SOYBEANS

Soybean traded lower. USDA July US/World supply and demand numbers were close to trade guesses. Still longs may liquidated after the report on concern over one 2 week weather map that suggest normal weather and concern over US food demand as virus cases increase. SU rejected the 9.00 level. Next support is 8.75 then 8.60. Key is US 3 week weather. USDA raised slightly US 2020 soybean acres to 83.8 million. They left the yield unchanged at 49.8. This raised the crop to 4,135 mil bu from 4.125. USDA also dropped US 2019/20 residual due to June 1 stocks estimate. This raised the US 2019/20carryout to 620. USDA also raised 2020/21 crush 15 mil bu. All of this raised US 2020/21 soybean carryout from 395 to 425. USDA dropped World 20/21 soybean end stocks to 95 mmt versus 96 previous and 99 last year. USDA left China 20/21 soybean imports at 96.0 mmt despite talk this week of lower demand. There were no new US soybean sales announced to China today.

November soybean futures chart

CORN

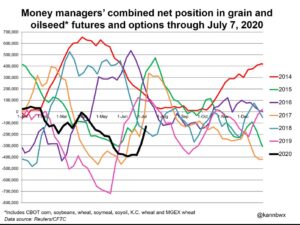

Corn futures traded sharply lower. Managed funds were sellers of 14,000 corn. Managed funds are net short 177,000 corn. At one point before the USDA June acreage report funds were net short 320,000 corn contracts. After today’s USDA supply and demand report corn futures traded lower. Some feel that funds did not want to be long futures if the 2 week American model is correct and US Midwest rainfall will be normal. Others fear that resurgence of the virus in the US will slow food demand. As expected USDA dropped US 2020 corn acres to 92.0 million. They left the yield unchanged at 178.5. This reduced the crop to 15,000 mil bu from 15,995. USDA also dropped US 2019/20 feed and ethanol use. This raised the US 2019/20 carryout to 2,248. USDA also dropped 2020/21 feed use. All of this dropped US 2020/21 corn carryout from3,323 to 2,648. Drop in US crop size dropped World 20/21 corn end stocks to 315.0 mmt versus 337.8 previous and 297.0 last year. The World carryout is still adequate for demand. USDA estimates World corn trade near 182 mmt. US is 54, Brazil 38, Ukraine 37 and Argentina 36. It will take hot and dry Midwest weather over the next 3 weeks to lower the US crop enough to push prices higher. Fact USDA announced 1.3 mmt US corn sold to China today failed to support prices.

WHEAT

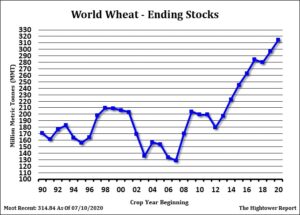

Wheat futures traded mixed. Chicago SRW traded higher. KC HRW traded lower. MLS HRS traded unchanged. USDA July numbers were in line with expectations. USDA dropped US 2020 wheat crop to 1,823 mil bu from 1,877. HRW crop is 710 mil bu vs 833 ly. SRW is 280 vs 239 ly. HRS is 502 vs 522 ly. USDA raised the US 2019/20 carryout to 1,044. USDA also dropped 2020/21 feed 10 mil bu. All of this raised US 2020/21 wheat carryout from 925 to 942.HRW is 423 vs 521 ly. SRW is 103 vs 105 ly. HRS is 270 vs 280 ly. USDA dropped World 20/21 wheat end stocks to 315 mmt versus 316 previous and 297 last year. This due to 1.5 mmt drop in EU crop and .5 in Russia. USDA continues to estimate World wheat trade near 188 mmt. Russia is 36 mmt, EU 27 mmt, US 25, Canada 24, Ukraine 17.5 and Australia 17.5. Fact USDA announced new US HRS and HRW wheat sales to China failed to support prices.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.