Soybeans, soymeal, soyoil, corn and wheat traded lower. Early strength after weekly US export sales were better than expected were erased by a wave of long liquidation before tomorrows USDA report and weekend weather updates. Buckle up for the USDA.

SOYBEANS

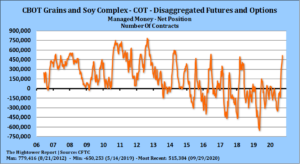

Soybean traded lower. SX closed near 10.50. Today’s range was 10.48-10.69. Some feel SF near 10.85 may be a little overdone. SMZ is near 360.8. BOZ is near 33.00. Managed funds were early buyers of 2,000 soybeans, 2,000 soymeal and 1,000 soyoil. Managed funds are net long 285,000 soybeans, 104,000 soymeal and 98,000 soyoil. We estimate they are net long a near record 751,000 grain and oilseed contracts. China will be back from Holiday tonight. Their futures should trade sharply higher trying to catch up with CBOT gains while on Holiday. USDA announced 374 mt US soybeans to China, 152 mt US soybeans to Mexico and 132 mt US soybean sales to unknown. There was talk China was a buyer of US soybeans overnight for Jan. Brazil estimated their 2021 soybean crop near 134 mmt versus 125 last year and USDA 133. Brazil could see rains after Oct 11. US weekly soybean export sales were 2.591 mmt versus 2.591 last week. Total commit s near 40.7 mmt versus 16.2 last year. USDA goal is 57.8 mmt versus 45.7 last year. China commit is near 22.1 mmt with 10.7 in unknown. US soybean export prices are near $11.98. Brazil has no bids until Feb.

CORN

Corn futures traded lower. Some link this to long liquidation before tomorrow’s USDA report and weekend weather updates. Managed funds were early buyers of 2,000 corn. Managed funds are net long 207,000 corn. We estimate they are net long a near record 751.000 grain and oilseed contracts. China will be back from Holiday tonight. Their future should trade sharply higher trying to catch up with CBOT gains while on Holiday. There was talk China was a buyer of US corn for April. Brazil will be dry until Oct 11 then rains could start to develop. Russia could be dry all of October. Argentina will be mostly dry over the next 2 weeks. Brazil estimated their 2021 corn crop near 105 mmt versus 102 last year and USDA 110. US weekly corn export sales were 1.225 mmt mt versus 2,027 last week. Total commit is near 25.8 mmt versus 10.0 last year. USDA goal is 59.0 mmt versus 44.8 last year. China commit is near 9.9 mmt with 3.8 in unknown. US corn export prices in near $5.28. This on par with South America. Average trade guess for US 2020 corn crop is 14,808. Range is 14,604-14,963. USDA is 14,900. Average trade guess for US 2020/21 corn carryout is 2,113. Range 1,859-2,333. USDA is 2,503. Average trade guess for World 2020/21 corn carryout is 300.1 mmt. Range 291.3-305.0. USDA is 306.7. Some feel CH near 4.10 may be overdone.

WHEAT

Wheat futures traded lower. Some link this to long liquidation before tomorrow’s USDA report and weekend weather updates. Wheat futures have seen a 7 week rally in prices to near 5 year highs. Most of this due to dry weather in US, Black Sea and Argentina. West Australia has also turned dry. Average trade guess for US 2020/21 wheat carryout is 887, range 830-917. USDA is 925. Average trade guess for World 2020/21 wheat carryout is 317.2. Range is 310.9-322.0. USDA is 319.3. Most do not look for USDA to make many changes to wheat numbers. In fact they could increase last years Russia and Australia wheat crops. Managed funds are net sellers of 9,000 wheat. Managed funds are net long 55,000 wheat. We estimate they are net long a near record 751.000 grain and oilseed contracts. Russia could be dry all of October. US south plains will remain dry for the next 2 weeks. Argentina will be mostly dry over the next 2 weeks. There could be some light rains for US south plains and Russia after Oct 20. US weekly wheat export sales were near 530 mt versus 506 last week. Total commit is near 14.5 mmt versus 13.2 last year. USDA goal is 26.5 mmt versus 26.2 last year. US HRW wheat export prices is near $7.35. Despite dry weather, Russia export price is 45 cents cheaper.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.