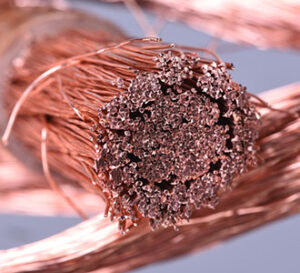

COPPER

The bias in copper remains up with residual hope of positive Chinese economic news from new loans scheduled for release early today. However, expectations predict February new loans dropping by more than 50% from the prior reading (January) and therefore copper bulls should brace for an even bigger reaction to US CPI. Apparently, the copper trade yesterday saw value in the May copper contract on the early dip below $3.8815. However, today’s Chinese new loan report will be very important to the near-term direction of copper, as Chinese copper demand concerns hover in the background following three straight weeks of large increases in weekly Shanghai copper warehouse stock readings.

GOLD & SILVER

There is no doubt the gold market has expended a tremendous amount of speculative buying fuel in achieving a $200 rally and today the trade will finally see the true origin of the rally. In our opinion, part of the significant rally in gold is the markets attempt to mirror the record rally in Bitcoin, with a lesser force from hopes of a June rate cut. Clearly, traders are becoming price sensitive as Friday’s massive range up move has stalled and trading volume has moderated significantly. While today’s CPI reading will probably set the trend for gold and silver for the rest of this week, Chinese new loan figures also figure to be a key focal point, especially with Chinese gold premiums narrowing at the same time Indian gold has shifted into discount status.

Interested in more futures markets? Explore our Market Dashboards here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.