SOYBEANS

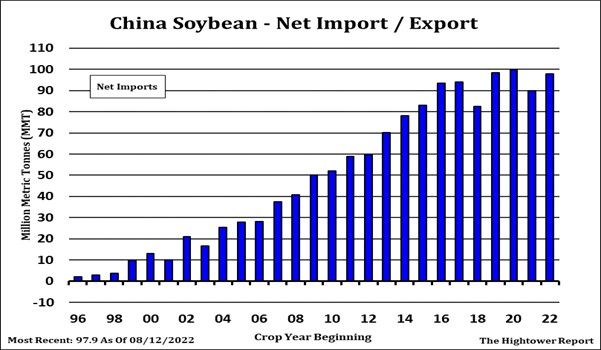

Soybean and soyoil futures have turned lower. Before Putin Ukraine export corridor speech most of the soybean news was bearish. July China energy and soybean import data was lower than expected suggesting China economy may be worsening. Some still feel US 2022 soybean crop could be record high. US farmer is not selling as he is cash rich for this tax years. Argentina new soy peso policy triggered Argentina farmer to sell 2 mmt of soybeans. Some feel US soybean exports may drop tom only 1,900 mil bu. Palmoil prices continue to trade lower on slower demand and rising stocks. Trade est US 2022 soybean crop at 4,500 mil bu with a range of 4,441-4,568 and versus USDA 4,.531. Trade est US 2021/22 soybean carryout at 235 vs USDA 225 and 2022/23 carryout at 246 with range of 203-335 versus USDA 245.

CORN

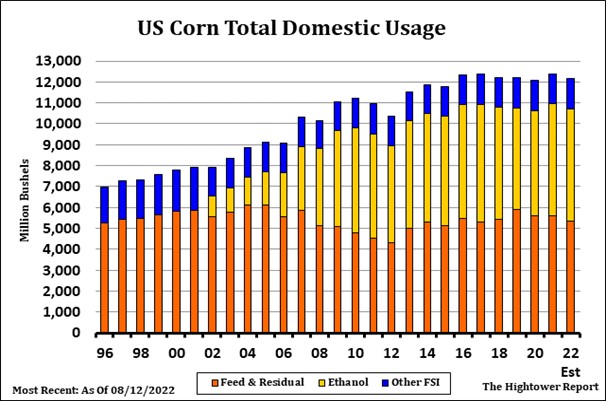

Corn futures gave back early gains and ended lower on the day. News of lower China energy imports suggested China economy could be worsening. Managed funds have no interest in buying corn futures even with talk of lower US crop. Talk of global disinflation even has them looking for place to sell corn futures. US farmer remains a reluctant seller of cash. Unlike last year, appears the basis will have to buy corn for the pipeline. Some buyers in central Midwest are willing to pay +40 CZ which is near 7.20 versus in June when futures were near 7.40 and basis was -40 or near 7.00. One wire service today maintained EU corn crop estimate at 60 mmt due to upcoming rainfall over the next two weeks that will replenish soil moisture and help corn yield in the late stages of grain fill in September with crop starting harvest. Matif closed higher, but there were still lower cash corn quotes of Ukraine corn but users were not buying as Putin’s comments reinforced uncertainty over shipments. Our weather guy released a special weather that suggested La Nina could last into January. This could suggest a dry South America spring and summer again and dry US south plains. Some techies may not like that CZ made new high for the move on good volume but closed below Tuesdays close. CZ range was 6.69-6.88 and settled near 6.71.

WHEAT

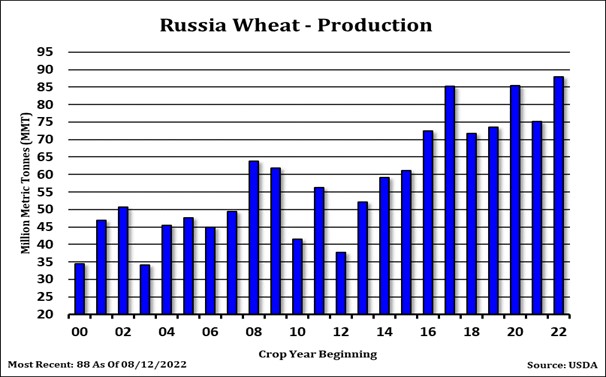

Some say that ever since Alan Greenspan became head of the Fed in 1987, the world has been accustomed to the declarations of one man being able to significantly move financial markets. Until now however, World grain markets had never known such a situation but this morning comments by Putin lifted US wheat and Matif futures and sending the shorts scurrying for cover. Putin claimed Ukraine exports are going to the EU and other western nations not to the poor African/Asian countries that are facing shortages and he wants a full review of the export corridor agreement. The reality is very different: Putin may now be more and more on the defensive. The winter will be tough for wheat traders. WZ range was 8.09-8.73 settling near 8.44. KWZ range was 8.74-9.34 settling near 8.98. MWZ range was 8.80-9.01 settling near 9.01, Chicago wheat and MLS wheat futures are in carries which suggest cash should store. KWK minus KWN is inverted which suggest increase cash sales.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.