next week.

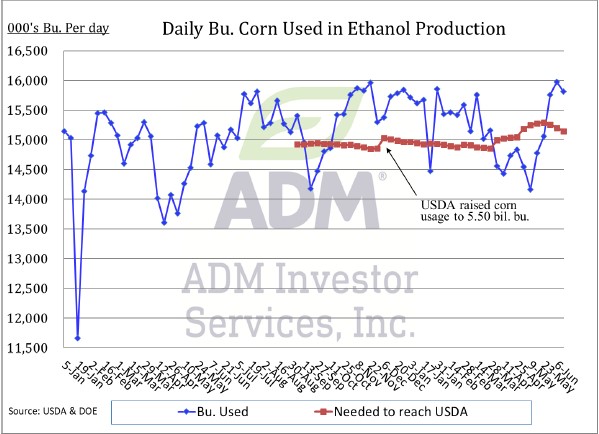

Ethanol Production fell to 1.109M barrels per day for week ending 6-13-25. This was in line with the market estimates and just confirms the USDA estimate of 5.5 billion bushels of corn used is in line.

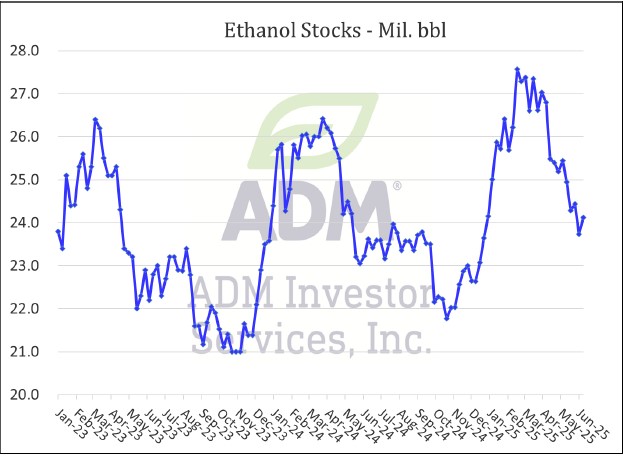

Ethanol Stocks were recorded at 24.1M barrels on Wednesday. Ethanol stocks were slightly higher week-over-week, but still over 3M barrels less than the highs in February/March.

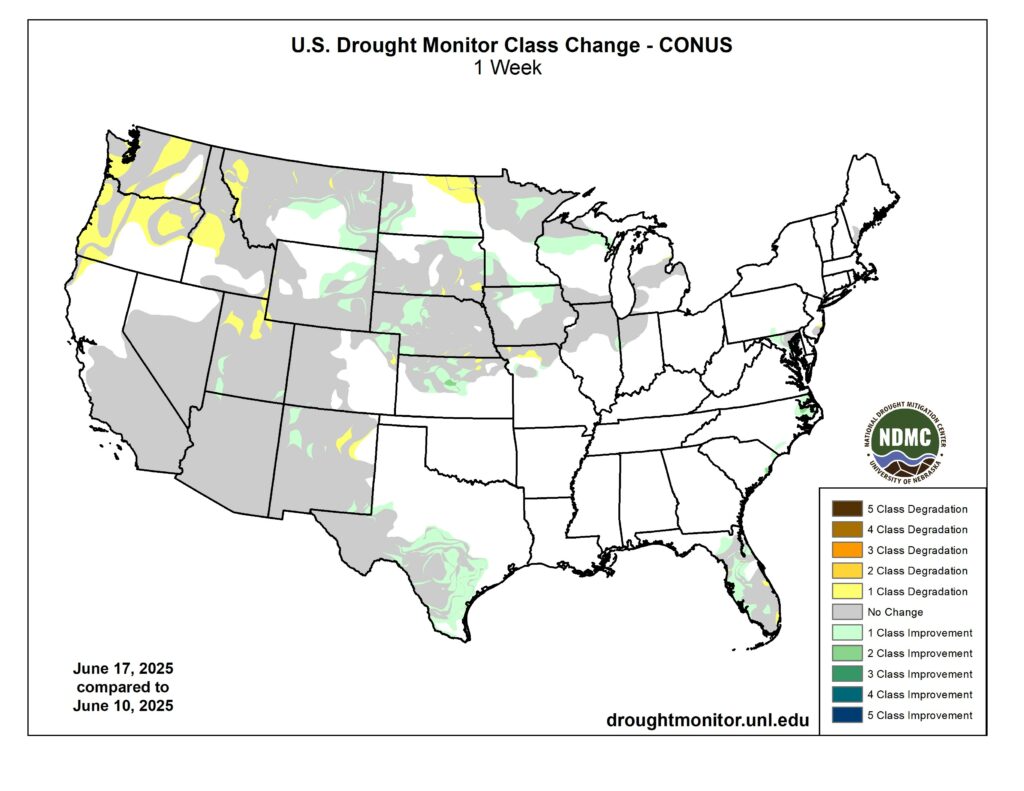

Comparing The Drought Monitor today vs. this time last year, Nebraska and South Dakota are dryer today than this time last year, and northern Minnesota also lacking the moisture seen in spring of 2024.

Weekly Export Sales

| Sales 24/25 | Est Range | Sales 25/26 | Est Range |

Wheat | na | na | 388,900 | 300K-600K |

Corn | 791,300 | 600K-1.2M | 29,600 | 0-200K |

Beans | 61,400 | 0-400K | 58,100 | 0-200K |

Meal | 214,500 | 150K-350K | 46,500 | 0-100K |

Soyoil | 5,600 | 0-22K | 1,500 | 0-10K |

Export & World News

This morning the USDA reported a flash sale of 124K MT of corn to unknown destinations.

Malaysian palm oil futures were up 11 ringgit overnight, now at 4115.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.