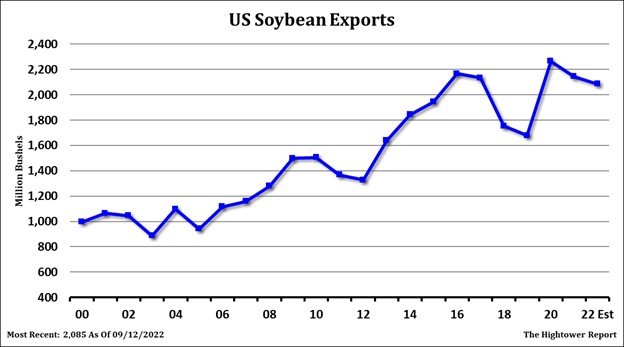

SOYBEANS

Risk off risk on. The fact Bank of England is trying to add liquidity into their economy after their administrations decided to lower taxes may be sending the wrong message to traders that Central Banks are becoming less hawkish and more dovish. There are no signs that US Fed will not continue to increase interest rates which ultimately be bullish US Dollar and bearish fix assets. Concern over lower Asian demand and higher South America supplies offers resistance to soybean, soymeal and soyoil futures. There is some concern about higher inflation lowering food and feed demand. Trade estimates weekly US soybean export sales near 200-850 mt vs 446 last week. Some fear lower China demand and higher 2023 South America supplies could drop final US soybean exports closer to 1,900 mil bu vs USDA 2,085.

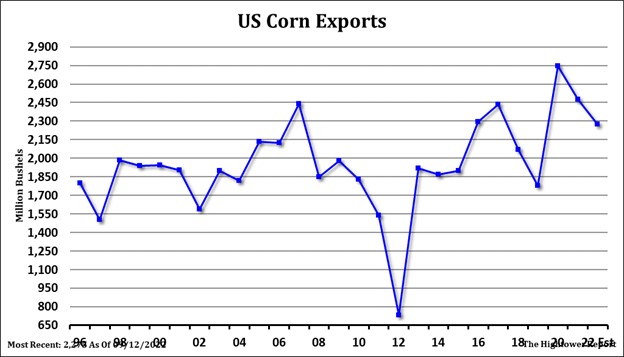

CORN

Dec corn saw and down and up trading day on relatively low volume. Talk of higher US Dollar, higher US interest rates, threat of inflation and slower global demand for corn weighed on CZ down to 6.62. Quick turnaround in the higher Dollar to lower and lower base commodities from lower to higher helped rally CZ closer to 6.73. The fact Bank of England is trying to add liquidity into their economy after their administrations decided to lower taxes may be sending the wrong message to traders that Central Banks are becoming less hawkish and more dovish. Corn was a follower to the higher wheat price action. US 2 week weather forecast is warm and dry and should allow for good harvest weather. Here again there may be some short covering before USDA report just in case USDA does not surprise the market with a lower estimate than the average trade estimate. Low river water levels could begin to slow barges to gulf. US ethanol production was down 5 pct from last week and down 6 pct from last year. Stocks were up 1 pct from last week and up 12 pct from last year. Trade estimates weekly US corn export sales near 250-800 mt vs 182 last week. Some fear lower global demand and higher 2023 South America supplies could drop final US corn exports closer to 2,000 mil bu vs USDA 2,275.

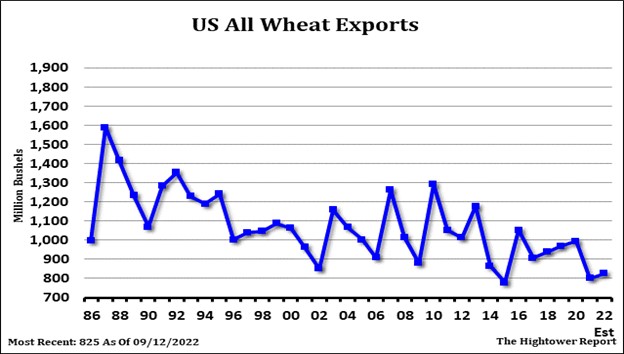

WHEAT

Wheat futures ended higher after US Dollar broke lower and commodities rallied. Wheat futures may also be higher due to short covering before Fridays report. Trade is not looking For any bullish wheat news from USDA but one never knows for sure. There is talk that Russia may close the Ukraine export corridor. Ukraine has asked for an export corridor to EU. Russia annexed 4 Ukraine states that account for 30 pct of Ukraine wheat area. Big day Friday with USDA report and Quarter end. Trade estimates weekly US wheat export sales near 175-500 mt vs 183 last week.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.