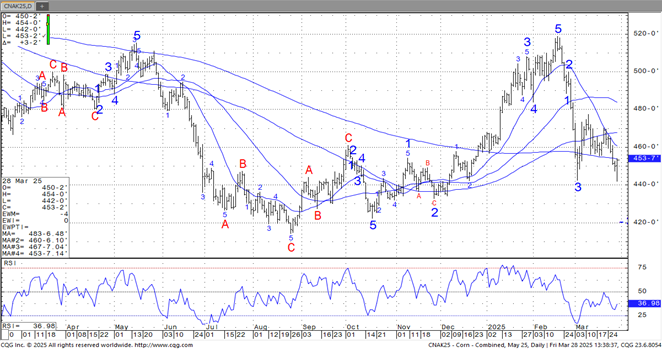

CORN

Corn futures rallied late and ended near 4.53. This weeks range was a high near 4.60 and todays low near 4.42. US and Brazil farmers have slowed cash sales which is supporting cash basis. Season to date US corn exports are near 2,089 mil bu vs 1,689 last year. USDA goal is 2,450 vs 2,292 ly. Trade may have priced in at todays low fact USDA will show next week US 2025 corn cres higher than last year. Bears fear CN could eventually trade below 4.00 id acres are higher than last year and US summer weather is normal. There were a few concerned about increase in US west Midwest dry topsoils and wet US east. Delta and SE soils. Headline trading continues due to uncertainty of US tariffs on Canada, Mexico, EU, Japan and China and those countries retaliation.

SOYBEANS

Soybean futures had a late rally with SK ending near 10.22. Soyoil is higher and near 45.23 cents on talk tariffs could reduce China export of UCO to US and Canada exports of canola oil to US. Ag lobbyist also trying to get US to increase biofuel subsidies. Season to date soybean export commit is near 1,681 mil bu vs 1,482 last year. USDA goal is 1,825 vs 1,695 ly. Some could see SN above 10.50 if US soybean acres are 4-5 million less than last year. Some could see US 2024/25 corn carryout up 20 mil bu from USDA. Same group est US 2025/26 soybean carryout at 625

WHEAT

WK was down to 5.17 on forecast of needed rains in Ukraine, Russia and US plains. Our weather guy said wet EU US plains forecast is too wet. Season to date US wheat export commit is near 767 mil bu vs 688 last year. USDA goal is 835 vs 707 ly. Slow World wheat import buying is increase stocks despite lower Russia and EU 2025 crops. Next week, USDA is expected to show US March 1 stocks higher than last yea

Charts provided by QST.

>>See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.