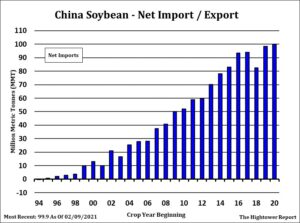

SOYBEANS

Soybeans traded higher and held support near the 20 day moving average near 13.84. Talk of lower Argentina crop and potential pricing in futures by China of open and unshipped Brazil sales offered support. China has secured 35-37 mmt Brazil soybean and 19 mmt US soybeans. Most of the US soybeans have been shipped. Talk of tight US 2021 soybean supply may also be offsetting concern that US export demand and shipments will slow. Record US Jan soybean crush and higher basis could also be supporting soybean futures but at the same time offering resistance to soymeal and soyoil values. Today Informa est Brazil soybean crop near 136 mmt. China soybean futures hit a new high near $25.75. Some link this to delays in Brazil exports to China.

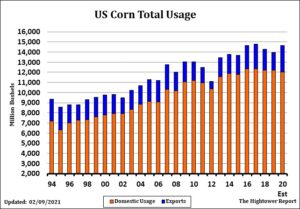

CORN

Corn futures traded higher. Fact Japan bought US corn suggested to some that the overnight lows in CK may be near value and support. Argentina raised their crop rating to 30 pct G/E but below last year 67 G/E. Some est the crop near 45.5 mmt. Today Informa est the crop near 47. Informa also est Brazil corn crop near 108.6. Crop watchers est the Brazil corn crop at 105 mmt. China corn futures traded lower but at still high at $10.91. Trade still trying to figure out if ASF is impacting the China pig herd and lowering feed demand. Informa raised China corn crop 1 mmt to 266. Weekly US ethanol production should rebound from last week. Stocks should be lower than last week. A few plants may not be back all the way yet. There is talk that domestic corn is hard to buy after May especially to SW feedlots. USDA next report is Supply and Demand revision on March 9. Some feel USDA may make few changes to US 2020/21 corn carryout. They may wait until after the March 31 stocks and acreage report. Most private guesses for US 2020/21 corn carryout is near 1,100 mil bu vs USDA 1,502. Key will be how demand draws down supplies. CH-CK spread traded out to +16 on lack of deliveries and higher domestic basis. Most doubt there will be deliveries on May or July. In 2013 spread went out to +31.

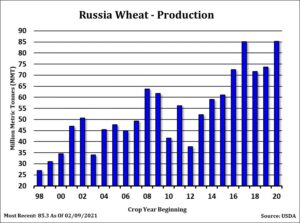

WHEAT

Wheat futures traded higher. WK had an outside day, traded back above the 20 day moving average near 6.56 and back above Mondays high. Helter skelter, choppy and volatile trade is higher after USDA dropped weekly US HRW crop ratings. Still there is talk of better rains across parts of the US HRW growing areas later this week. Matif wheat futures made new 8 year highs on lower EU supplies. Informa raised India wheat crop 300 mt to 107.9 and rice crop 300 mt to 120.3. Informa also increased Ukraine wheat crop 3.5 mmt to 25.5. USDA lowered US weekly HRW crop ratings. KS is 32 pct G/E vs 40 lw, TX 28 vs 30, OK 46 vs 48. Most do not look for USDA to make many changes to US 2020/21 Wheat supply and Demand on March 9. USDA could also keep most of the World numbers also unchanged. US export prices are not competitive to N Africa or Mideast buyers. Fact here were KC deliveries on the March suggest the lack of export business. There is also an 8 cent carry from KWH to KWK. Key now will be US and north hemisphere April weather.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.