SOYBEANS

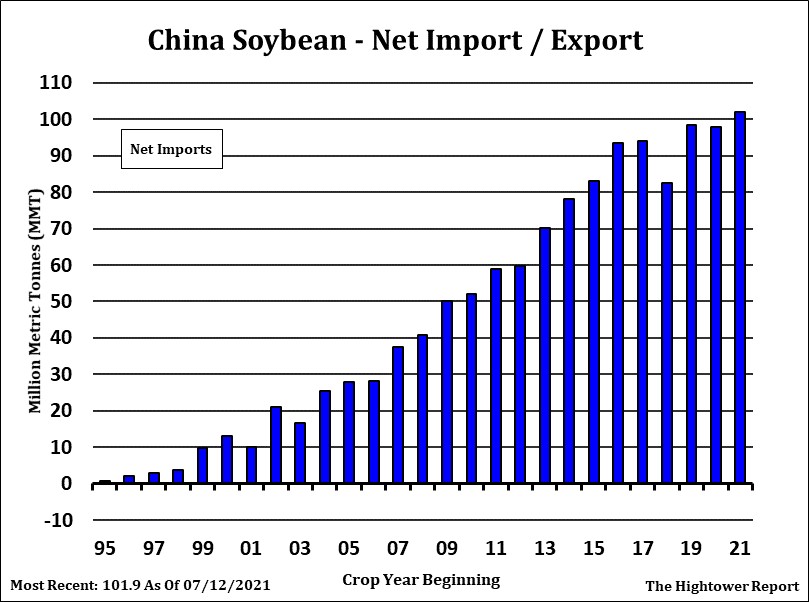

Soybeans continues to trade in a narrow range on low volume. SU is near 13.97. SMU has rallied to 370 on soyoil/soymeal spread liquidation. Concern about Argentina export logistics may also be helping soymeal. US farmer continues to sell old crop soybeans. Crushers continue to be buyers at elevated margins. Funds continue to be concern about a lack of China buying new crop US soybeans. China may be done buying Brazil and are now buying Argentina. Some feel they are also asking for US PNW Aug-Sep. Trade est US weekly soybean export sales near 100 to 600 mt vs 311 last week. US export commit is near 2,275 mil bu vs 1,712 last year. USDA export goal is 2,270 vs 1,679 last year. US 6-14 day NW Midwest forecast is warm and dry. Key is 15-30 day forecast. US farmers are 30-50 pct sold of 2021 soybean crop.

CORN

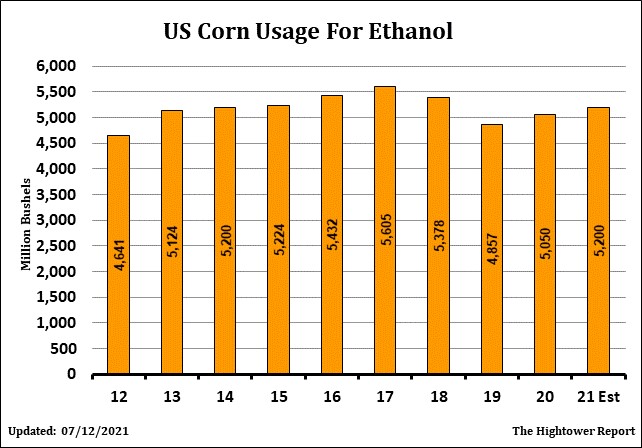

Sep corn futures were unchanged in light volume and near 5.71. Range was 5.67 to 5.79. CU needs to fill the gap near 5.88 to move higher. Some feel a close over 5.85 CZ could suggest a target near 6.90. Will need poor US NW Midwest weather to fill the gap and trade over key resistance. Managed funds continue to be reluctant buyers on feelings that 10 days of warm/dry US NW Midwest weather may not be long enough to drop US corn yield low enough to push futures higher. Our weather guy though feels day 11-14 could also be warm and dry. Cool Pacific sea surface water temps could even extend the ridge into August. Funds also reluctant to add to corn longs until US new crop corn sales increase. Most look for lower South America corn exports that could shift 300-400 mil bu of corn demand to US. Trade est US weekly corn export sales 100-700 mt vs 271 last week. US corn export commit is near 2,750 mil bu vs 1,712 last year. USDA goal is 2,850 vs 1,777 last year. Weekly US ethanol production was down 1 pct from last week but up 13 pct from last year. Stocks were up 6 pct from last week and up 13 pct from last year. Margins remain negative. Trade watching news from Washington as Democratic Congress wants to eliminate biofuel mandate. Biden administration could delay mandate policy. WH still wants green fuel.

WHEAT

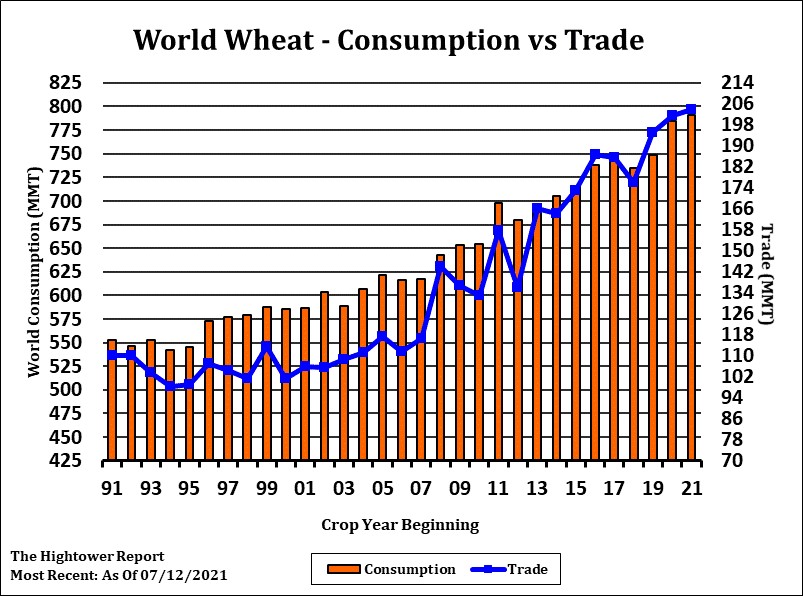

Wheat futures traded mixed. WU traded up 10 cents and near 7.10. KWU traded up 8 cents and near 6.69. WU resistance near 7.20. KWU 6.80. MWU continued to trade lower and near 8.97. WU/KWU may have less resistance as US harvest nears end and there is less hedge selling. KC farmers have sold much of the 2021 crop. Talk of showers in the 10 day forecast for parts of South Canada prairies and ND offered resistance to MWU. Better EU harvest weather may be offering resistance to Matif wheat futures. Talk of lower Russia Wheat crop may be offering support. Trade est weekly US wheat export sales near 350-600 mt vs 425 last week. US wheat export commt is near 261 mil bu vs 303 last year. US HRW export prices near $310, Baltic $256, Germany $262, Russia $251, French $258.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.