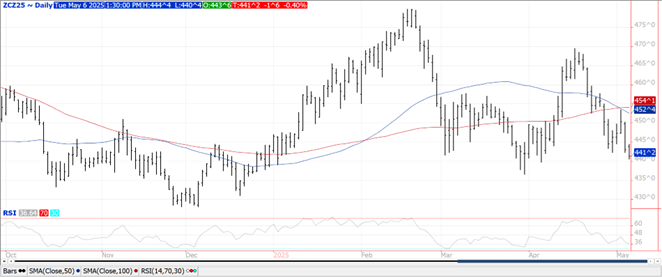

CORN

Prices ranged from $.01 higher in old crop to $.02 ½ lower for new crop. Spreads were mostly higher. Support for July-25 is at the March low at $4.50 ½. Dec-25 traded to a fresh 5 week low on favorable US weather forecasts. Plantings advanced to 40% complete, above the YA pace of 35% and just above the 5-year Ave. of 39%. 11% of the crop has emerged. Plantings in the far WCB are running well above their historical average led by rapid progress in the Dakota’s. Progress in the Central third is running behind with both IL and KY 12% below their historical pace.

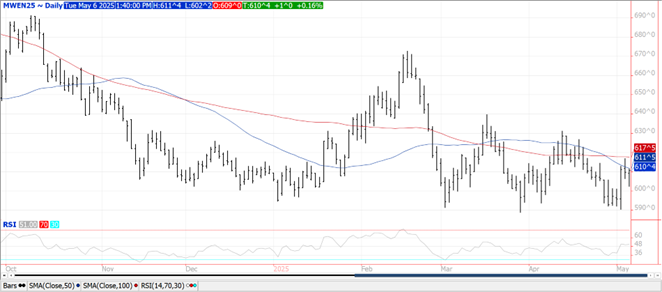

SOYBEANS

Prices were lower across the complex with beans down $.03-$.04, meal was $2-$3 lower while oil was off 30-40 points. Spreads were mostly lower. July-25 beans fell to a 4 week low however held support at the 50 day MA at $10.38. Fresh 5 week low for July-25 meal with next support at its contract low just below $290. July oil slipped to a 2 week low before recovering. Spot board crush margins slid $.08 ½ today to $1.22 ½ per bu. with bean oil PV inching up to 45.6%. Rains this week will gradually spread across the Gulf coast and Delta region with 1-3” totals common. Week 2 of the outlook brings much needed drying across the south. Little to no rain across the northern 2/3rd’s of the nation’s midsection will enable rapid planting progress to occur. Bean plantings as of Sunday stood at 30%, in line with our est. while continuing to run at a record pace. Every reporting state is above their historical average with the exception of IL which at 33% is only 1% off their 5-year Ave. Still awaiting to see if US/China can begin to sit down and address the current trade standoff. Census exports in Mch-25 at 129 mil. bring cumulative sales over the first 7 months of the 24/25 MY to 1.544 bil. bu. up 9% from YA vs. the USDA forecast of up 8%.

WHEAT

Prices ranged from a penny higher in MGEX to $.05 higher in CGO and KC. Spreads were slightly better. Winter wheat conditions improved 2% to 51% G/E, in line with expectations. Spring wheat seedings advanced 14% to 44% complete, while just below YA they remain well above the 5-year Ave. Census exports in Mch-25 at 67 mil. bu. brought cumulative 24/25 MY sales to 657 mil. bu. up 16% from YA, in line with the USDA forecast. To reach the current forecast, sales April thru Aug. will need to reach 163 mil. vs. 130 mil. YA. EU soft wheat exports as of May 4th have reached 17.8 mmt down 34% from YA. Heat and dryness is starting to raise potential issues with wheat production in EC China.

Charts provided by QST.

>>See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.