OPENING COMMENTS

Geopolitics:

Today the damage done in the middle east between Iran and Israel is hard to determine due to inconsistent and unofficial reports. The Iranian Health Ministry reported at least 224 deaths and 1,277 injured as of June 15th. Of those casualties 90% of them were reported by the IHM to be civilians. A separate report on Iran from a human rights group was 406 deaths, 197 civilians, 90 military, and 119 unidentified, with over 650 wounded. Israel sources have reported 24 deaths and 390 wounded as of June 16th. Outside parties have seemed to stay out of it, aside from the US helping Israel shoot down incoming Iranian missiles over the weekend. Additionally, I did not see any significant reports from the “no kings” rallies in the US over the weekend.

Macroeconomics:

Crude oil backed down from it’s highs on late Friday and early this morning. Crude reached over 76.74/Bbl and is now trading near 71.60/Bbl. Seems the cool down was due to a lack of reaction from outside world powers in the conflicts overseas. This week’s market-moving reports could be the retail sales report out tomorrow, the Bank of Japan reporting their monetary policy this evening/tomorrow morning, and the US federal reserve meeting will announce their decision on interest rates on Wednesday. We do have the Juneteenth holiday on Thursday to break up the trading week as well. Today both the Bank of Japan and US federal reserve are expected to keep rates unchanged.

Ag Fundamentals:

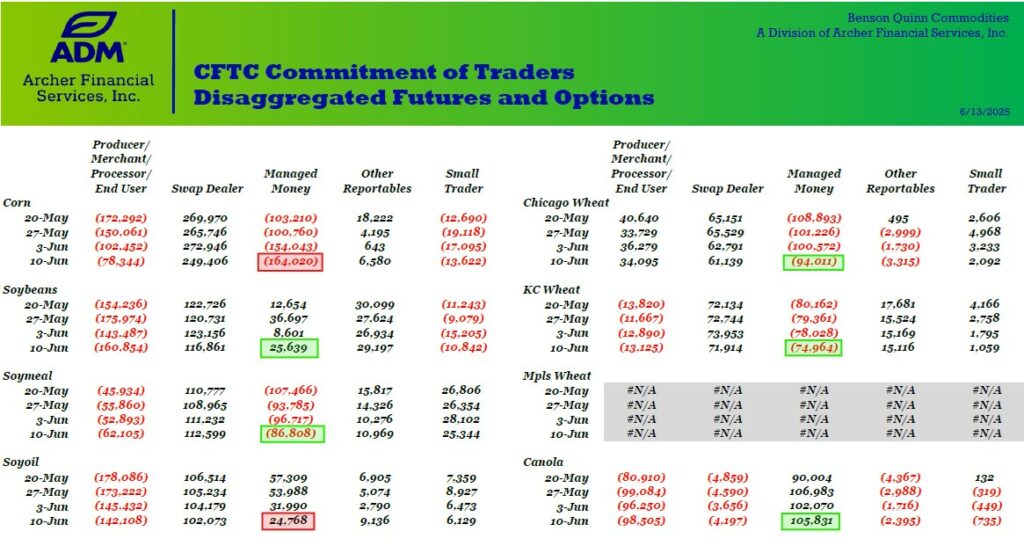

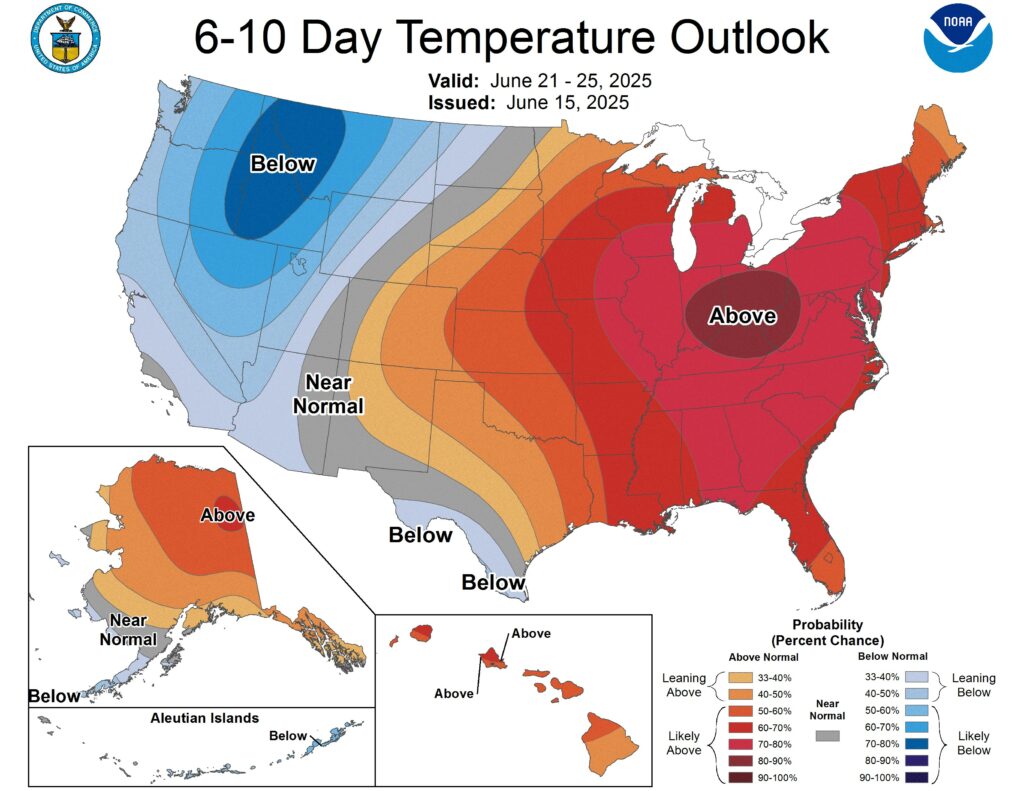

On Friday morning the EPA announced their proposed increase to biofuel blending targets. This year the current target is 22.33 billion gallons, and the EPA raised targets fro 2026 to 24.02 billion gal and 2027 at 24.46 billion gallons. This does come up short of the recommended 25 billion gallons for 2026 by separate industry groups but did have soybean oil up the limit on Friday. This morning Soybean oil was up over the normal limit at +3.5, resulting in beans higher, and soybean meal lower. As prices of soyoil increase there will be more soybean meal supply as a result. Corn futures lower this morning due to a healthy weather forecast for the rest of June. July is still a wildcard, but if we hit just a couple good rains during July, we can stick a fork in this year’s crop. No major changes to the Money Manager’s positions in the CFTC commitment of traders report on Friday. Their soybean position had the biggest move of +17K contracts. We have crop ratings and planting progress out later this afternoon.

The CFTC Commitment of Traders Report

Change in Managed Money Positions

Corn: -9,977

Soybeans: +17,038

Soybean Meal: +9,909

Soybean Oil: -7,222

Chi Wheat: +6,561

KC Wheat: +3,064

Canola: +1,761

Export & World News

Tunisia is believed to have bought around 100K MT of soft wheat from optional origins in an international tender on Friday.

Malaysian palm oil futures were up 178 ringgit overnight, now at 4105.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

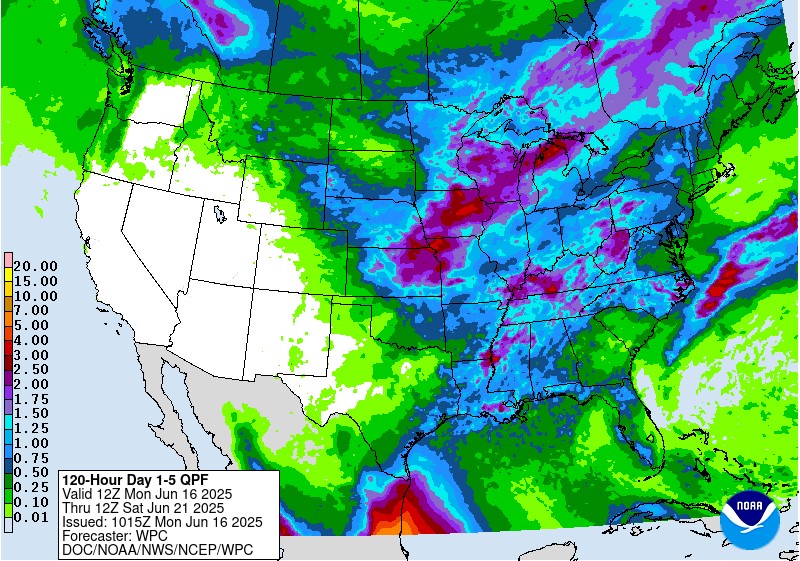

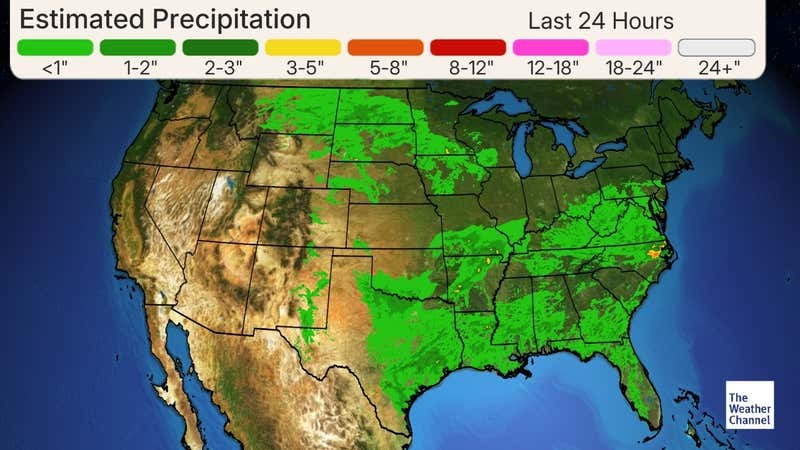

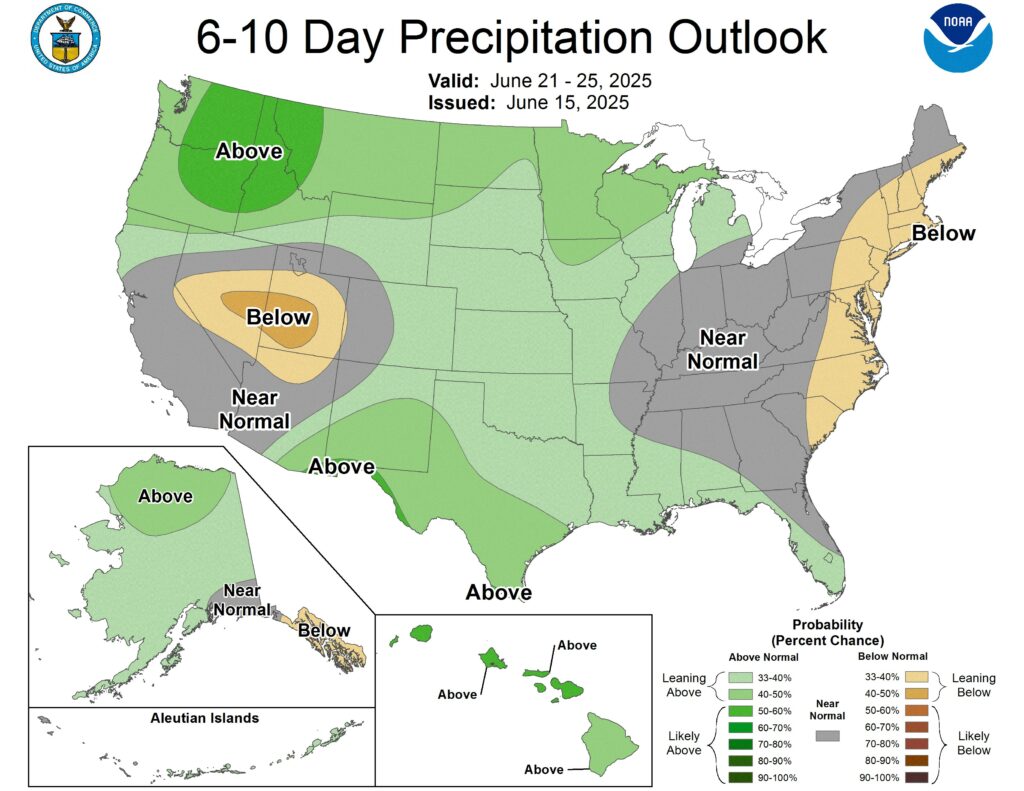

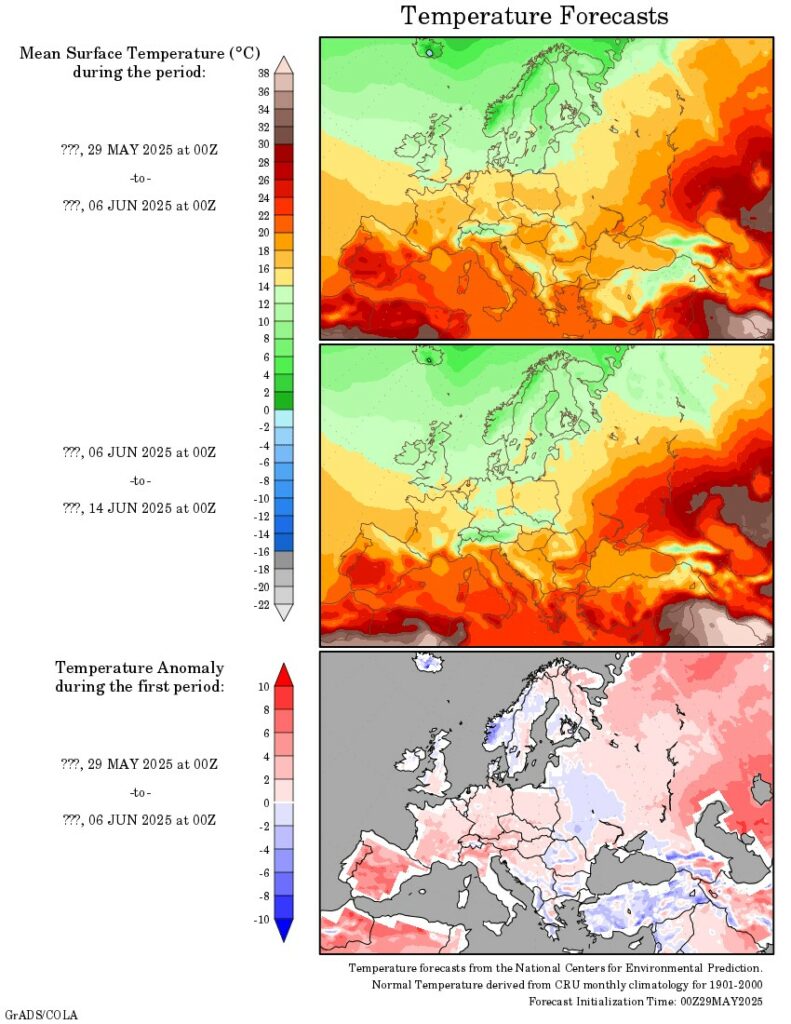

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.