OPENING COMMENTS

Ag Fundamentals:

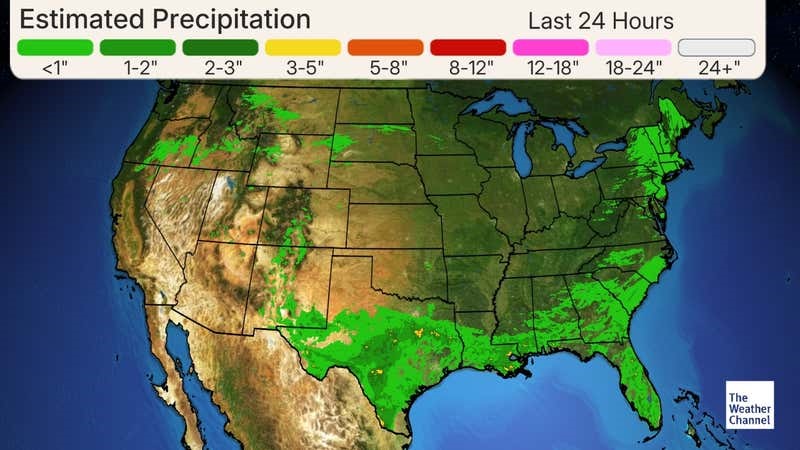

Some rain was pulled out of thee forecast for the next 7 days, but most of the US growing regions will still see 100% of normal rainfall in the next week. Iowa is one of the regions that precip was taken out of the week forecast. If it’s a June weather rally you want, you’ve came to the wrong year. It seems progress was made between China and the US in their most recent sit down in London. The 10% tariffs on US goods entering China and the 55% tariffs on Chinese goods entering the US will remain in place. Chinese students studying in the US will keep their visas and China is expected to resume exporting rare earth metals to the US. It seems the deal is not signed by both parties yet, but President Trump said it is “done” on a truth social post this morning.

Macroeconomics:

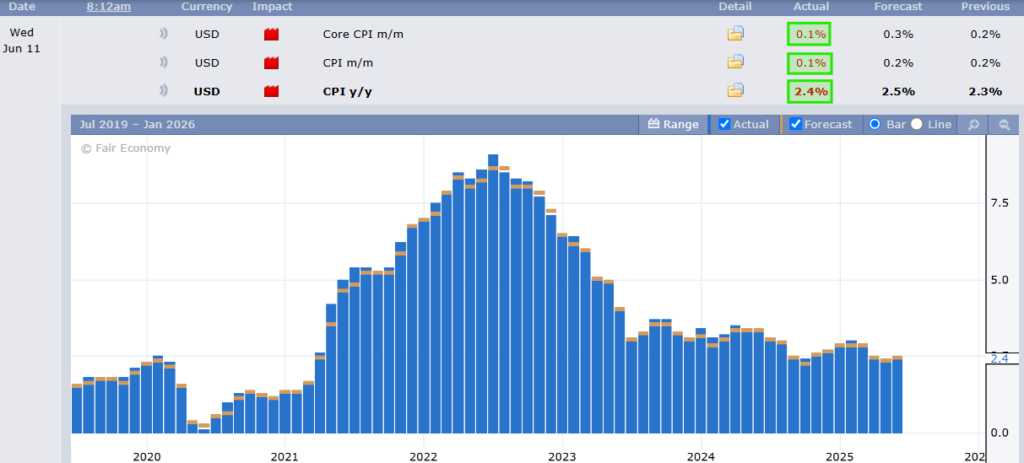

The dollar is weaker this morning continuing its trend down from it’s peak at the beginning of the year when it peaked above 109.50 on the index. A weaker dollar keeps the US competitive globally regarding commodity exports and gives South American exporters some headwind. This morning’s Consumer Price Index reported 2,4% increase in consumer prices year-over-year and a 0.1% increase to CPI and core CPI month-over-month. Prices rose less than expected across the board and this is the 4th month in a row that prices rose at rates below the market estimates.

The US Dollar is weaker again this morning. The Chart below shows the dollar trending weaker since the beginning of 2025. Commodity prices here in the states have benefited from a weaker dollar.

Brazilian Real has has overtaken levels last seen in September/October of last year. A stronger Real may allow for global buyers to readjust their focus back to US exports.

The Consumer Price Index reported lower than expected increase to consumer prices for the month of May. This is the 4th month in a row that core CPI has come in below expectations, meaning prices are not increasing at the expected rate for consumers.

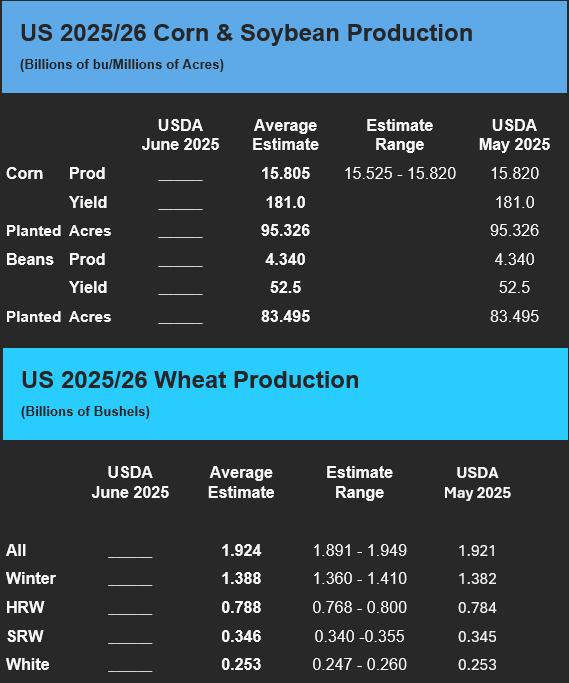

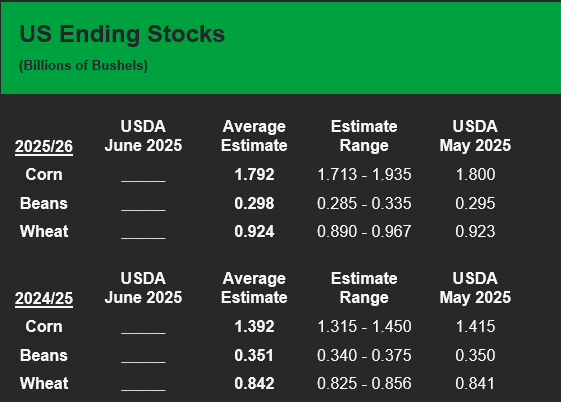

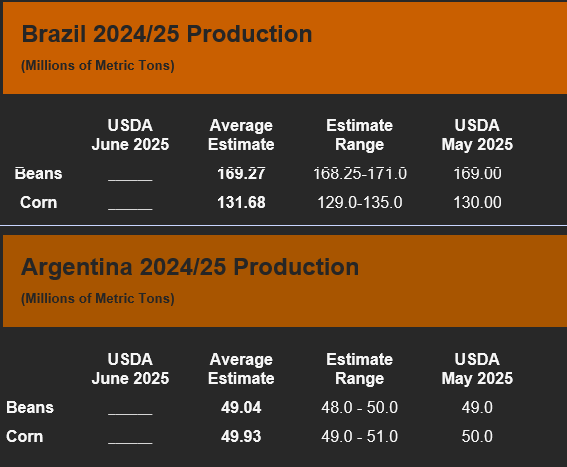

USDA June 12th WASDE Estimates

Export & World News

South Korea bought an estimated 337K MT of animal feed corn in three separate international tenders. Taiwan has also purchased an estimated 65K Mt of animal feed corn sourced from Brazil.

Malaysian palm oil futures were down 25 ringgit overnight, now at 3839.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

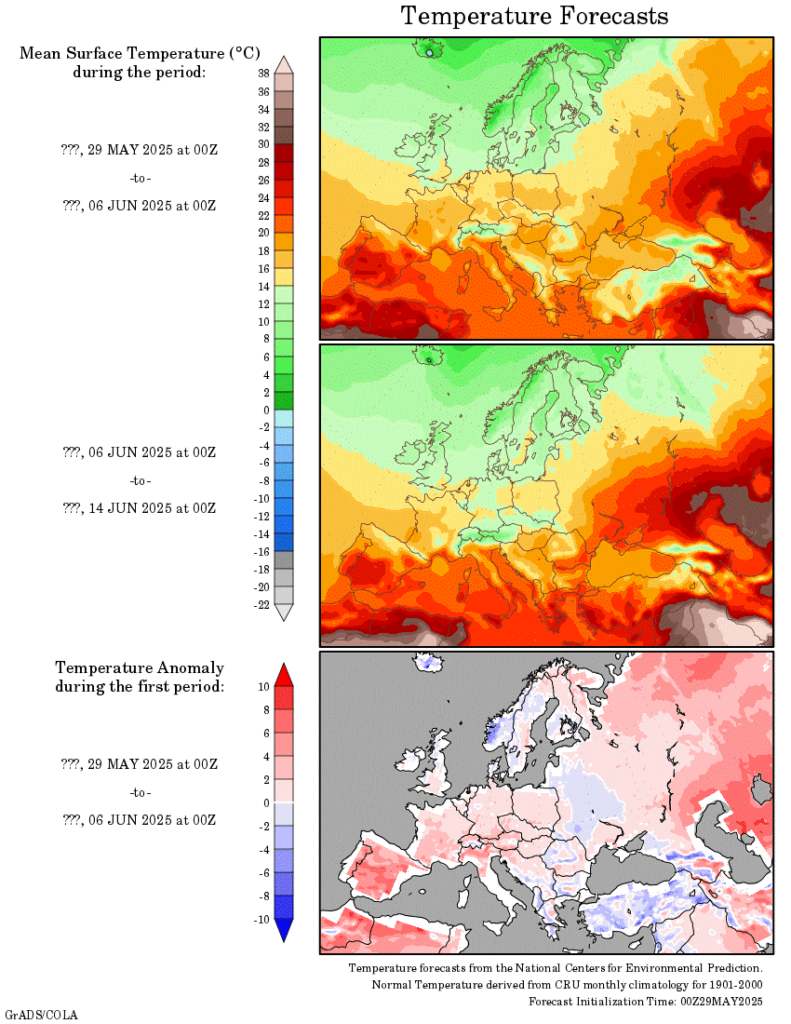

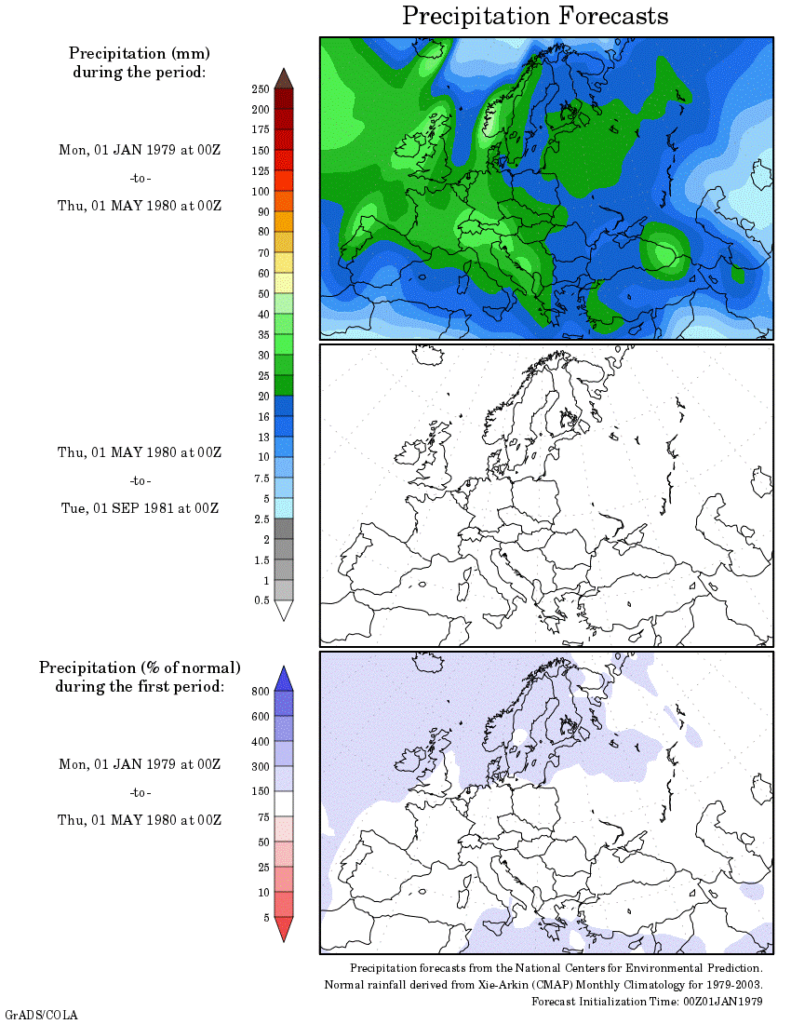

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.