Soyoil and wheat futures traded lower. Soybeans traded unchanged. Soymeal and corn traded higher. US stocks were mixed. Crude was lower. Gold was higher.

SOYBEANS

Soybean turned lower on lack of fund follow through buying and increase US farmer selling. US 2 week weather forecast should be favorable for harvest. Brazil looks dry until Oct 10. Rains could begin after Oct 10. On USDA Wednesday, funds bought 30,000 soybean and 11,000 soymeal contracts. They are now near a record long 222,000 soybean contracts, 73,000 soymeal contracts and 95,000 soyoil contracts. Weekly US soybean export sales were near 95.2 mil bu. Total commit is near 1,401 mil bu versus 520 last year. USDA goal is 2,125 versus 1,680 last year. China was best buyer. China has 752 mil bu bought with 389 mil bu in unknown. US soybean export commit is record large for this time of the year. Commit is up 881 mil bu over last year. USDA export estimate is for a 445 increase. USDA export number could be conservative. New crop US soymeal sales jumped 523 mt. There remains some concern about Brazil and Argentina crush rate. After USDA report, range of guesses for US 2020/21 soybean carryout is 325 to 440. Key is final yield. US August soybean crush is estimated near 175 mil bu and lowest in 6 months. Argentina dropped export tax 3 pct to 30 pct. This to encourage farmer selling, This is unlikely with Peso losing value every day.

CORN

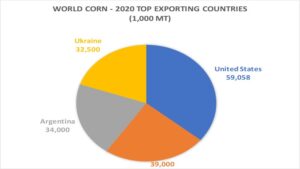

Corn futures traded higher. Increase consumer buying and limited US farmer selling offered support. US 2 week weather forecast should be favorable for harvest. Brazil looks dry until Oct 10. Rains could begin after Oct 10. Parts of Russia and Ukraine remain dry. On Wednesday, funds bought 55,000 corn contracts. They are now long 152,000 corn contracts. Weekly US corn export sales were near 79.8 mil bu. Total commit is near a record 969 mil bu for this time of year versus 382 last year. USDA goal is 2,325 versus 1,765 last year. Commit is up 587 mil bu from last year. Unknown, Japan and China were best buyers. China has 396 mil bu bought with 140 mil bu in unknown. Commit is up 587 mil bu over last year. USDA export estimate is for a 560 increase. USDA export number could be conservative. After USDA report range of guesses for US 2020/21 corn carryout is 1,800 to 2,280. Key is final yield. Next USDA report is Oct 9. Bulls feel US corn yield could be closer to 177.0 versus 178.5. Final export demand could reach 2,525. Bears feel final yield could be near 179.5. Some estimate IL low ground corn yields near 150. High group is averaging 210-215. This suggest USDA state yield of 207 could be high. Private estimates of US corn crop will start tomorrow and Monday.

WHEAT

Wheat futures trade lower. WZ range was 5,68 to 5,84. Lack of follow through technical and fund buying may have triggered long liquidation. On Wednesday Managed funds were net buyers of 25,000 Chicago wheat contracts. They are now estimated to be long 30,000 contracts. Some feel that prices could be overvalued. Most of Russia and pats of Ukraine are dry. Some feel current weather pattern is similar to 1966. In that year, October Russia weather remained dry. This could cause concern about germinations. In that same year, November turned wet but cold. Lower crop could force Russia to have export quotas. US south plains 2 week weather looks also to be drier and warmer than normal. Need a change in southern oscillator and less tropical systems in the gulf to open the gulf for moisture to move into the plains. Weekly US wheat export sales were near 18.6 mil bu. Total commit is near 514 mil bu versus 474 last year. USDA goal is 975 versus 965 last year. Mexico was best buyer.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.