OPENING COMMENTS

Ag Fundamentals:

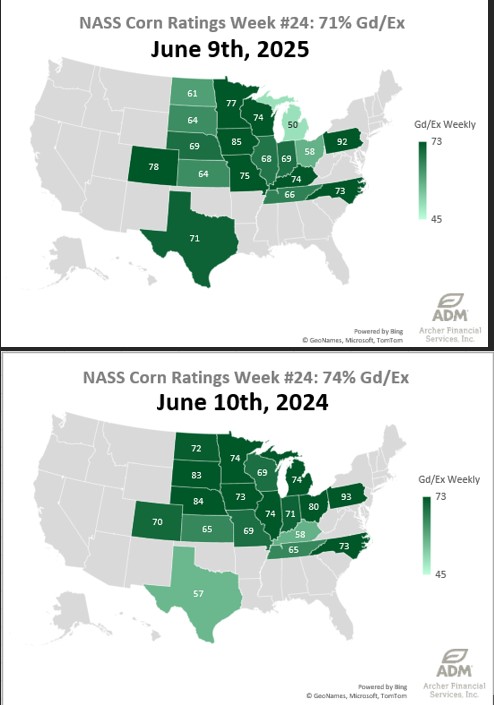

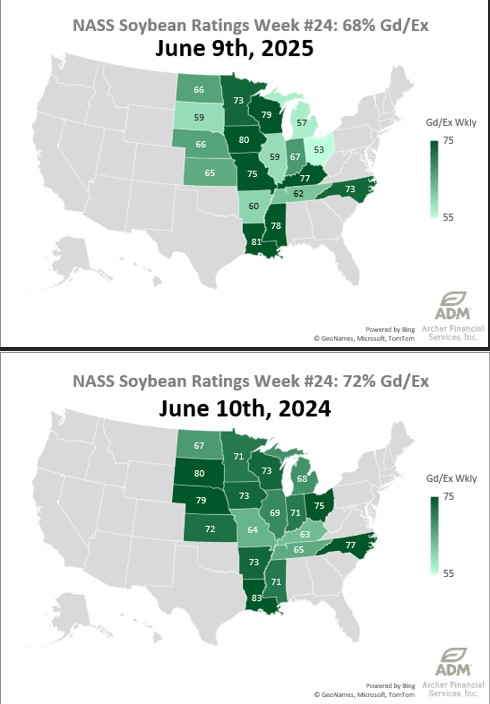

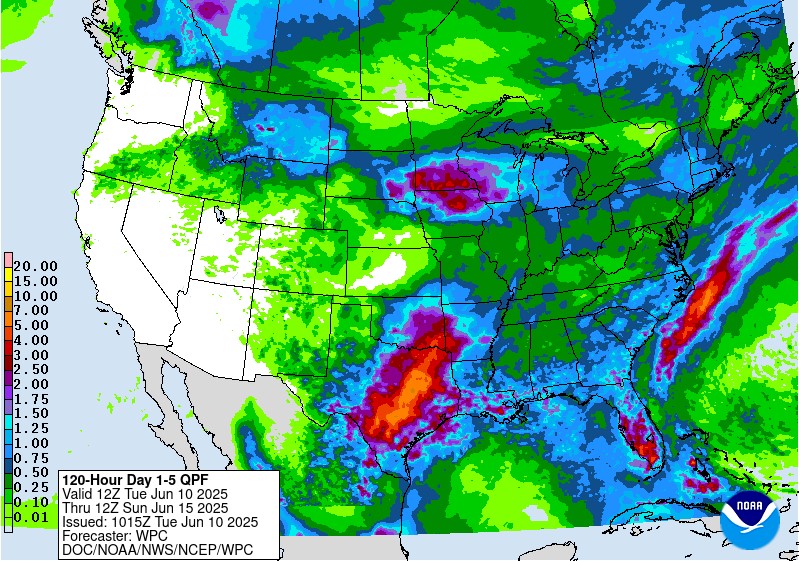

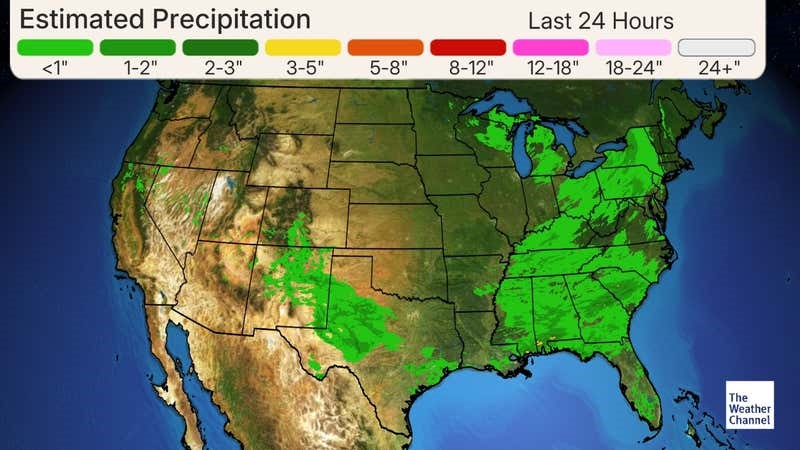

Yesterday’s crop condition report did not offer the market any rally fuel. Most of the US is in good shape regarding both crop conditions and planting progress. There is plenty of time for conditions to change between now and harvest, but there are no hurdles to jump in the 10-14 day forecast. The winter wheat crop conditions improved +2% to 54% good/excellent, which is one of the top ratings US winter wheat has received this time of year in a while. Spring wheat conditions improved +3% to 53% good/excellent, and I’m not hearing many concerns from the northern plains regarding production outlook. Oklahoma has received alot of rain recently which has slowed harvest progress down significantly. It will be important to keep an eye on the OK wheat crop in case the moisture and harvest delays cause disease pressure, light test weights, or yield loss. This Thursday’s WASDE estimates will be out soon, and It looks like the market wants to decrease old and new crop corn ending stocks, while leaving wheat and soybeans near unchanged. Overnight, July corn hit it’s lowest value on the board since October last year. Despite the planting delays in the eastern corn belt, the weather is not offering any issues to sustain prices. The Brazilian second corn harvest is progressing at it’s slowest pace in 4 years. Only 1.9% of the crop was harvested as of last Thursday. This is due to a late planting and rainfall slowing fieldwork.

July Corn hits lowest level since October of 2024.

Corn Crop Conditions TY vs LY

Soybean Crop Conditions TY vs LY

Export & World News

South Korea privately purchased an estimated 65K Mt of animal feed corn in an international tender. US looking at rolling back the port fees on China vessels.

Malaysian palm oil futures were down 61 ringgit overnight, now at 3864.

Daily Trading Limits: Corn $0.35 (expanded $0.55); Soybeans $0.75 (expanded $1.15); Minneapolis Wheat $0.60 (expanded $0.90); KC Wheat $0.40 (expanded $0.60); Chicago Wheat $0.40 (expanded $0.60)

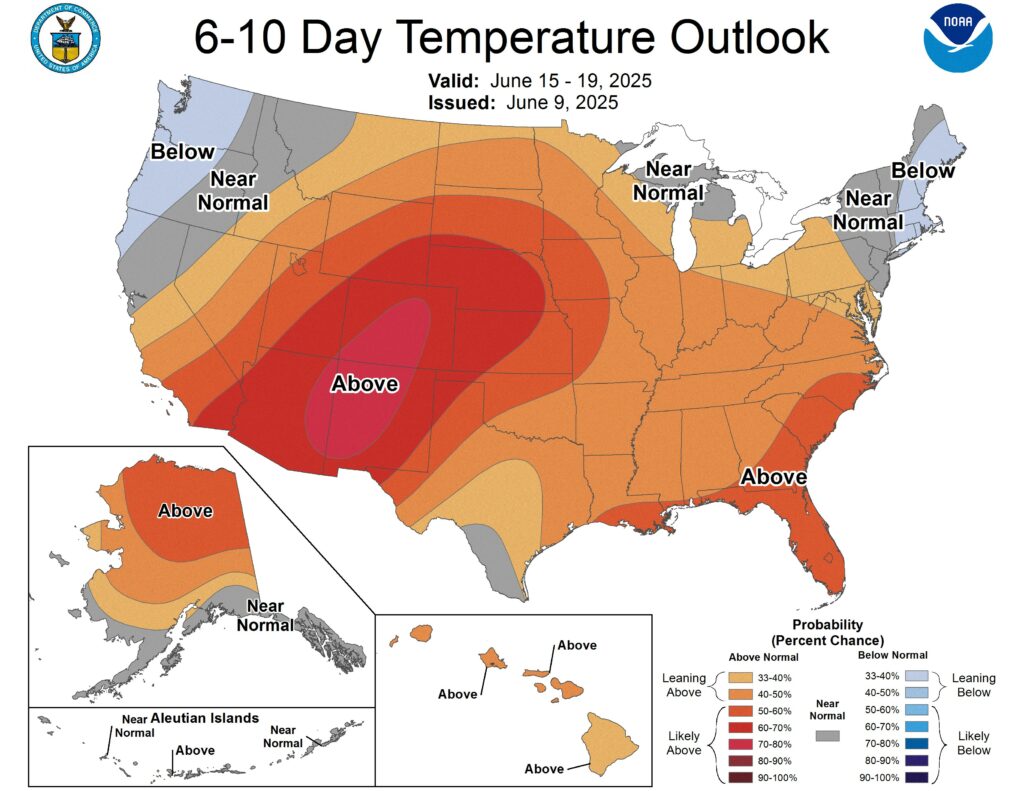

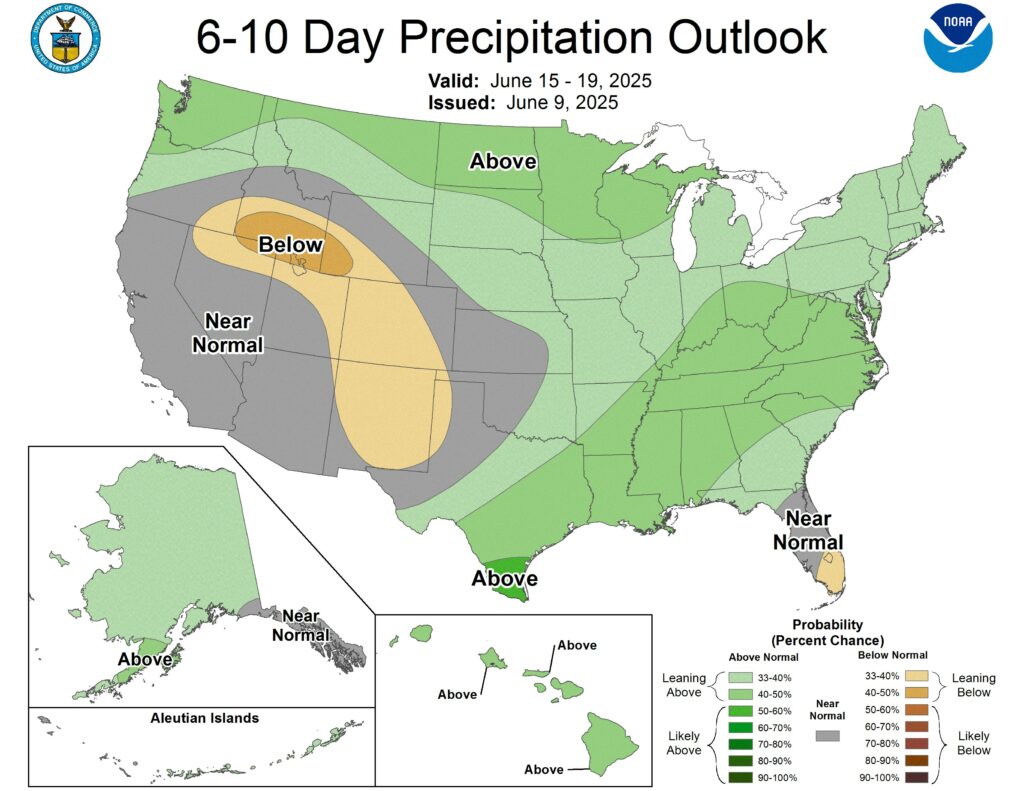

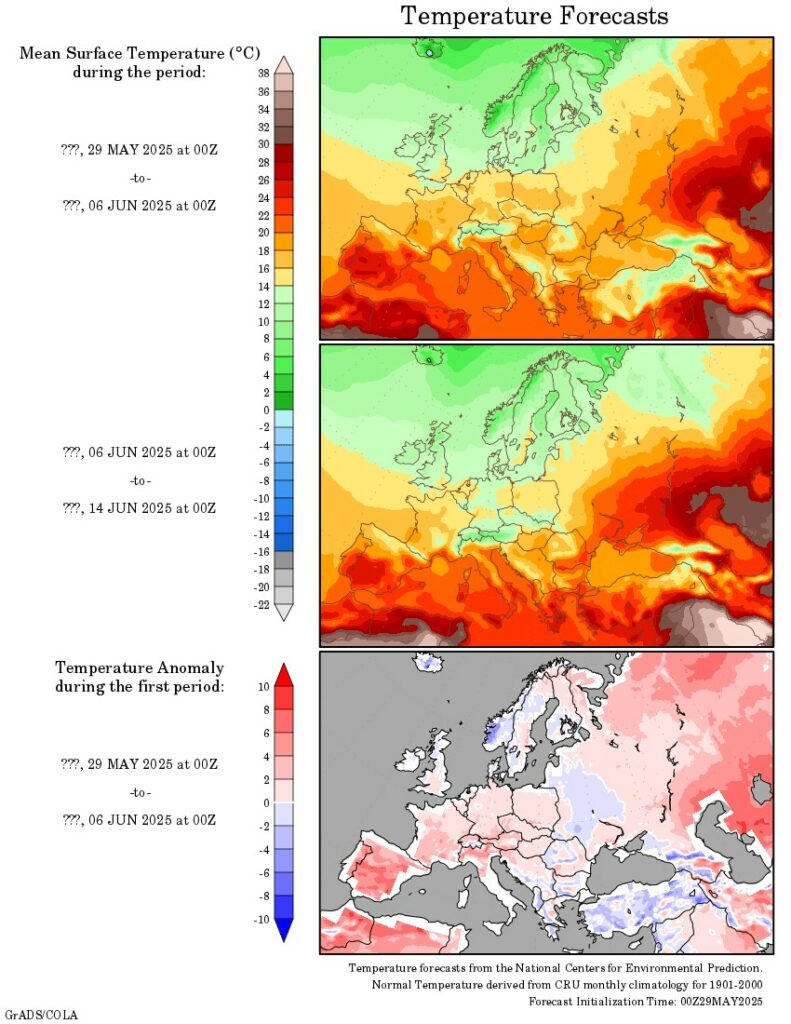

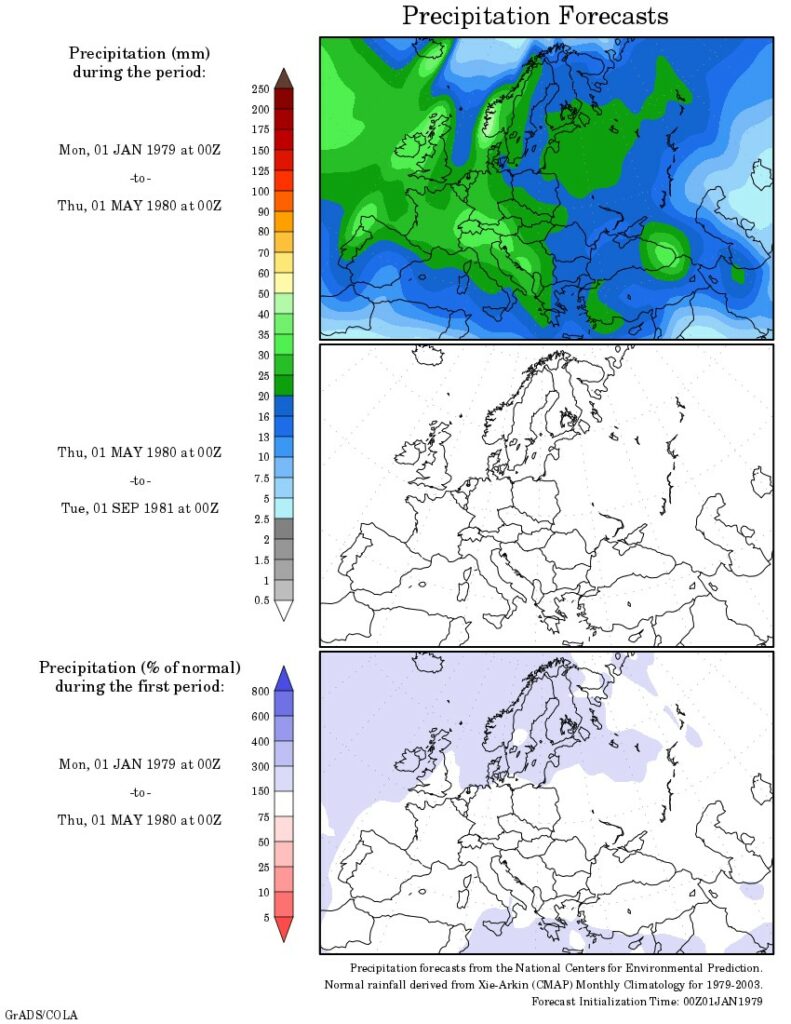

Weather Outlook

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.