CORN

Prices finished $.01-$.02 higher in choppy two-sided trade. Spreads firmed a touch. Dec-25 rebounded after holding support at the 50 day MA at $4.14 ¼. Major resistance is at the 100 day MA just above $4.30. Census exports in July-25 at 245 mil. bu. were roughly 19 mil. above inspections data while bringing YTD sales to 2.601 bil. To reach the USDA export forecast of 2.820 bil. bu. sales in Aug-25 will need to reach 219 mil. vs. 203 mil. YA. Ethanol production increased to 316 mil. gallons in the week ended Fri. Aug. 29th, up from 315 mil. the previous week. There was 107 mil. bu. of corn used in the production process, or 15.3 mil. bu. per day. In the MY to date there has been 5.423 bil. bu. used. Ethanol stocks ticked up to 22.6 mil. barrels, in line with expectations while below YA inventories at 23.3 mb. Prices need to remain globally competitive to keep export demand strong which could enable prices to dip back below $4.00. Tomorrow’s export sales are expected to range between 20-90 mil. bu.

SOYBEANS

Prices recovered late enabling the entire complex to close with modest gains. Beans were up $.01-$.02, meal was $1-$3 higher while oil was up 5-10 points. Bean and meal spreads firmed while oil spreads were mixed. Early trade saw Nov-25 beans slip to a 3 week low however quickly rejected trade below its 50 day MA at $10.23 ¼. Oct-25 oil fell to a three-month low, finally filling a gap from mid-June before recovering. Oct-25 meal rejected trade into new lows for the week before quickly recovering to its 50 day MA at $280.70. Spot board crush margins rebounded $.12 to $1.66 bu. while bean oil PV slipped back to 47.8%. Census exports in July-25 at 64 mil. bu. were in line with the inspections data and brought YTD sales to 1.802 bil. To reach the USDA export forecast of 1.875 bil. bu. sales in Aug-25 will need to reach 72 mil. vs. only 63 mil. YA. Inspection data thru Aug. 28th have already reached 70 mil. The USDA is forecasting Chinese imports at 112 mmt for the 25/26 MY, with Brazilian exports also at 112 mmt. The more they sell the China, the less they can sell to everyone else. Imports by all countries other than China are expected to be 72 mmt. US exports are already down to 1.705 bil. bu. (46 mmt). Long SA growing season ahead. Rabobank is forecasting Brazilian plantings in 2025/26 growing season will rise 1.5%. The USDA has a 3% increase plugged into their balance sheets. Export sales tomorrow are expected to range from 10-55 mil. bu. of beans, 100-450k tons of meal and 0-20k tons of oil.

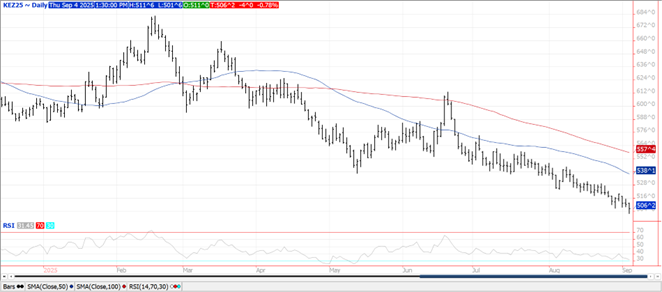

WHEAT

Prices were $.02-$.04 lower across the three classes today with both CGO and KC closing well off session lows. Spreads were slightly weaker. The Dec-25 contracts established fresh contract lows across all three classes on early weakness. With prices hovering near 5 year lows it’s hard to imagine going much lower from here, however speculators remain comfortable being short, while rolling positions forward capturing the wide carries in the market. Higher production estimates in Russia along with strong production prospects in the S. Hemisphere will limit upside opportunities for now. Census exports in July-25 at 85 mil. bu. were in line with the inspections data and up nearly 18% from July-24. Cumulative sales in the first 2 months of the 25/26 MY at 149 mil. bu. are up 19% from YA and the highest in 5 years. The low prices are doing what they are supposed to, stimulate demand. Tomorrow’s export sales are expected to range from 13-25 mil. bu.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.