SOYBEANS

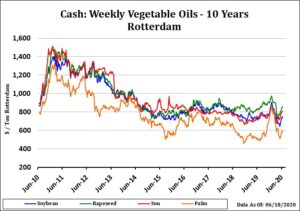

Soybeans traded higher. Soyoil jumped higher on talk of lower palmoil supply and positive China demand. Higher World vegoil prices helped support soybeans. This week, China buying US soybeans offered support. Pace is still below what is needed to reach USDA goal and Phase 1 trade deal. Some estimate China may need to buy 1.5 mmt of US soybeans per month. Fed Beige Book suggested a slow US economic recovery but poor Ag outlook. NOAA 90 day forecast calls for above normal Midwest temps. Rainfall could be above normal in NW Midwest and SE. Looking ahead, Oil World estimates 2020/21 World oilseed production to increase to 699 mmt versus 681 this year. Soybean production could increase to 365 mmt versus 340 this year. Crush could increase to 316 mmt versus 307 and end stocks could also increase to 16.7 mmt versus 9.7. World vegoil production could increase to 205 mmt versus 198 this year. All of this is negative to prices. Sep soybean appear to be in a narrow trading range between 8.75-9.00.

CORN

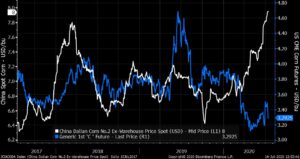

Corn futures traded higher. Recent China buying US corn and lack of farmer selling offers support. Most of the other news in corn continues to offer resistance. This week’s headlines were managed funds return net sellers of corn futures on improved US Midwest weather outlook. Bullish USDA acreage report helped trigger fund short covering. Funds continued to cover shorts due to hot/dry Midwest weather dropping crop Ratings especially in east states and NE. Needed IA and Il rains also offered resistance. Recent China buying US/Ukraine corn raised talk of their corn supply. This week China also began to buy Brazil 2021 corn. Fed Beige Book suggested a slow US economic recovery but poor Ag outlook. NOAA 90 day forecast calls for above normal Midwest temps. Rainfall could be above normal in NW Midwest and SE. This could suggest an early and fast US corn harvest. USDA est US 2020/21 total corn supply near 17.3 bil bu versus 15.8 last year. Total demand is est near 14.6 bil versus 13.6 last year. Some feel USDA demand est could be high. This suggest 20/21 carryout near 2.6 bil versus 2.2 this year.US corn export price are still the highest in the World. USDA also est World 20/21 corn crop near 1,163 mmt and end Stocks near 315 mmt versus 311 this year. Sep corn appears to be in a 3.20-3.40 range. Assuming normal weather, prices should trend lower into the fall.

Dalian corn futures versus US corn futures.

WHEAT

Wheat futures settled unchanged. Higher Russia prices and dry and warm Russia spring wheat forecast offered support. Recent rally in French wheat prices also supported prices. Lack of confirmation that China bought US SRW wheat triggered new fund long liquidation. Sep Chicago wheat appears to be in a broad range between 5.00-5.50. KC 4.40-4.60. US Feb Beige Book suggest slow US economic recovery but poor Ag outlook. This week, UN warned lower World demand due to resurgence of Covid could lower grain values. This could also reduce Wheat import demand to key buyers.. USDA est US 20/21 wheat supplies near 3,007 mil bu versus 3.105 last year. Demand is est near 2,065 mil bu versus 2,061 last year. Carryout is est near 942 versus 1,044 last year. World 20/21 wheat crop is est near 769 mmt versus 764 last year. Demand is est near 751 mmt versus 747 last year. End stocks are 314 mmt versus 297 last year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.