OPENING COMMENTS

Ag Fundamentals:

ADM Decatur dropped their nearby soybean bid by around 60¢ late yesterday. Central Illinois bids were around +22¢ over the July Soybean (SN5) futures until the change yesterday. Today they are posted -20¢ under the November, and with the spread being about an 18¢ inverse, cash bids are now about 60¢ lower. The SN/SX spread is 10¢ weaker since yesterday morning. is This may have happened for a few reasons: Processors have enough old crop beans to cover their needs, they are expecting a large crop this year, and/or margins are better for new crop beans. Today, nearby soybean crush margins are 10¢ higher off the lows at $1.25 against the July while new crop crush margins are $1.77/bu against the November. Export sales this morning were overall disappointing but exports are still the biggest case for cuts to old crop corn ending stocks later this morning. The USDA will release the June WASDE report at 11:00am today. June reports are typically not the game changer, and it is likely the USDA will punt large production changes to next month.

Macroeconomics:

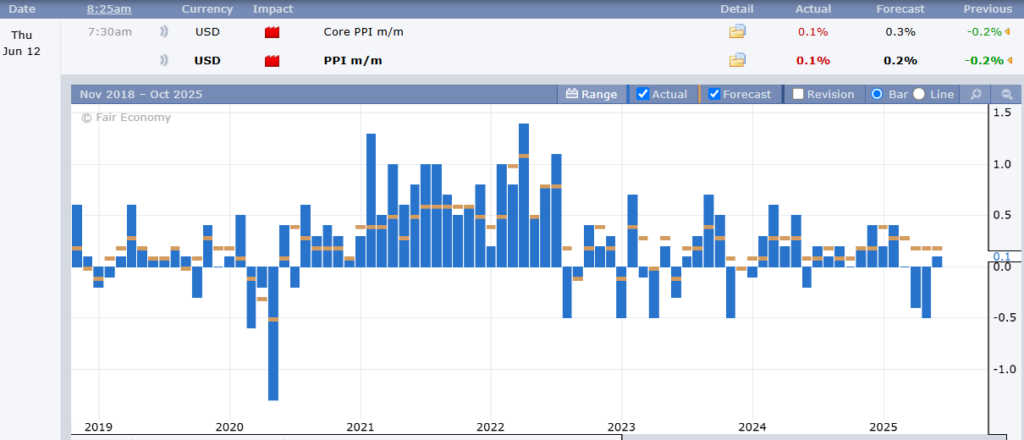

The dollar made a 3-year low this morning, dropping sharply below 98.0 on the index. These are levels last seen in the first quarter of 2022. A lower dollar is supportive for commodity prices, but could spark inflation concerns. CPI yesterday was better than expected and PPI this morning was also lower than estimates. The Producer Price Index reported a +0.1% change in prices month-over-month vs. the 0.2% expected and core PPI came in at +0.1% when the market was expecting a 0.3% increase.

May Producer Price Index shows inflation is not as bad as the market expected. This is the 4th month in a row PPI has come in below expectations.

Weekly Export Sales

|

Export & World News

Taiwan purchased around 65K MT of animal feed corn from Brazil and about 95K MT of grade 1 milling wheat sourced from the USA. South Korea bought an estimated 55K to 65K MT of animal feed wheat in a private deal.

Malaysian palm oil futures were down 1 ringgit overnight, now at 3838.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

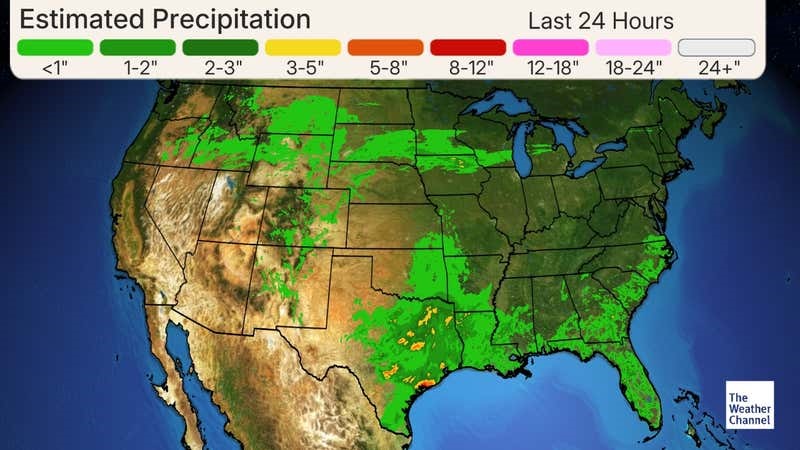

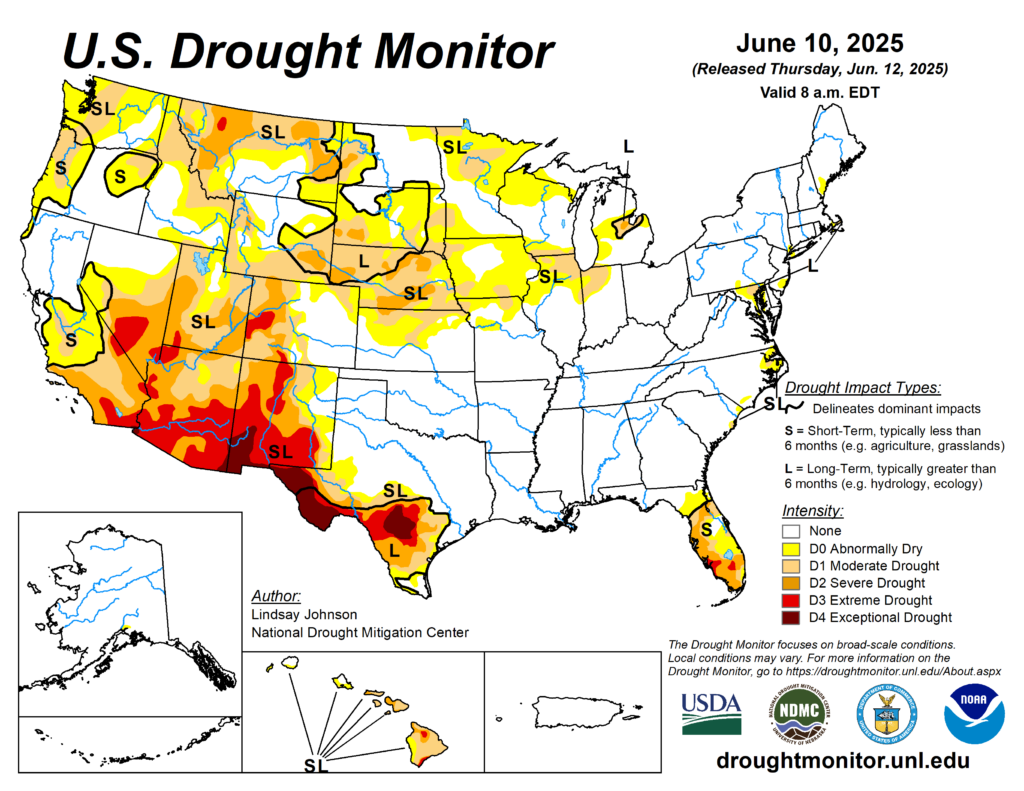

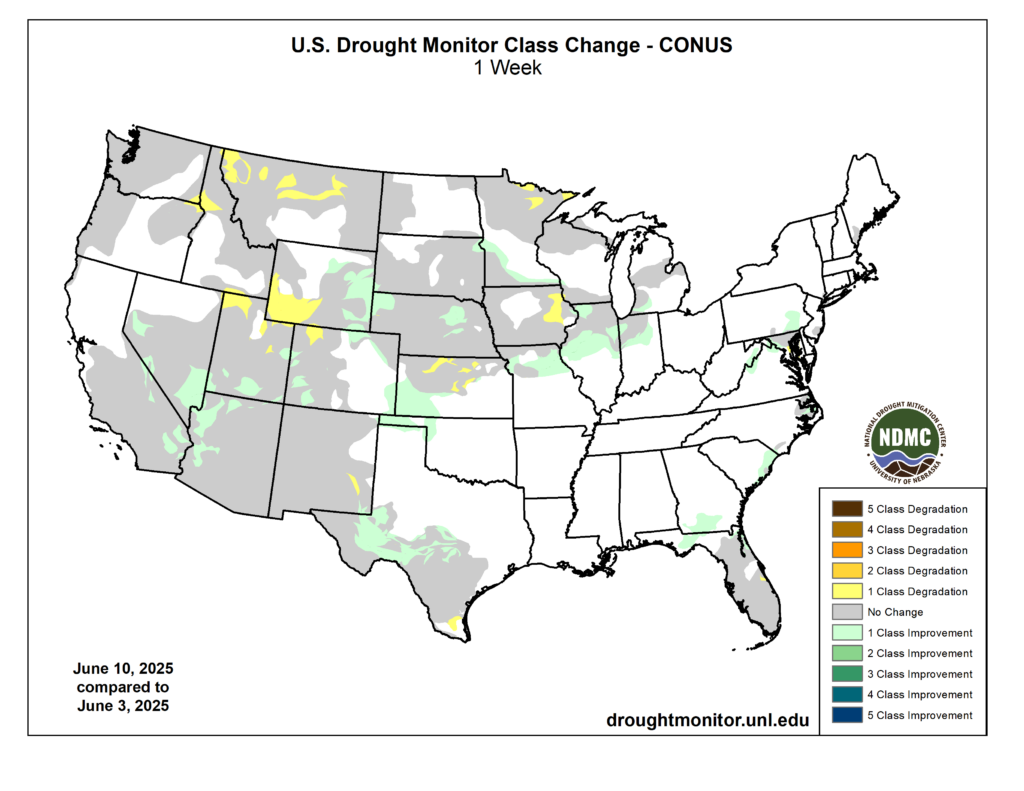

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.