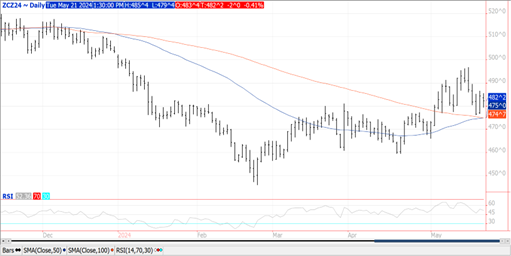

CORN

Prices were down $.02 – $.03 today forming an inside day on the charts. July held support at its 100 day MA near $4.55. Next support is the May low at $4.43 ¾. Support for Dec-24 is at $4.75 where both the 50 and 100 day MA’s have converged. The USDA reported the sale of 110k mt (4.3 mil. bu.) of corn to Spain, and 113k mt of corn to Mexico. Half of the corn sold to Mexico was 23/24 MY and half 24/25 MY. US corn plantings advanced 21% LW to 70% complete, at the high end of expectations. Progress remains behind YA pace of 76% and just below the 5-year Ave. of 71%. Emergence at 40% in line with recent history. Big gains were made across the northern plains and Midwest with the Dakota’s leading the way. SD advanced 34% to 66% complete with ND advancing 29% to 51% complete. WI advanced 26%, MN and IL 25%, NE 24% and IA 21%. Based off March planting intentions and the progress report their remains 3.6 mil. acres left to plant in IL, 2.8 mil. in IA, 2.35 in IN, 2.1 mil. in NE and 1.5 mil. in MN, areas expected the heaviest rains this week. 2019 was the last year we witnessed a significant amount of corn acres get switched to other crops or lost to prevent planting. March intentions that year at 92.8 mil. fell 1.1 mil. in June to 91.7 mil. with final acres down another 2 mil. to 89.7 mil. Corn plantings in 2019 were only 65% by the end of May while this year we’ll likely be close to the historical average of 85%. As of May 3rd EU corn imports had reached 15.7 mmt, no YOY comparisons were available. Tomorrow’s EIA report is expected to show ethanol production between 990 – 1,028 tbd last week vs. 1,000 bpd the previous week.

SOYBEANS

Prices were lower across the board with beans down $.04 – $.12 as spreads weaken, meal was $1 – $2 lower, while oil was down 45 – 50. An inside day for July beans with next major support at the 50 day MA, currently at $12.00. Nov-24 beans for now have established an $11.95 – $12.30 trading range. July-24 meal hasn’t been able to establish much of a bounce off support at $365. An inside day for July-24 oil which rejected trade above its 50 day MA yesterday, back below $.46 today. Soybean recovered, particularly new crop, on news China had priced US soybeans off the PNW for July shipment where the US is a bit more competitive with SA supplies. Good rains across NE and northern half of IA the past 24 hours. Heaviest amounts in EC NE and WC IA with some 3-5” totals being reported. Best rains over the balance of this week expected across the central and eastern corn belt, lighter amounts over the WCB while the Gulf coast and Delta region dry out. More rain is expected for RGDS in Southern Brazil thru the end of the week threatening addition flooding and production losses. Soybean plantings at 52% were at the high end of expectations. Progress remains below YA pace of 61% and just ahead of the 5-year Ave. of 49%. 26% of the crop has emerged, vs. 31% YA and 5-year Ave. of 21%. Spot board crush margins improved $.02 to $.86 ½ bu. with bean oil PV holding just above 38%. As of early May Argentine farmers had sold only 31% of this years expected harvest, the slowest pace in a decade.

WHEAT

Prices closed mostly higher as all classes experienced two sided trade. Chicago led the way higher, up $.07 – $.09, KC was $.04-$.06 higher, while MGEX was steady to $.01 lower. Chicago July-24 established a fresh 9 month high while also briefly trading over $7.00. KC July-24 failed to trade above its recent high at $7.10. Little moisture is expected across the SW plains this week as drought conditions deepen. Winter wheat conditions slipped 1% to 49% G/E vs. expectations for a 1% improvement. Despite the modest decline overall ratings remain the highest since 2020. Ratings improved 2% in KS to 33% G/E while poor/VP fell 2% each. Ratings in IL fell 7% to 70% G/E. 69% of the crop is headed, vs. 58% LW and 5-year Ave. of 57%. Spring wheat plantings advanced to 79%, ahead of YA pace of 57% and 5-year Ave. of 48%. Jordan passed on all offers for their tender for 120k mt of milling wheat citing prices were too high. Tunisia is seeking 100k mt of soft milling wheat with offers due tomorrow. IKAR cut Russia’s wheat production forecast another 2.5 mmt to 83.5 mmt, vs. the USDA est. of 88 mmt. IKAR also cut their export forecast 2 mmt to 45 mmt, vs. the USDA est. of 52 mmt.

Charts provided by QST.

>>See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.