Soybeans, soymeal, soyoil and corn traded higher Wheat futures were mixed. Managed funds were net buyers of 18,000 soybeans, 3,000 soymeal, 6,000 soyoil ,8,000 corn and 2,000 wheat. Managed funds are net long 208,000 corn, 55,000 wheat, 300,000 soybeans, 104,000 soymeal and 102,000 soyoil. US stocks were higher. US Dollar was lower. Gold was higher.

SOYBEANS

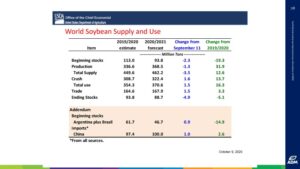

Soybeans traded higher and made new highs. Fact USDA lowered US and World 2020/21. Soybean carryouts offered support. Soymeal also made new highs. Key now is will funds keep their record long position. South America and Black Sea weather looks dry. China is expected to continue to buy US soybeans. USDA estimated US soybean 2020/21carryout at 290 mil bu versus 369 expected and USDA Sep 460. USDA estimated the US soybean crop at 4,268 mil bu versus 4,282 expected and 4,313 in Sep. USDA lowered harvested acres. Yield was left near 51.9. USDA raised US export guess. Most look for US harvest near 65 percent done. USDA estimated World soybean 2020/21carryout at 88.7 versus 91.3 mmt expected and USDA Sep 93.6. USDA dropped US crop and raised China imports at 1 mmt to 100 mmt. There was talk that China was buying US Jan soybeans. USDA left Brazil 20201 soybean crop at 133.0 mmt and Argentina at 53.5. Brazil 2020 crop was 126.0 and Argentina 49.0. Brazil farmer has been an active seller on new crop soybeans. There is talk of increase chances for needed rains. Argentina farmer remains a reluctant seller of cash. Argentina weather forecast remains dry.

CORN

Corn futures traded higher. Fact USDA dropped US and World 2020/21 carryouts offered support. Corn futures made higher highs for the move. Prior to August US drier then normal weather, there was talk that Dec corn was going to trade below 3.00. It is now testing 4.00. In August, USDA had estimated US 2020 corn crop at 15,278 mil bu and a 181.8 yield. Today, USDA estimated the US corn crop at 14,722 mil bu versus 14,808 expected and 14,900 in Sep. USDA lowered harvested acres. Yield was left near 178.4. USDA estimated US corn 2020/21carryout at 2,167 mil bu versus 2,113 expected and USDA Sep 2,503. USDA dropped domestic use but left exports unchanged. Some feel final exports could be higher. There was talk today that China was active this week in buying US April corn. Most look for US harvest near 50 percent done. USDA estimated World corn 2020/21 carryout at 300.5 versus 300.1 mmt expected and USDA Sep 306.7. USDA dropped US and Ukraine crop but left China imports at 7 mmt. USDA estimated Brazil corn crop at 110.0 mmt versus 102.0 last year. Argentina was estimated at 50.0 mmt versus 50.0 last year. Ukraine corn was estimated at 36.5 mmt versus 38.5 previous and 35.9 last year. USDA left China corn crop at 260.0 mmt versus 260.7 last year. China Ag Minister estimated the crop near 264.7. Stocks are expected to drop 16 mmt.

WHEAT

Wheat futures traded mixed. Fact USDA increased World wheat end stocks offered resistance. Fact they lower US crop and dropped US HRW carryout helped KC wheat. WZ trade below Thursdays low. KWZ support is 5.20. Resistance is near 5.50. USDA estimated US wheat 2020/2 carryout at 883 mil bu versus 887 expected and USDA Sep 925. USDA estimated the US wheat crop at 1,826 mil bu versus 1,838 in Sep. USDA dropped HRW stocks to 334 versus 385, SRW to 102 versus 108 and Spring 288 versus 293. USDA estimated World wheat 2020/21 carryout at 321.4 versus 317.2 mmt expected and USDA Sep 319.3. USDA raised Russia old crop 5 mmt to 83.0. USDA estimated Canada wheat crop near 35.0 mmt versus 36.0 previous, Australia 28.5 versus 15.2 last year, Argentina 19.0 versus 19.5 previous, EU at 136.7 versus 154.9 last year, China 136.0 versus 133.6 last year and India 107.6 versus 103.6 last year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.