OPENING COMMENTS

Macroeconomics:

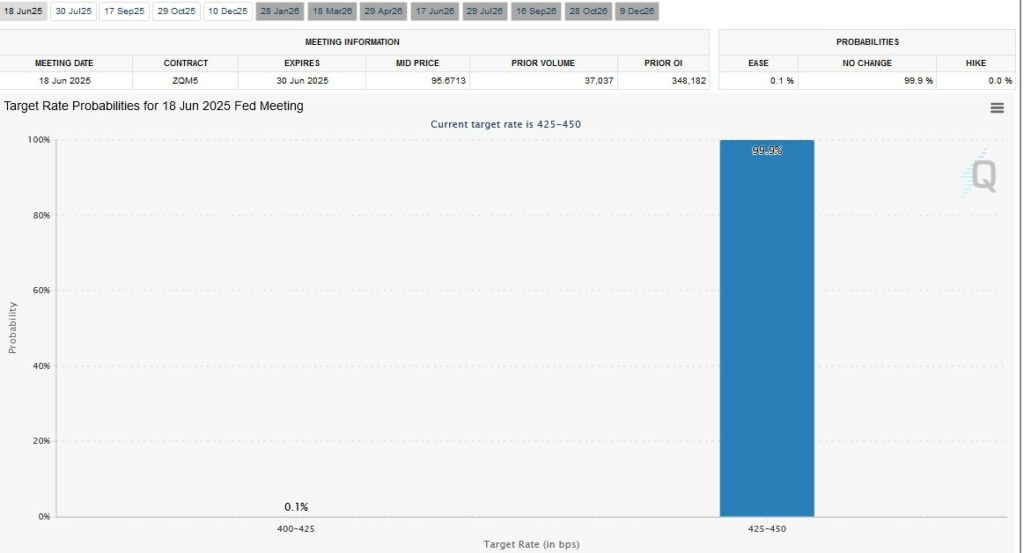

Expectations suggest the Federal Reserve will leave interest rates unchanged today at 4.25%-4.50%. The last rate cut was in December of 2024. Right now, the majority of the market is expecting rates to remain untouched until September, but there is a good chance we still see two cuts in 2025. It will be important to listen to Jerome Powell and weather his tone is hawkish or dovish. “Hawkish” policies favor raising interest rates to combat inflation while “dovish” policies favor lowering rates to stimulate the economy.

Ag Fundamentals:

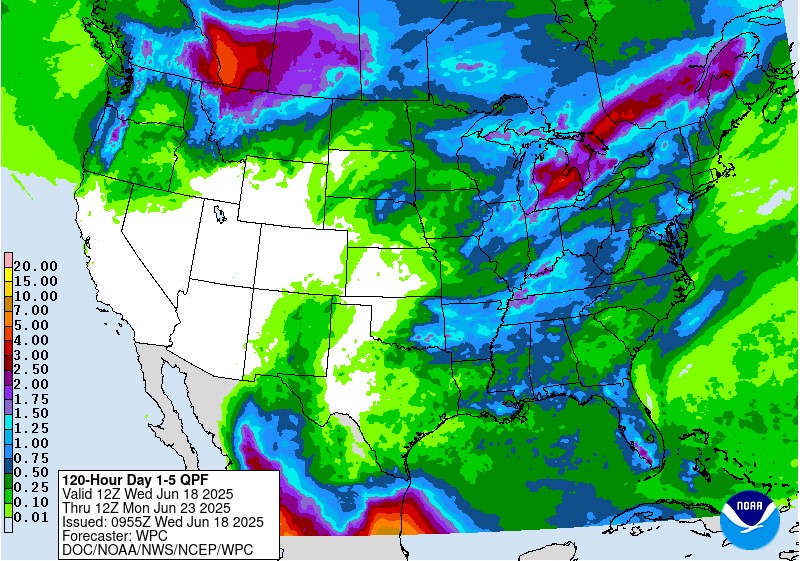

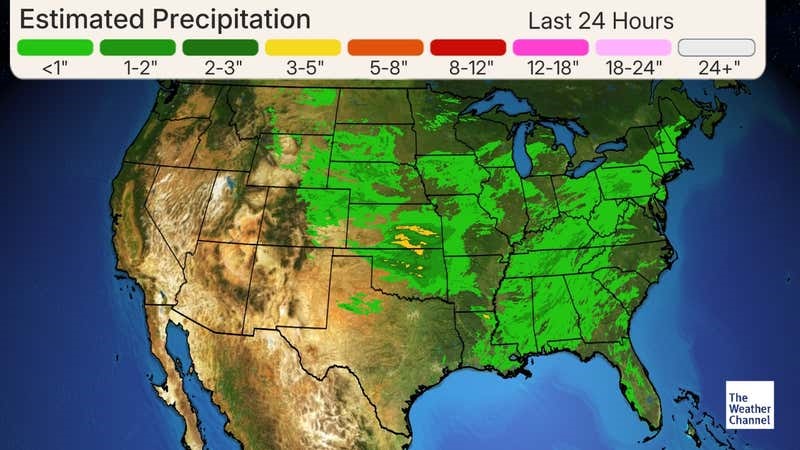

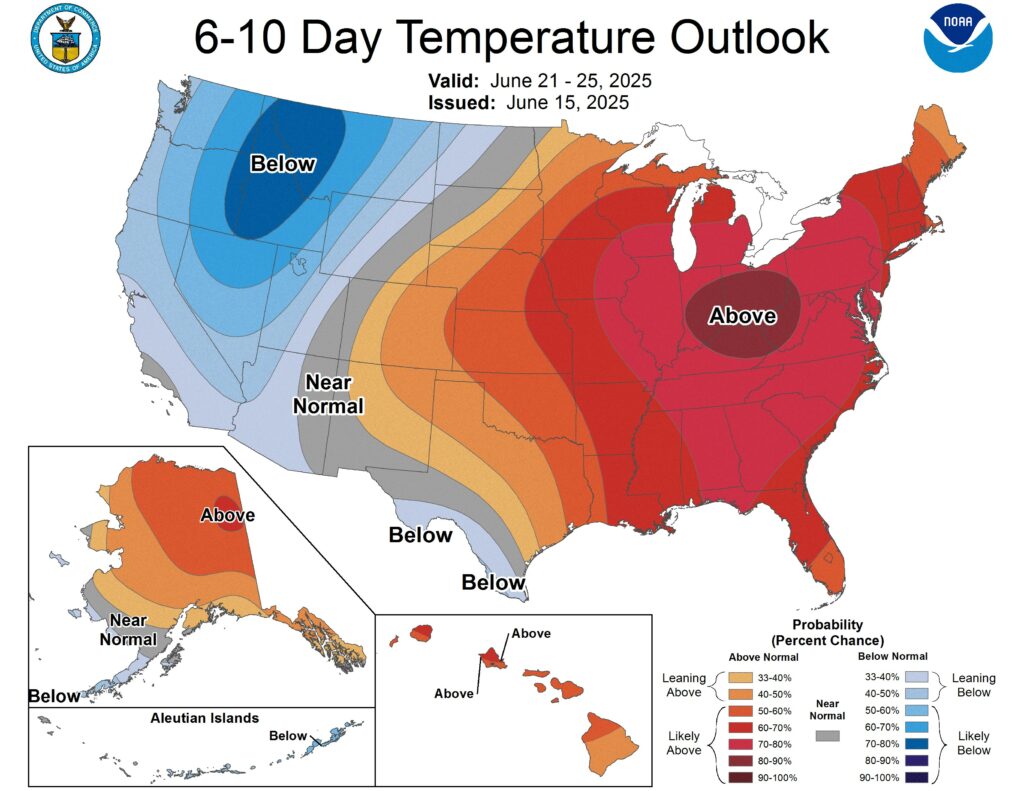

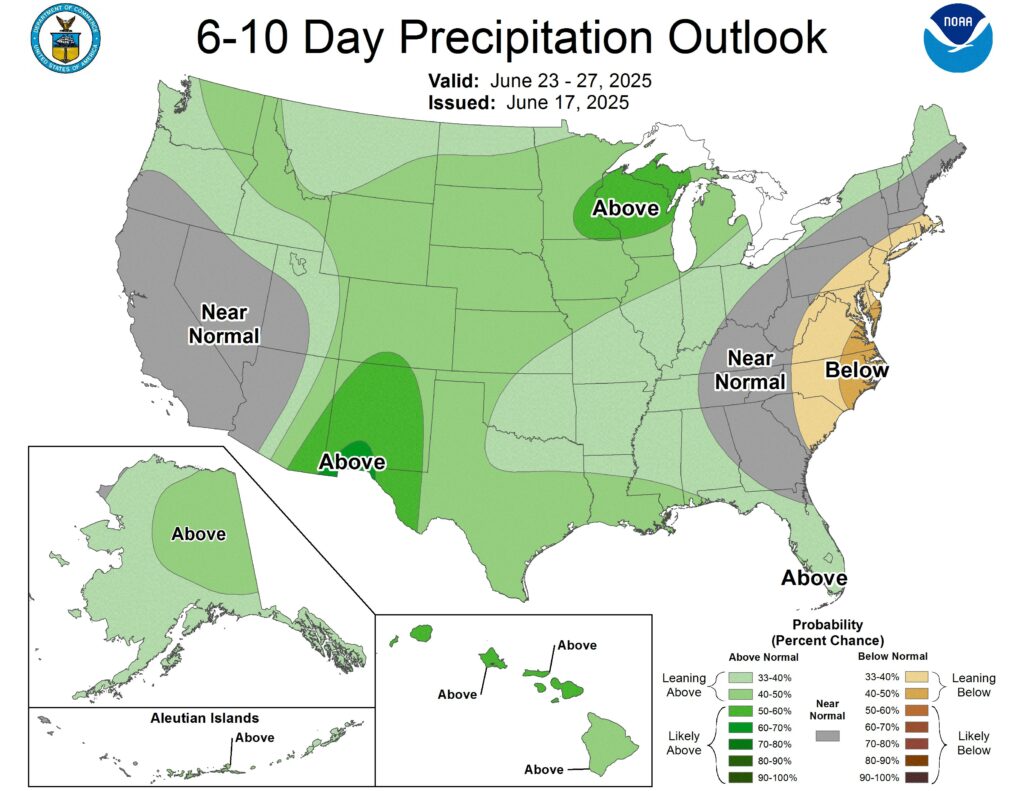

The Grain Stocks and Planted Acreage report will be out at 11:00am CST on Monday June 30th. That is the next major US commodity report that could potentially move markets. Corn exports have been strong, while feed and residual may be reduced for a few reasons. The corn/wheat ratio firmed up a within 50¢/bu in late April giving reason for wheat feed to work it’s way into feed rations. That corn/wheat ratio has since rebounded with reactions to potential trade disruptions in the black sea region. Additionally with the strength of soybean oil, soybean meal has dropped $10/ton and has become more competitive compared to corn regarding feed as well. US weather is favorable for the next 10 days. Nothing in the forecast including the heat tells me to worry about crop growth.

Tomorrow Juneteenth Holiday Hours: evening session closed tonight, day session closed tomorrow and normal hours Friday.

99.9% Probability the Federal Reserve leaves interest rates unchanged.

Export & World News

Yesterday, the US announced a sale of 120K MT of soybean meal to unknown destinations. Algeria bought an estimated 550K-570K MT of milling wheat in an international tender. Jordan also purchased about 60K MT of hard milling wheat.

Malaysian palm oil futures were up 37 ringgit overnight, now at 4101.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

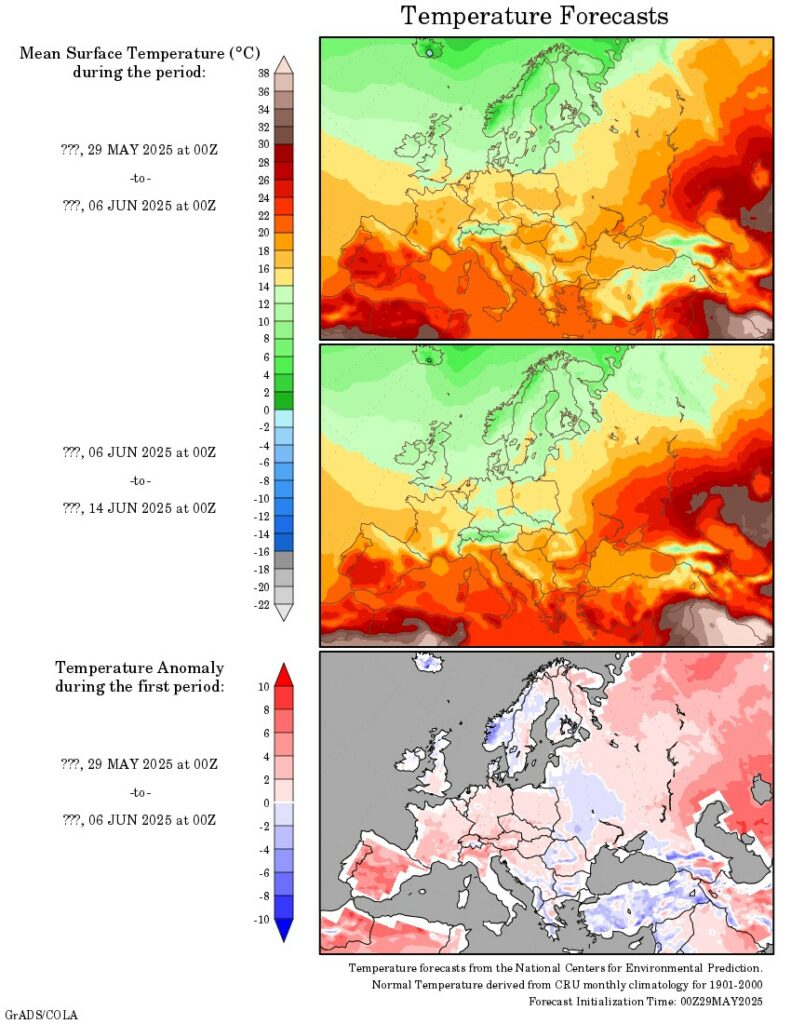

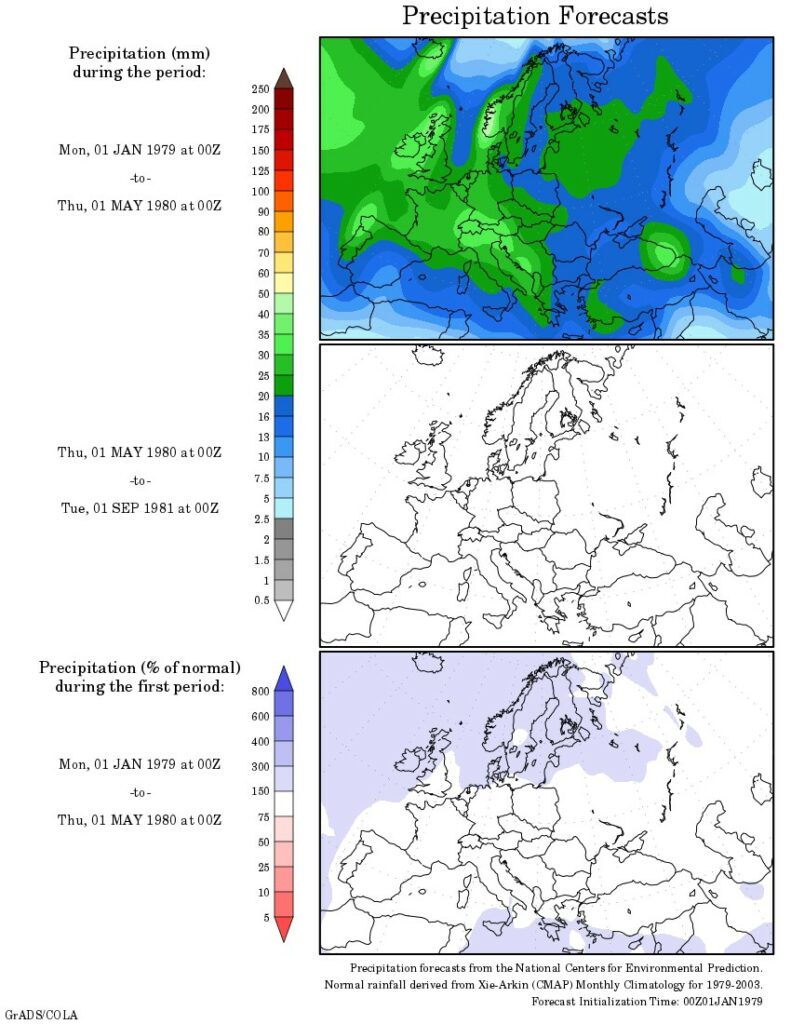

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.