SOYBEANS

Soybean ended lower. Overnight prices started sharply higher. There was talk about follow through buying from Fridays gains. Lower US Dollar and talk of increase demand offered support. Fact CBOT increased price limits may have triggered some spec long liquidation. Some fund Managers may have looked at position versus potential 2.00 daily price move and reduced open positions. Talk of higher US soyoil demand and need for higher US 2021/22 crush and acres offered support. Good 10 day US Midwest weather and low weekly US soybean exports may have triggered long liquidation. Some feel prices have not topped and first sign of ridging in west Midwest will be the next chance to buy futures. Most look for USDA to keep US 2020/21 soybean carryout near 120. Some could see US 2021 soybean crop near 4,500 mil bu and range of carryout from 105-150. Weekly US soybean exports were 5 mil bu vs 14 last year. Season to date exports are near 2,038 mil bu vs 1,241 last year.

CORN

Corn futures closed mixed. CK open interest has dropped and CK may have reached its highest price level. July corn rallied on talk of continued talk of strong domestic corn basis and good weekly corn exports. There remains talk that China may now talk all the corn China has bought but not yet shipped will be shipped. Some feel USDA feels China was going to roll 160 mil bu of open sales forward. Some now feel China will export that corn versus trying get import in the fall during a large soybean import program. This would suggest final US carryout could be closer to 1,200 mil bu vs USDA 1,352. There is also talk that a lower Brazil 2021 crop could increase US 2021/22 corn exports 400 mil bu. Last week US corn crushers were paying +60/+80 over CN for corn. First key to corn prices could be USDA May 12 report. Some estimate US 2021 corn crop near 15,300 mil bu and carryout from 1,100 to 1,300 mil bu. Fact CBOT raised price limits may have triggered some long liquidation. This due potential 80 cent range each day. Weekly US corn exports were 84 mil bu. Season to date exports are near 1,707 mil bu vs 936 last year. China exports were 33 mil bu.

WHEAT

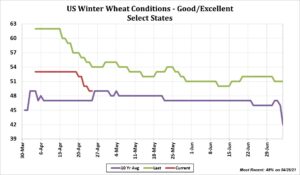

Wheat futures traded lower. Talk of better weather in Europe and Black Sea offered resistance. The 2 week US forecast hints of possible rains across parts of the US north plains may have also triggered some selling. Most look for US HRW weekly crop ratings could drop again this week. US spring wheat plantings could be ahead of average. The key will be US and World weather. Some feel that US late spring and summer US and Canada prairie could be drier than normal. Weekly US wheat exports were near 18 mil bu vs 21 last year. Season to date exports were near 850 mil bu bs 848 last year. Most look for US 2020/21 US wheat carryout to remain near 852 mil bu. Some feel that US 2021 wheat crop could be near 1,920 mil bu. Still this could suggest a US 2021/22 carryout near 720 mil bu to 820. Some look for US 2021 HRW crop near 740 mil bu vs 659 last year and end stocks near 234 vs 338 last year. SRW crop is est near 340 mil bu vs 266 last year and end stocks near 180 vs 114 last year. HRS crop is est near 510 vs 530 last year and stocks near 255 vs 275 last year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.