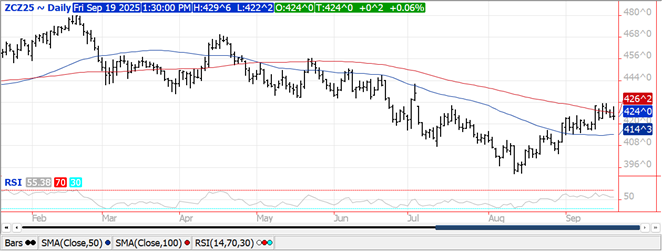

CORN

Prices were mixed and within $.01 of unchanged. Spreads firmed a bit. Dec-25 held support above this week’s low of $4.22 setting up the late day recovery. The USDA announced the sale of 206.5k mt of corn (8 mil. bu.) to an unknown buyer. China has approved another 96 genetically modified corn varieties as they seek to become more self-sufficient. With wheat and barley harvest completed in Ukraine their attention shifts to corn which is 2% harvested. The BAGE held their Argentine corn planting forecast steady at 7.8 mil. HA while plantings advanced 2.4% to 6.2% complete. The US house passed a stop-gap funding bill which now moves on to the Senate. Any hope for a late year rally will likely have to be driven by expectations for US production to be lowered several hundred mil. bu. which could happen, it did last year. US exports remain strong, which they need to in order to reach the lofty USDA forecasts. Cattle on feed as of Sept 1st at 99% of YA was in line with expectations. Placements in Aug at 90% of YA were slightly below expectations of 91%, while marketings in Aug at 86% were also just below expectations of 87%.

SOYBEANS

Prices were lower across the complex with beans down $.10-$.12, meal was steady to $1 lower while oil was off 50-55 points. Bean spreads weakened, meal spreads firmed, while oil spreads were mixed. Nov-25 bean violated support at both its 50 and 100 day MA’s, however held support above the September low at $10.21 ½. Oct-25 oil made a new low for the week closing just above $.50 lb. Next support is at the Sept low of 49.44. Oct-25 meal held support above its 50 day MA at $281.40. Spot board crush margins improved $.04 ½ to $1.56 bu. while bean oil PV slipped to 47.1%. Pres. Trump and Chinese Pres. Xi spoke via phone this AM with both sides acknowledging their conversation was constructive and upbeat. It appears they agreed to terms for the sale of TikTok while also discussing trade relations however no specific mention of Chinese purchases of US agricultural commodities sent soybean prices to new lows for the week. They plan to meet in person at the APEC Summit in S. Korea in either late Oct. or early Nov. while Pres. Trump also indicating he’d travel to China early next year. They also left open the possibility for Pres. Xi traveling to the US. Good news that they appear to be willing to keep dialogue open, bad news that Chinese purchases of US Ag. goods do not appear imminent. Wire services reported China has purchased up to 550k mt of canola from Australia in recent weeks after imposing anti-dumping duties on Canadian canola. China has also approved 2 more GM soybean varieties. RIN generations from biodiesel (D4) fell 14% in August to only 545 mil., he lowest in 6 months suggesting late summer slowdown in biodiesel and RD production. For now US tariffs on Chinese imports related to fentanyl remain at 20%. Chinese tariffs on US soybean and grain imports hold at 23%. The window for US soybean sales to China continues to narrow with Brazilian harvest expected in late Jan to February of 2026.

WHEAT

Prices range from $.02 – $.04 lower across the 3 classes. Spreads weakened a touch. Dec-25 CGO held support at this week’s low. New weekly low for Dec-25 KC. Dec-25 CGO wheat premium to Dec-25 corn is back under $1.00 bu. US Rainfall coverage over the next week is expected to be heaviest across the central Midwest with 1-3 inches likely. While its impact on this year’s corn and soybean yields is expected to be minimal, it will help ease drought conditions that have spiked in recent weeks while also boosting subsoil moisture for the winter wheat crop that is currently being planted. Western Australia raised their wheat production forecast 4.4% to 11.8 mmt. Russia’s Ag. Ministry maintains their 2025 grain production forecast at 135 mmt. So far 114 mmt of grain has been harvested including 84 mmt of wheat.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.