What a week. Bullish USDA report, global weather unknowns and POTUS testing positive for Covid. Soybeans, soyoil and corn traded lower. Soymeal and wheat traded higher. US stocks were mixed after opening lower. US Dollar was higher. Crude was lower.

SOYBEANS

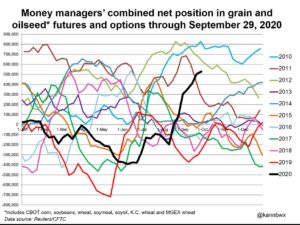

Soybean traded lower. US weekend weather should be favorable for harvest. Some feel US harvest could be near 35-38 percent done. 7 day Brazil weather is dry but rains could begin to fall after Oct 9. Drop in Brazil Real has Brazil farmers looking at record soybean profits. Argentina remain dry. Argentina farmer remains a reluctant seller of soybean despite record low Peso. One private crop watcher estimated US 2020 soybean crop near 4,294 mil bu versus USDA 4,313. Another private crop group had estimated the US 2020 crop near 4,351 mil bu. This was lower than their previous guess but still above USDA. For the week, SX range was 9.85 to 10.35. Low was made before USDA grain stocks report on concerns over China slowing US buying and potential harvest pressure. Friendly US report pushed prices to weekly highs. Managed funds are estimated to be long 221,000 soybean contracts, 79,000 soymeal contracts and 90,000 soyoil contracts. Soymeal is supported by talk of lower South America supplies/crush. Soyoil is lower on lower palmoil prices. SX support 10.00. Resistance 10.40.

CORN

Corn futures traded lower. Favorable US harvest weather may have offered seasonal resistance. US farmer is still a reluctant seller at current prices and until they have a better idea of yields. Most still want to store as much as the 2020 crop as possible. Most look for US corn harvest to be near 18-21 percent. For the week, CZ range was 3.60 to 3.85. Low was made on concern of lower feed and fuel demand due to Covid and potential harvest pressure. High was made after USDA estimated US Sep 1 corn stocks well below the average trade guess and their previous carryout guess. Managed funds are estimated to be net long 158,000 corn contracts. Resistance could be near 3.80 with support near 3.60. One Private crop watcher estimated US 2020 corn crop near 14,812 mil bu versus USDA 14,900. Another private crop group had estimated the US 2020 crop near 14,942 mil bu. This was lower than their previous guess but still above USDA. USDA report is Oct 9. Argentina rated their corn crop at 43 percent good/ex versus 48 last week and 33 last year. 15 percent of the crop is planted versus 21 last year. Brazil, Russia and parts of Ukraine need better rains. Some feel Brazil could see rains after Oct 9.

WHEAT

Wheat futures managed small gains on the close. Drier that normal Russia, Ukraine, Argentina and US south plains weather offers unseasonable support. Concern about lower global food demand due to Covid offers resistance. Fact POTUS tested positive for Covid raised new concerns about the spread and control of the virus. Next USDA crop report is on Oct 9. Most do not look for USDA to make many changes to the 2020 US wheat crop size. US 2021 winter wheat crop could use a rain. Most eel a slowdown in US gulf tropical action and a change in the southern oscillator is needed to open the gulf for south plains moisture. One private group lowered their estimates of 2020 EU, Russia wheat crop and 2021 Ukraine crop. They estimate World 2021 wheat crops near 778 mmt versus 775 this year. China is 134 versus 136, EU 134 versus 137, India 102 versus 107, Russia 80 versus 83, US 53 versus 49, Canada 36 versus 36, Australia 23 versus 29, Ukraine 25 versus 27 and Argentina 21 versus 19. Russia could announce 2021 export quota in October. Russia domestic wheat and flour prices are record high. This week, WZ range was 5.37 to 5.87. Resistance is near 5.80 with support near 5.40.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.