SOYBEANS

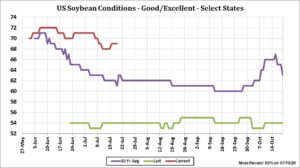

Soybean futures traded lower on improved US Midwest weather outlook. Managed funds liquidated net long positions in soybeans and increased net shorts in soymeal. USDA announced new US new crop soybean sales to China and unknown. Concern is that USDA old crop soybean export goal may be too high. This could add to US 2019/20 carryout. Rains are moving through C IL today. Rains will increase today in IA and IL. 7 day US Midwest weather forecast calls for normal temps and normal rains over most of the Midwest. 2 week forecast calls for mostly normal to above temps and normal rains. USDA estimated US soybean crop 69 pct good/ex versus 68 last week. Crops improved in AR, IL and MO. Crop ratings dropped in IA, MN, NE and OH. Best crop remain in the west. Ratings help support USDA soybean yield of 49.8. Some feel final yield could go higher. There continue to be concern about US 2020/21 demand. USDA estimates US 20/21 soybean demand to increase 500 mil bu. Some feel the demand may not increase. This could increase carryout to near 600 mil bu and push prices lower.

CORN

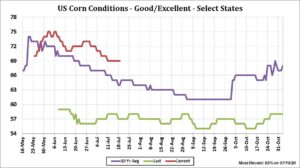

Corn futures traded lower. Managed funds increase their net short position on improved US 2 week weather outlook. Rains are moving through C IL today. Rains will increase today in IA and IL. 7 day US Midwest weather forecast calls for normal temps and normal rains over most of the Midwest. 2 week forecast calls for mostly normal to above temps and normal rains. US corn crop is running out of time to get hurt by dryness and heat. USDA estimated US corn crop 69 pct good/ex versus 69 last week. Crops improved in IL, MI, MO and SD. Crop ratings dropped in IA, NE and OH. Best crop remain in the west. Ratings help support USDA corn yield of 178.5. Some feel final yield could go higher. There continue to be concern about US 2020/21 demand. USDA estimates US 20/21 corn demand to increase 1.0 bil bu. Some feel the demand may not increase. This could increase carryout to near 3,600 mil bu and push prices lower. Interesting to note that China announced today that they are going to sell rice and rapeseed from their reserves to help supply corn feeding. Some wonder if record floods is reducing their corn crop and could increase their corn import demand. Weekly US ethanol productions should increase from last week. Stocks could also increase. Margins have dropped.

WHEAT

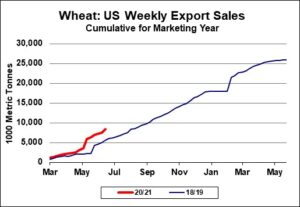

Wheat futures traded higher. Some feel recent drop in prices may have been overdone. Chicago Sep wheat futures remain in a broad range between 5.00-5.50. Matif wheat futures stabilized after days of decline. Talk of slow export interest weighed on prices as Europe harvest nears. Russia winter wheat harvest yields have been below expectations. Russia spring wheat areas remain warm and dry. Russia farmer selling remains slow. That is offset by thin vessel line up. US winter wheat harvest is near 74 pct done. USDA continues to rate the US spring wheat crop 68 pct good/ex. USDA currently estimates US all wheat 202 crop near 1,824 mil bu versus 1,920 last year. HRW crop is estimated near 710 versus 833 last year. SRW crop is estimated near 280 vs 239 last year. HRS crop is estimated near 502 versus 522 last year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.