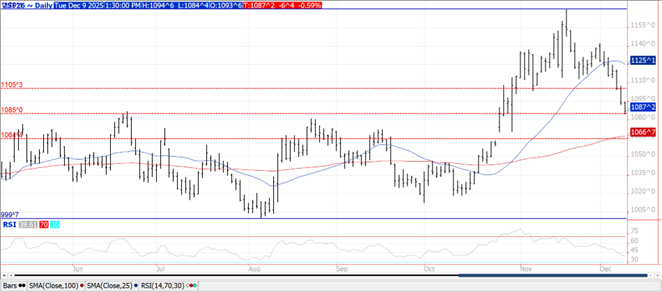

CORN

Prices were $.02-$.04 higher while spreads weakened. Both July-25 and Dec-25 closed at about the midpoint of today’s range after earlier enthusiasm from the softer tariff tone from the Trump Administration seemed to fade. Ahead of weekend trade talks with Chinese officials in Switzerland, Pres. Trump took to Truth Social stating “80% tariff on China seems about right.” US weather remains mostly favorable. The USDA announced another 288k mt (11.4 mil. bu.) of corn sold to Mexico with 95k mt for 2024/25 MY and 193k mt for 2025/26 MY. This afternoon’s CFTC report will likely show speculators continue to shed length in corn. We’ve got their long position now back to about 25k contracts. The BAGE shows Argentine corn harvest advanced only 4% to 35% complete.

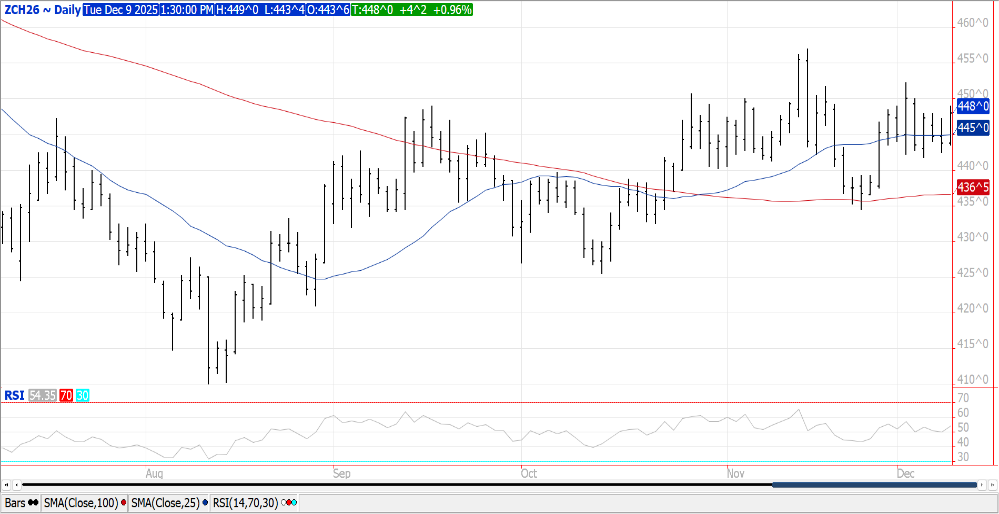

SOYBEANS

Prices were mixed with beans $.05-$.07 higher, meal was steady to $1 lower while oil was 10-20 better. Spreads were steady to firmer in beans, weaker in the products. July-25 beans jumped out to a new high for the week with next resistance at the April high at $10.67 ½. July-25 meal continues to consolidate just below $300 per ton. Higher trade in July-25 oil likely drawing support from higher energy prices. Spot board crush margins slipped $.07 to $1.29 ½ bu. with bean oil PV up to 45.2%. Much of the Midwest will remain warm and mostly dry thru the 2nd half of next week. Record highs are possible across the N. plains this weekend. Showers in S. IL and IN east into parts of OH yesterday will slow planting activities is these areas. Extended forecasts show better prospects for rain in week 2 of the outlook, supportive for early crop development. The USDA announced another 120k mt (4.4 mil. bu.) of 25/26 soybeans sold to Pakistan. The BAGE increased their Argentine production forecast 1.4 mmt to 50 mmt, now just above the USDA est. at 49 mmt. Dryer conditions enabled harvest to jump 21% to 45% complete, still slightly behind their historical average. Chinese bean imports in April at just over 6 mmt were down 29% from YA. In the first 4 months of the calendar year imports at 23.2 mmt are down 14.6% YOY suggesting the current USDA export forecast at 109 mmt is too high, down only 3% from LY record imports.

WHEAT

Prices were $.06- $.08 lower across all 3 classes today with spreads little changed. New contract low in CGO and KC. Support for July-25 MGEX is at its contract low at $5.88 ¾. My 2025/26 all wheat production est. is 1.871 bil. bu. with an average yield of 50.1 bpa. Winter wheat production is est. at 1.348 bil. (HRW – 748 mil., SRW – 355 mil. white – 245 mil.). Sources suggest China has purchased between 400-500k mt of Australian and/or Canadian wheat in recent weeks, avoiding US grain due to current strained relations. Wire services are reporting at midday that the US and EU are working on a 30 day ceasefire agreement between Russia/Ukraine with a proposal possibly within days.

Charts provided by QST.

>>See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.