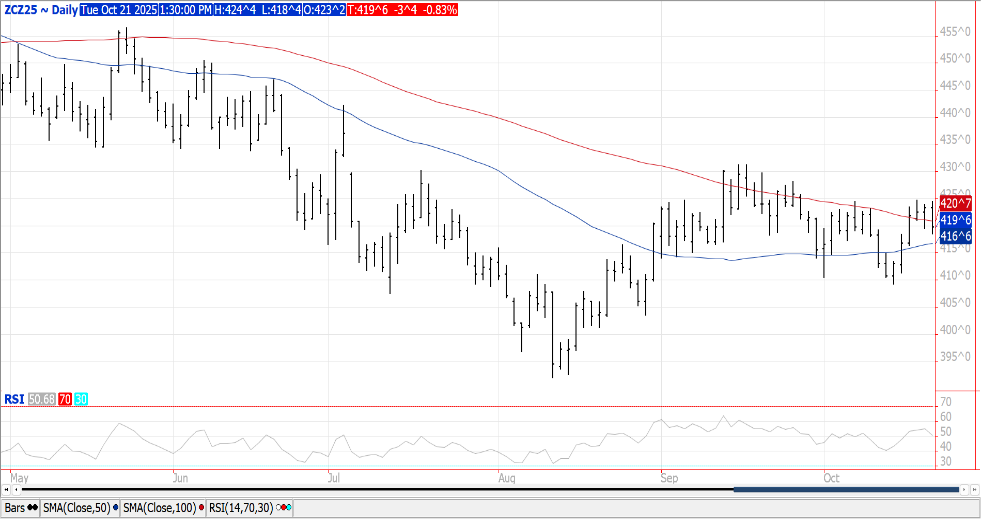

CORN

Prices fell $.03-$.04 today while spread finished mixed. Dec-25 slipped back below the 100 day MA as well as yesterday’s low. Next support is at the 50 day MA at $4.16 ¾. A Reuters poll indicates traders and analysts feel US corn harvest has reached 59%, below the YA pace of 62% however ahead of the 5-year Ave. of 57%. IMO prices have also been negatively impacted by increased tensions with Colombia. This past weekend the Trump Admin. ended all US aid to the SA country with Pres. Trump calling Colombian Pres. Petro an “illegal drug dealer” for doing nothing to stop drug production in his country. Colombia has been our 3rd largest importer of corn in recent years, taking just over 300 mil. bu. in 2024/25, just over 10% of our total corn exports. The API reversing their decision to no longer support the year round sale of E-15 in the US isn’t helping. DataGro is forecasting ethanol produced from corn in Brazil will increase 3-3.5 bil. gallons in 2026/27 MY, up from 9.9 bil. in 2025/26 which increased from 8.25 bil. in 2024/25. EU 2025/26 corn imports as of Oct. 19th at 4.61 mmt are down 26.6% YOY. Tomorrow’s EIA report is expected to show US ethanol production between 306-321 mil. gallons last week vs. 316 mil. the previous week.

SOYBEANS

Prices were mixed across the complex with bean down $.01-$.02, meal was steady to $2 higher while oil slipped 55-65 points. Bean and meal spreads firmed while oil spreads are slightly lower. Nov-25 beans stalled out after reaching a new high for the month. Support is at the 100 day MA at $10.25 ¾. Dec-25 meal also jumped out to a 1 month high stalling just below its 100 day MA at $287.40. Dec-25 oil failed to challenge its 50 day MA resistance at 51.54. Spot board crush margins slipped another $.02 to $1.57 ½ bu. with bean oil PV falling to a 4 month low at 46.9%. Recent strength in the soybean market may also be an injection of weather premium. Weekend rains across WC and northern growing areas of Brazil were fairly widespread, however according to World Weather, not as heavy as hoped. This area is forecast to hold in a dryer than normal pattern thru month end. While this may promote active plantings in the short term, much more rain is needed to promote crop development. US Soybean harvest likely to have reached 73%, ahead of the 5-year Ave. of 72% however below last year’s record pace of 79%. EU 25/26 soybean imports at 3.51 mmt are down 6.5% YOY. Meal imports at 5.41 mmt are down 1%. Markets remain hopeful that a US/China trade deal will enable the US to compete for roughly 300-350 mil. bu. of Chinese demand in the Dec/Jan timeframe ahead of Brazil’s new crop harvest early next year. After yesterday trade we estimate MM’s are short around 110k contracts of meal while long 15k soybean and 10k oil. Despite agribusiness bankruptcies on the rise in Brazil, soybean acres continue to grow, expanding their global production dominance.

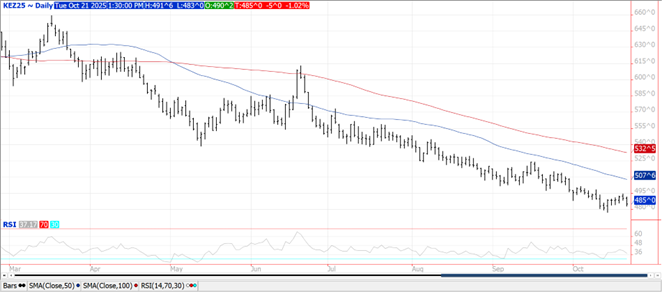

WHEAT

Prices were $.03-$.05 lower across the 3 classes today. Support for CGO Dec-25 is at LW’s contract low at $4.92 ¼. Support for Dec-25 KC is at $4.77 ¼. New contract low for Dec-25 MIAX while also slipping to a 14 month low on the weekly chart. Jordan didn’t make a purchase in their recent 120k mt tender. IKAR raised their Russian wheat production forecast another .5 mmt to 88 mmt, vs. the USDA est. in September at 85 mmt. Ukraine’s Ag. Ministry reports their winter crop is 72% planted, in step with the US as the Reuter poll est. plantings at 75%. EU soft wheat exports as of Oct. 19th at 5.87 mmt are down 21% YOY.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.