CORN

Prices were $.04-$.05 lower today, unable to hold the higher start in the overnight session. Spreads were steady to weaker. Minimal threat for a damaging frost this weekend across the NC Midwest with low temp’s likely to bottom out in the mid to upper 30’s. Crop ratings slipped 2% to 69% G/E, in line with expectations. Overall ratings remain the highest since 2016. The highest rated states are PA, IA and WI. Allendale is projecting US corn production at 16.63 bil. bu. with an average yield of 187.52 bpa. Usage for the production of ethanol in July-25 at 456 mil. bu. was at the low end of expectations and down 6% from YA. YTD corn usage for the 2024/25 MY has reached 4.978 bil. bu. To reach the USDA forecast of 5.470 bil. bu. usage in Aug-25 needs to reach 492 mil. bu. a record high for the month while up 2.6% from YA. Despite a modest drop in Brazilian basis levels, US corn remains $5 – $7 per ton below Brazilian FOB offers thru year end. Tomorrow’s EIA report is expected to show ethanol production range between 312-315 mil. gallons LW, vs. 315 mil. the previous week.

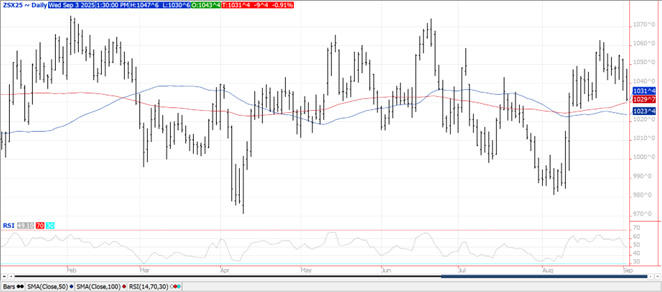

SOYBEANS

Prices were lower across the complex with beans off $.09-$.10 closing near session lows, meal was $1-$2 lower while oil was down 80 points. Meal spreads firmed while beans and oil were mixed. Nov-25 beans slipped to a 2 week low however held support above its 100 day MA at $10.30. Oct-25 oil closed pretty much right at its 100 day MA. Oct-25 meal held above yesterday’s low. The USDA announced the sale of 185k mt of soybean meal to the Philippines. Spot board crush margins rebounded $.02 to $1.54 bu. with bean oil PV slipping to 48.1%. Heightened trade tensions with China and weaker basis levels in Brazil outweighed the lower crop ratings here in the US. As China celebrated their 80th anniversary of victory in WWII, with Russian Pres. Putin and N. Korean leader Kim Jong Un in attendance, Pres. Trump accused China, Russia and N. Korea of conspiring against US interests. It would appear odds of getting a trade deal done with China this fall are fading as China continues to pile on soybean purchases from Brazil. Crop conditions slipped 4% to 65% G/E however remain the highest since 2020. Allendale is forecasting US bean production at 4.27 bil. bu. with an average yield of 52.28 bpa. Census crush in July-25 at 205 mil. bu. was below expectations. Cumulative crush for the 24/25 MY has reached 2.247 bil. bu. To reach the USDA forecast of 2.430 bil. bu. crush in Aug-25 will need to reach a record 183 mil. bu. up 9.4% from YA. Bean oil stocks were below expectations, falling 1% to 1.874 bil. lbs. and down 6.7% YOY. The EPA’s proposal to reallocate the nearly 1.4 bil. RINS generated from the approved SRE for the last two years is under interagency review at the White House.

WHEAT

Prices ranged from $.01-$.06 lower across the 3 classes at midday. Spreads were steady to firmer. The Dec-25 contracts for both KC and MIAX held withing yesterday’s range. Spring wheat harvest advanced 19% to 72% complete vs. 67% YA and the 5-year Ave. of 71%. Tunisia has reported bought 125k mt of optional origin wheat in five 25k ton consignments. Sale details are currently unavailable however the lowest offer is believed to be just under $256/ton C&F. Germany’s winter wheat production is expected to rise 26% in 2025 to 22.45 mmt, with all wheat production up 15% to 44.73 mmt. Russian wheat FOB offers remain in the $230-$232 mt range. Russian shipments in July/Aug at only 6.1 mmt are sharply below the 9.9 mmt YA. Ukraine passed on Russian Pres. Putin’s proposal to meet with Ukraine’s Pres. Zelenskiy in Moscow. At least 7 other countries have offered to host peace talks between the 2 leaders. Pres. Trump has acknowledged little progress has been made in ending the war since meeting with Putin last month. He went on the say he plans on speaking with him again in coming days.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.