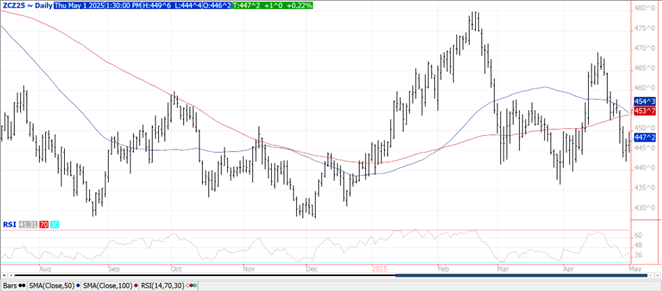

CORN

Prices ranged from $.03 lower to $.01 higher with old crop leading the declines. Early strength in July-25 fizzled out after failing to trade above its 100 day MA. Spreads were mostly weaker. Good rains across the nation’s midsection continues to ease drought readings without causing planting delays. Forecasts call for above normal temperatures across the nation’s midsection with normal to below normal moisture for the central and ECB into mid-May, favorable for corn and soybean plantings. Exports at 50 mil. bu. were in line with expectations. Old crop commitments at 2.313 bil. are up 26% from YA, vs. the USDA forecast of up 11%. Current commitments represent 91% of the USDA forecast, above the historical average of 87%. The largest buyer was Mexico with 18 mil. bu. however 6 mil. was switched from unknown. The BAGE reports Argentine corn harvest advanced only 1% LW to 31% as farmers have been more focused on bean harvest. They kept their production est. unchanged at 49 mmt just below the USDA forecast of 50 mmt. There was 454 mil. bu. of corn used for ethanol production in Mch-25, down 4% from YA and below expectations. In the 1st 7 months of the 24/25 MY corn usage has reached 3.210 bil. up less than 1% from YA and in line with expectations.

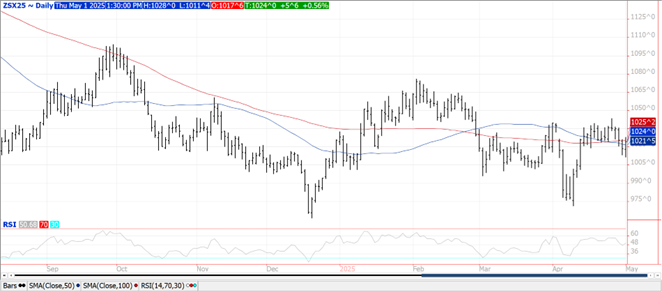

SOYBEANS

Prices were mixed with beans up $.05-$.06, meal was $3-$4 lower while oil was up 75-80 points. Spreads were also mixed. July-25 beans once again fell to a 2 week low overnight, however held support at the 50 day MA at $10.37. Fresh 3 week low for July-25 meal with next support at the contract low just below $290. Spot board crush margins backed up $.04 ½ to $1.33 bu. while bean oil PV increased to 46.3%. News on the tariff front is limited other than claims from Chinese state media that the US has reached out to their Govt. to discuss tariffs. Expect little progress in the near term as China celebrates May Day thru the 5th. Key growing areas in Argentina will remain dry thru Saturday before better prospects for rain Sunday thru Thursday. No significant harvest delays are expected. Beneficial rains are forecast for S. Brazil next week while drier conditions are forecast across Central Brazil as the monsoonal season ends. Exports at 18 mil. bu. were in line with expectations. Old crop commitments at 1.742 bil. are up 13% from YA vs. the USDA forecast of up 8%. China showed as a buyer of 5 mil. bu. however these were switched from unknown. Outstanding sales to China have slipped to only 5 mil. bu. with another 58 mil. to unknown. Soybean meal sales at 328k tons were in line with expectations. YTD commitments are up 11% from YA, vs. USDA up 8%. Soybean oil sales at 8k mt (18 mil. lbs.) were in line with expectations. YTD commitments at 2.152 bil. lbs. represent 94% of the USDA forecast of 2.30 bil. lbs. The BAGE reports soybean harvest advanced 9% to 24% complete, still well below YA pace of 36%. Soybean oil usage for biofuel production over the first 5 months of the 24/25 MY at 4.746 bil. lbs. is down 7.3% from YA, vs. the USDA forecast of up 2%. The USDA usage est. at 13.25 bil. lbs. is still too high without reinstatement of the blenders credit. March crush at 207 mil. bu. was up 1.6% from YA and slightly above expectations. It also represents a record high for March. In the 1st 7 months of the 24/25 MY cumulative crush has reached 1.439 bil. bu. up 4.8% from YA, vs. the USDA forecast of up 5.8%. Bean oil stocks jumped 8% to 2.079 bil. lbs. above expectations of 1.940 bil.

WHEAT

Prices were mixed ranging from $.02 lower in KC to $.04-$.09 higher in CGO and MGEX. KC was not able to hold the morning rally, likely the result of month end speculative short covering. Spreads firmed across all 3 classes. Early trade saw fresh contract lows for July-25 CGO and KC futures, the 3rd consecutive day for both. Perhaps too much rain across key US winter wheat growing areas is fueling quality concerns. Heavy rains were recorded across NC TX and OK the past 24 hours with more on the way. Over the next week we could see some localized flooding across the S. plains but we’ll definitely see further easing of drought conditions. Net drying across EC China may pose a late threat to their winter wheat crop. The USDA is currently projecting record production at just over 140 mmt. The BAGE is projecting Argentina’s 2025/26 wheat production at 20.5 mmt, which if realized would be the 2nd higher ever. Russia raised their export tax 10% to 1,758 roubles/mt for the period ended May 13th. Export sales tomorrow are expected to range from 0-25 mil. bu.

Charts provided by QST.

>>See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.