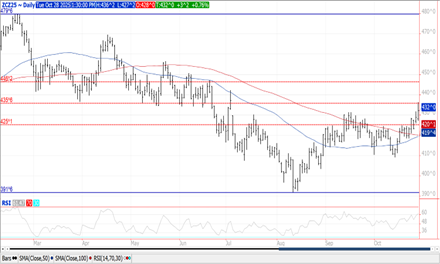

CORN

Prices ranged from $.01 lower to $.02 higher as spreads firmed. Inside trade for Dec-25 futures. Today’s EIA report showed ethanol production slipped to 1,091 tbd, or 321 mil. gallons in the week ended Fri. Oct. 24th, down from 327 mil. the previous week however up 1% from YA. Production was below expectations. There was 109 mil. bu. of corn used in the production process, or 15.53 mil. bu. per day, just above the 15.4 mbd needed to reach the USDA corn usage estimate of 5.60 bil. bu. Implied gasoline demand last week at 8.924 tbd, while up 5.6% from the previous week was still down 2.6% YOY. Ethanol stocks rose 2% to 22.37 mil. barrels, slightly above expectations and up 2.75% from YA. Rabobank is projecting Brazil’s 25/26 corn production at 137 mmt, down 3.5% from their 24/25 est. however well above the USDA forecast for 25/26 at 131 mmt. While corn exports and demand from ethanol production are holding up well, it’s still hard to come up with a scenario where US stocks fall below 2 bil. bu. unless yields fall below 181 bpa.

SOYBEANS

Prices were mixed with beans ranging from $.02 lower to $.02 higher, meal was up $1-$2 while oil was 10 points lower. Spreads firmed across the complex. Inside trade for soybeans after reaching a 12 month high yesterday. Dec-25 meal jumped out to a fresh 5 month high closing higher for a 12th consecutive session. Dec-25 oil violated support at $.50 lb. before recovering to close back above it. Spot board crush margins bounced $.01 ½ to $1.50 ½ bu., very near its long term Ave., while bean oil PV fell below 45% for the first time in 6 months. Trade discussions with China have been ongoing with reports that Pres. Trump has offered to cut the fentanyl tariff in half to 10% while offering China access to higher quality US computer chips. China is reportedly offering rare earth mineral exports for a year before reevaluation while also pledging to purchase upwards of 10 mmt of US beans for the 25/26 MY, still less than half of what they bought in the 24/25 MY. Bears maintain potential Chinese buying is too little too late as Brazil’s crop will flood the global marketplace by Feb-26 leading to a buildup of US inventories despite US planted acres falling to a 6 year lower earlier this Spring. Bulls would hope this is the beginning of a much larger buying spree of US soybeans. Rabobank is projecting Brazil’s 25/26 bean production at a record 177 mmt, up 3% from YA and just above the USDA forecast of 175 mmt. Rabobank has planted acres at 48.8 mil. HA, up 2% from YA with exports reaching 111 mmt, vs. the USDA forecast of 112 mmt.

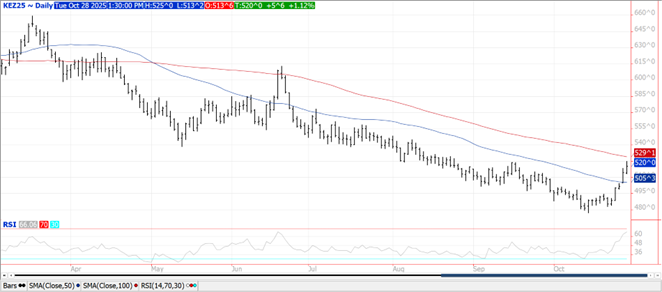

WHEAT

Prices were mixed ranging from $.02 lower to $.03 higher in spot CGO and KC futures. Spreads also firmed. Inside trade for the Dec-25 contracts across all 3 classes. Ukraine’s wheat exports for the 25/26 MY at 6.15 mmt are off 20% from YA. We had speculative traders buying nearly 4k contracts of CGO wheat yesterday leaving MM’s still short 80-85k contracts. O.I. was down 6.5k contracts, an indication short funds positions were exiting the market. The price recovery over the past week has largely been confined to the US to the detriment of US exports. The LSEG raised their Australian production forecast 2% to 34.8 mmt, very near the USDA forecast from September at 35 mmt. Expectations for higher global production and stocks will work to limit upside price potential.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.