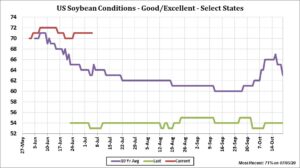

SOYBEANS

Soybeans found support from fact USDA announced new old crop US soybeans sold to China last week. Their buying pace continues to be below level to reach USDA goal. Rains fell across east NE and moved into IA. Rains are in E IA and should move across most of IL today. 7 day US Midwest weather forecast calls for .50-1.00 inches of rains over 65 pct of the Midwest. Temps moderate. Rains favor east plains, NE, MN, IL, WI and MI. The second week suggest a ridge in the SW and warmer and drier Midwest conditions. Any rain favors ND, MN, WI and MI. Most look for weekly US soybean crops ratings to drop 2-3 pct. Trade expects increase trade volume and volatility after USDA supply and demand report on Friday. Weekly US old crop soybean export sales were near 952 mt versus 241 last week. China bought 461 mt. New crop sales rose only 382 mt versus 841 last week. US soybean export prices are competitive to China but tension between US and China raises concern about China buying. China Senior Diplomat said US and China relations are at an all-time low.

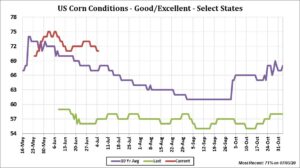

CORN

Corn futures traded higher. Talk of drier US Midwest weather offered support. Fact USDA also announced new US corn sales to China last week also offered support. Rains in E NE that moved into IA limited gain. Rains are now in E IA and radar suggest these rains will move into IL today. 7 day US Midwest weather forecast calls for .50-1.00 inches of rains over 65 pct of the Midwest. Temps moderate. Rains favor east plains, NE, MN, IL, WI and MI. The second week suggest a ridge in the SW and warmer and drier Midwest conditions. Any rain favors ND, MN, WI and MI. Most look for weekly US corn crop ratings to drop 2-3 pct Trade expects increase trade volume and volatility after USDA supply and demand report on Friday. Biggest change could be drop in US 2020 corn acres and carryout. USDA could also drop their estimate of US corn exports due to slow pace of exports versus expectations. Weekly US old crop corn export sales were near 599 mt versus 361 last week. China bought 407 mt. New crop sales rose 409 mt versus 262 last week. Argentina corn export prices are lower than US. China sold another 4 mt of corn from reserve but domestic prices are still near all-time highs. Import margins remain positive. Drop in US corn demand for fuel, exports and feed continues to offer resistance to futures. Bullish USDA acreage report helped trigger fund short covering into ne farmer selling. It will take at least 2 weeks of US Midwest hot and dry weather to drop yields enough to push futures higher.

WHEAT

Wheat futures closed mixed. Chicago Sep closed higher following higher corn and soybean prices. KC Sep closed unchanged and off session higher. MLS Sep traded slightly higher but also off session highs. Stogner domestic SRW basis offered support to WU. Talk of lower Europe and Russia 2020 crops has helped support Paris and Black Sea wheat futures. This has helped trigger short covering in Chicago futures. Some est that Europe Wheat crop could drop 8 mmt and exports could also drop 6 mmt. Early Russia wheat yields are down 24 pct from last year. Trade expects increase trade volume and volatility after USDA supply and demand report on Friday USDA could drop their estimate of US wheat exports due to slow pace of exports versus expectations. Weekly US wheat export sales were near only 326 mt versus 414 last week. Russia export prices are cheaper than US. Concern about World wheat trade could add to World supplies. Argentina is trying to push domestic wheat prices higher to reduce wheat exports.

Kansas September wheat – Chicago September corn spread chart

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.