SOYBEANS

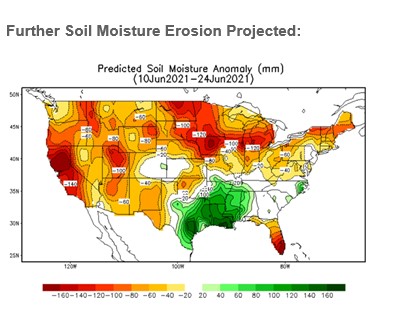

Soybean ended lower after USDA unexpectedly lowered US soybean crush and failed to increase export. Positive crush margins would suggest US crushers will continue to crush soybean until they cannot source soybeans. US Census soybean exports are running higher than to date inspections and could be up 45 mil bu above USDA guess. USDA est US 2020/21 soybean carryout at 135 vs 120 in May. 21/22 155 vs 140. Both are too high. USDA est World 2020/21 soybean carryout at 88.0 vs 86.5 in May. 21/22 92.5 vs 91.1. USDA est Brazil soybean crop near 137.0 mmt vs 136.0 in May. Argentina 47.0 vs 47.0. USDA dropped US soyoil production and lowered both domestic and export use. USDA also lowered soymeal production and domestic use. Now it is up too weather with US Midwest 2 week forecast warm and dry.

CORN

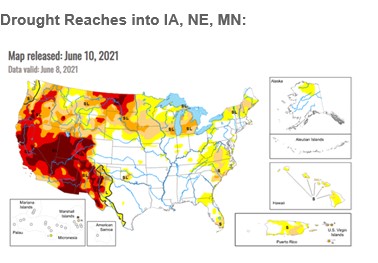

Managed funds were net buyers after USDA lowered US 2020/21 corn carryout. USDA est US 2020/21 corn carryout at 1,107 vs 1,257 in May. 21/22 1,357 vs 1,507 USDA est US 2021/22 corn exports at 2,450 vs 20/21 2,850. USDA raised ethanol use 75 mil bu and exports 75 mil bu. Both could be 200 mil bu higher. This suggest US 2020/21 corn carryout could be closer to 950 mil bu. USDA will need to find 1.5-3.0 million more acres on June 30 and we will need a 180 corn yield to keep US 21/22 corn carryout from dropping to 1,000 mil bu. Long range maps still suggest overall dryness for the US PNW, north US plains and Canada prairies. The 2 week maps are also drier and warmer than normal from a line from California to Michigan including key US crop states of IA. MN. WI. MI, NE and KS. There will be continued showers in IL, IN, KY and OH. US corn export commit is near 2,728 mil bu vs 1,619 ly. China shipments are near 15.2 mmt with total commit near 23.2 and 1.4 in unknown. Most feel China will take the 23 mmt. Total imports could be 30 mmt vs USDA guess of 26.

WHEAT

Chicago and KC wheat managed small gains and followed corn higher. Minneapolis wheat traded higher despite this weeks rains across parts of the US and Canada HRS area. SE ND and SD missed the rains. USDA estimated US 2021 wheat crop near 1,898 mil bu versus 1,872 est in May. USDA est US winter wheat crop at 1,307 vs 1,283, HRW 771 vs 731, SRW 335 vs 332, white 201 vs 220. Despite this weeks rains a return to warm and dry weather could drop final US 2021 HRS crop below last years 530 mil bu. Approaching US winter wheat harvest could offer resistance to Chicago and KC futures. USDA est US 2020/21 wheat carryout at 852 vs 872 in May. 21/22 770 vs 774. USDA est World 2020/21 wheat carryout at 293.4 vs 294.6 in May. 21/22 296.8 vs 294.9. USDA estimated Russia wheat crop near 86.0 mmt vs 85.3 ly. US wheat export commit is near 202 mil bu vs 214 last year.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.