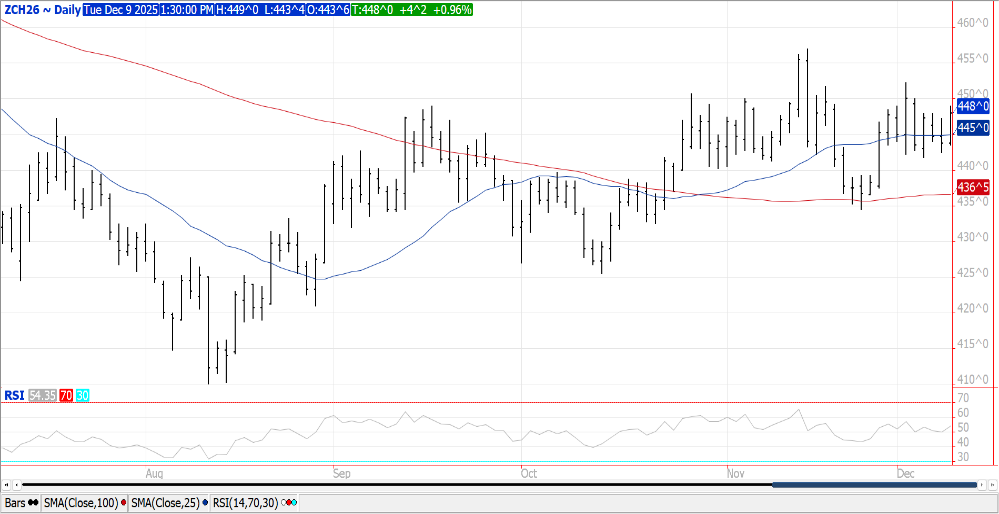

CORN

Today’s USDA data was mildly supportive for corn. Prices were $.02-$.04 higher however remain well within this month’s range. Spreads were steady to slightly firmer. The jury is still out on usage for ethanol production. We’ll see what next month’s stocks figure as of Dec. 1st suggests for domestic usage for Q1 of 2025/26.

- US ending stocks lowered 125 mil. bu. to 2.029 bil., 95 mil. below expectations

- Exports raised another 125 mil. to record 3.2 bil.

- Demand for ethanol production and feed usage unchanged

- Global stocks down just over 2 mmt to 279.2 mmt vs. expectations of 280.7 mmt

- No changes to SA production, Ukraine down 3 mmt to 29 mmt, EU up 1 to 56.75 mmt

- Global stocks/use among global exporters for 24/25 rose to 9.5% from 9.2% in Nov-25

- Global stocks/use for 2025/26 fell to 9.7% from 10.1% in Nov-25.

SOYBEANS

Today’s USDA data was neutral for the soybean complex while SA weather and lack of fresh sales to China tilt bearish. Argentine plans to lower agricultural export taxes also weighed on valuations. Prices were lower across the complex with beans down $.06-$.08, meal was off $3-$5 while oil is down 15-20 points. Bean spreads firmed, meal spread eased while oil spreads were steady. Jan-26 beans pulled back to the 50% retracement from the Aug-25 low to the Nov-25 high near $10.85.

- US ending stocks unchanged at 290 mil. bu. vs. expectations of 302 mil.

- 5th consecutive year of no change in the December WASDE

- Global stocks rose .4 mmt to 122.4 mmt, in line with expectations

- No changes to SA production or Chinese imports

- 2024/25 bean oil usage for biofuel production lowered to 11.758 bil. lbs.

- 2025/26 usage for biofuel for now holding at 15.5 bil. lbs, likely too high

- Global stocks among major exporting countries were little changes.

WHEAT

Mixed trade as markets appear to have already discounted the higher global production and stocks. Next month’s round of USDA data to include US winter wheat acres.

- US ending stocks unchanged at 901 mil. bu. vs. expectations of 890 mi.

- HRS stocks up 5 mil. to 221 mil., white wheat stocks down 5 mil. to 87 mil.

- Global production up another 9 mmt to 837.8 mmt

- Global stocks rose 3.5 mmt to 274.9 mmt vs. expectations for 272.8 mmt

- Production increases for Canada +3 mmt, Argentina + 2 mmt, EU + 1.7 mmt, Australia & Russia + 1 mmt

- Global Stocks among major exporting countries rose to 17% up from 16.5% in Nov-25.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.