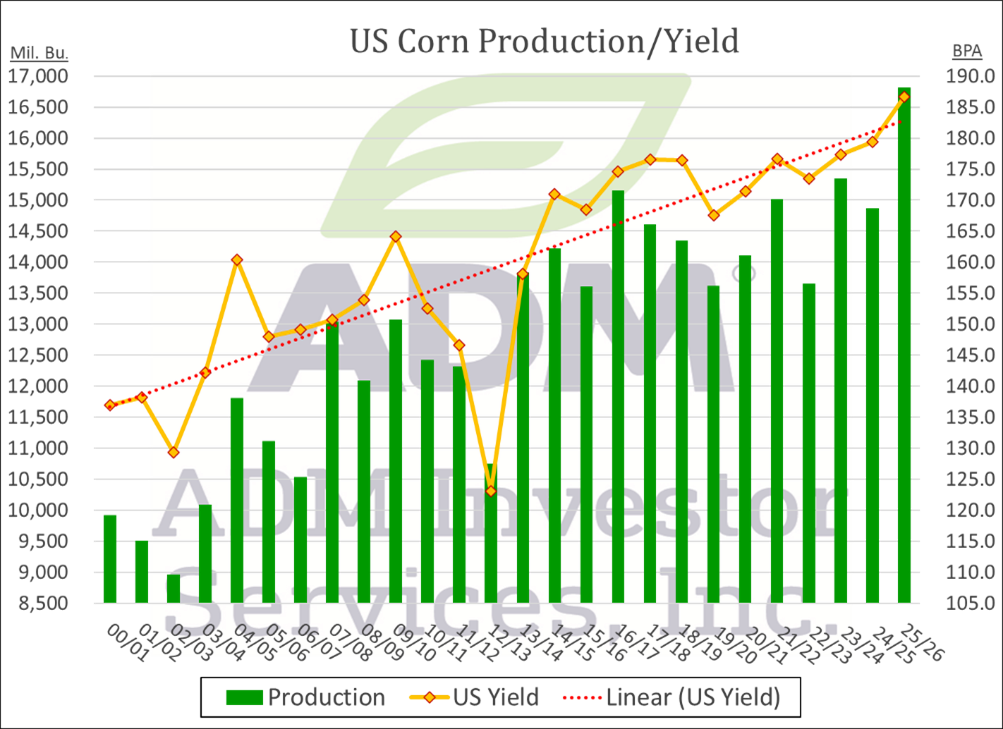

CORN

Prices were $.09-$.10 higher despite the neutral to bearish USDA data. Dec-25 closed above its 100 day MA for the first time in 4 months. Today’s high matched the high from mid-July. Moving forward bulls will argue Brazil’s production hikes are over and with their higher supplies absorbed domestically US demand will remain stout. Bears will argue demand won’t hold up and ending stock above (if not well above 2 bil.) will result in prices back below $4.00 at some point.

- US Production rose 72 mil. bu. to 16.814 bil. 300 mil. above expectations

- Harvested Acres rose another 1.356 mil. to 90.047 mil.

- Acres in key states: NE +250k, MN and IL +200k, SD + 150k, IN, KS, MO and ND +100k

- US yield fell 2.1 bpa to 186.7 bpa, still a record high

- 2024/25 US ending stocks rose 20 mil. bu. to 1.325 bil. on lower demand

- 2025/26 US ending stocks at 2.110 bil. bu. 100 mil. above expectations

- 2025/26 exports up another 100 mil. to record 2.975 bil.

- 2025/26 world stocks at 281.4 mmt in line with expectations

- Brazil’s 2024/25 production up 3 mmt to 135 mmt with most of the higher production being absorbed by higher domestic consumption.

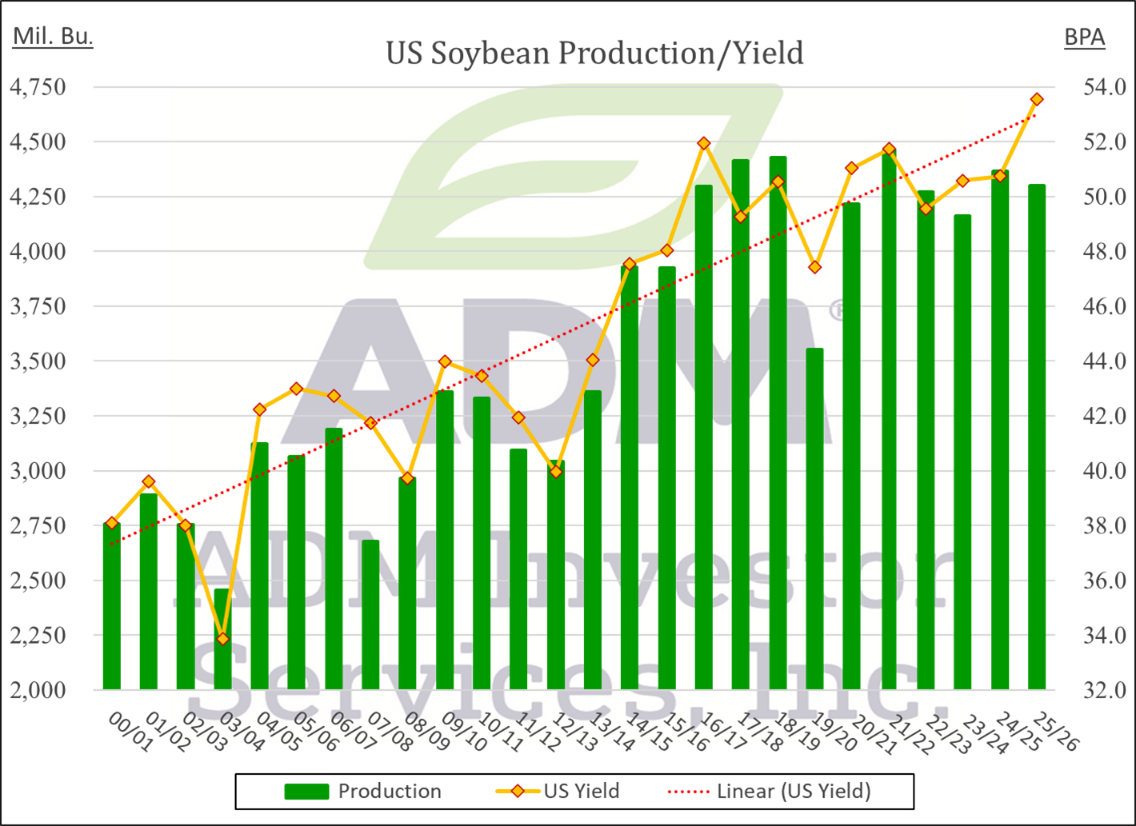

SOYBEANS

Prices were up $.11-$.13. Next resistance for Nov-25 is the Aug-25 high at $10.62 ¾. Oct-25 oil traded into new highs for the week however closed just below its 100 day MA. Oct-25 meal traded to new highs for the month however failed to challenge its 100 day MA. Since 1990 there has been only 2 years where the USDA raised yields in the August report only to lower them in the September report. Both years final yields were below the Sept. estimate.

- US production was up 9 mil. bu. to 4.301 bil., 30 mil. above expectations

- Harvested acres rose 209k while yields slipped .1 to 53.5 bpa, still a record high

- Acres rose 150k in MN while up 50k in IN, IA and NE. Down 50k in IL and ND

- 2024/25 US ending stocks unchanged at 330 mil. bu.

- 2025/26 US ending stocks up 10 mil. to 300 mil. bu. slightly above expectations

- 2025/26 exports cut 20 mil. bu. crush up 15 mil.

- 2025/26 world stocks at 124 mmt at the low end of expectations

- No changes to SA production. Chinese imports steady at 112 mmt.

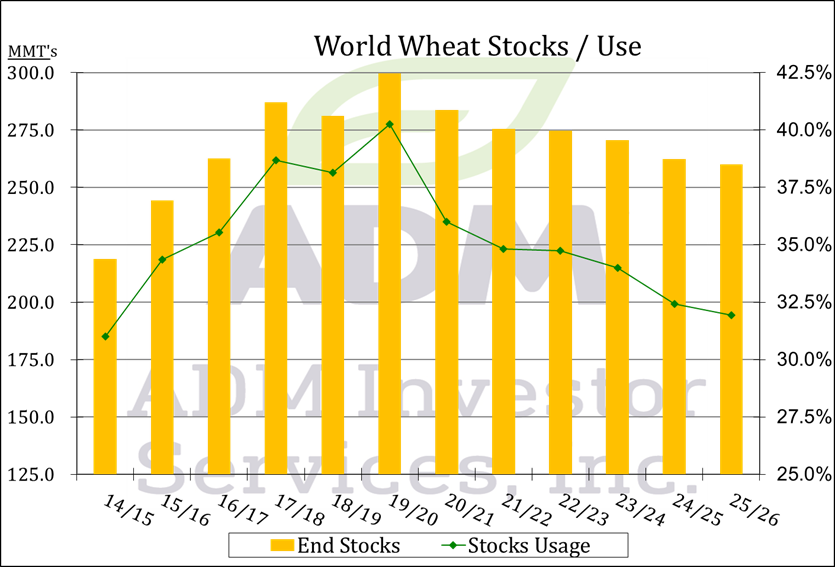

WHEAT

Prices bounced off session lows to close steady to $.05 higher drawing support from higher corn and soybeans prices. USDA to update US production in the Sept. 30th Small Grains Annual Summary. Despite the jump in global stocks from the estimate in August, they remain at their lowest level in a decade. Continue to lack a spark to ignite a lasting short covering rally.

- 2025/26 US ending stocks down 25 mil. bu. to 844 mil., 20 mil. below expectations

- Exports increased 25 mil. to 900 mil. the highest in 5 years

- Higher exports were all for HRW wheat – KC futures

- 2025/26 Global stocks up 4 mmt to 264 mmt, 3 mmt above expectations

- Global production rose 9.3 mmt to 816.2 mmt, global demand up 5 mmt to 814.6 mmt

- Production increased in Australia, Canada, Russia and Ukraine

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.