CORN

Prices were steady to $.01 higher in 2 sided trade. Spreads were a bit weaker. Mch-26 matched its 2 week high in early trade. Overall prices remain in a $4.35-$4.55 range. Exports for the week ended Dec. 11th at 69 mil. bu. brought YTD commitments to 1.873 bil. bu. up 31% from YA, vs. the USDA forecast of up 12%. YTD commitments represent 59% of the USDA forecast, above the historical average of 50%. Noted buyers were Japan with 14 mil. while Korea, Mexico and Spain all bought 9 – 10 mil. bu. EU corn imports as of Dec. 21st at 7.8 mmt are down 21% YOY. Exports remain strong with US competitively priced in the global marketplace, feed usage at 6.1 bil. bu. is likely a couple hundred mil. bu. too high while demand for ethanol production on pace to reach USDA 5.6 bil. bu. forecast.

SOYBEANS

Mixed trade across the complex with beans closing steady to $.02 lower, meal was up $2-$3 while oil was down 30 points. Bean spreads weakened while product spreads were higher. Spot Jan-26 beans held in a tight range after ending a run of 6 consecutive lower closes yesterday. Jan-26 meal held support at its 100 day MA at $298.50. Jan-26 oil rejected trade above yesterday’s high however held support above $.48 lb. Spot board crush margins improved $.05 to $1.42 ½ bu. while ban oil PV slipped back to 44.5%. Soybean exports at 88 mil. were a MY high and brought YTD commitments to 947 mil. down 33% from YA vs. the USDA forecast of down 13%. Commitments represent 58% of the USDA forecast, below the historical average of 72%. Sales to China at nearly 1.4 mmt (51 mil. bu.) brought sales to 5.4 mmt. Announced flash sales add another 1 mmt to roughly 6.4 mmt. Actual sales are probably closer to 8.5 mmt when you include unannounced sales and some of the purchases currently sitting in the unknown category. Meal sales at 617k tons brought commitments to 8,485k tons up 10% YOY vs. the USDA export forecast of up 5%. Bean oil sales at 19 mil. lbs. bring YTD commitments to 460 mil. down 57% YOY vs. USDA down 64%.

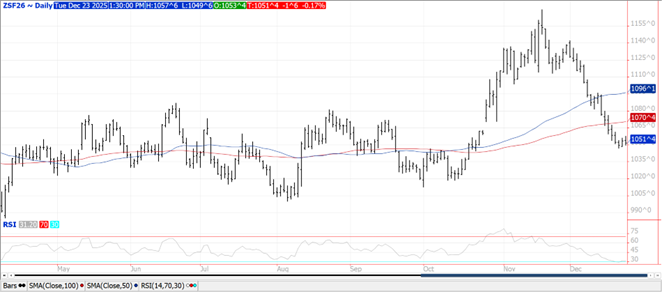

WHEAT

Prices ranges from steady in MIAX to $.06 higher in KC. KC Mch-26 spread over CGO Mch-26 is back over $.10 bu., $.30 off the lows from last month. Spreads firmed in both KC and CGO. Mch-26 KC topped out right at its 100 day MA at $5.29 ¾. Mch-26 CGO made a new high for the week in late trade. Export sales at 16 mil. bu. brought YTD commitments to 726 mil. bu. up 22% from YA, vs. the USDA forecast of up 9%. By class commitments vs. the USDA forecast are: HRW up 90% vs. USDA up 49%, SRW up 11% vs. up 2.6%, HRS down 8% in line with USDA, and white up 6% vs. down 10%. EU soft wheat exports as of Dec. 21st at 10.8 mmt are down 2% YOY. Jordan passed on making a wheat purchase in their recent tender for 120k mt.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.