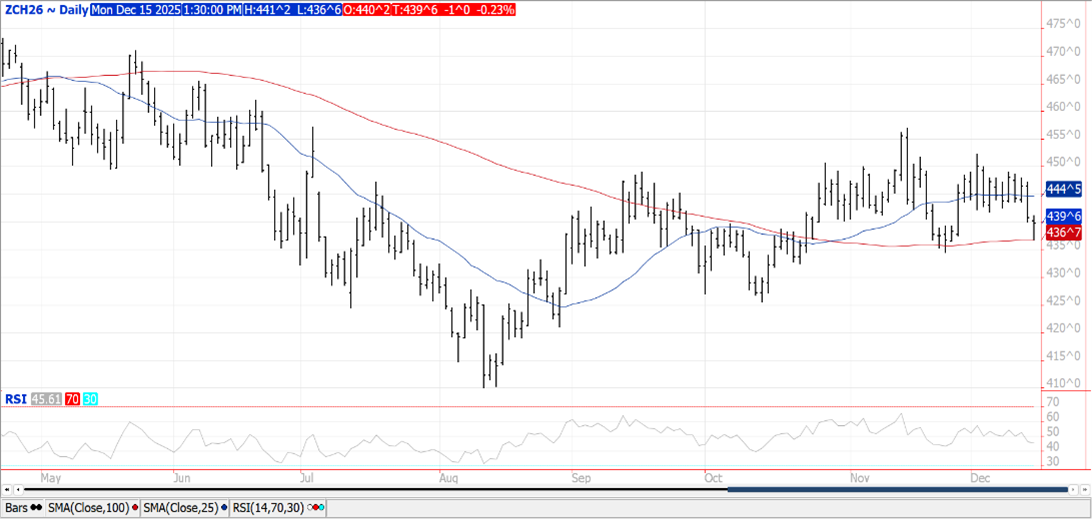

CORN

Prices were $.01 lower today in 2 sided trade. Spreads finished mixed and little changed. Although Mch-26 fell to a new low for the month, it held a challenge of its 100 day MA at $4.36 ¾. The $4.35-$4.55 range remains intact. Export sales for the week ended Nov. 20th at 73 mil. bu. brought commitments to 1.676 bil. up 31% from YA, vs. the USDA forecast of up 12%. The USDA also announced a flash sale of 150k mt (6 mil. bu.) to an unknown buyer. Export inspections for the week ended Nov. 11th at 62 mil. bu. were in line expectations. The previous week’s inspections were revised up by over 11 mil. bu. bringing YTD inspections to 886 mil., up 69% from YA. Noted buyers were Mexico – 19 mil. Japan – 11 mil., Spain – 9 mil. while 6.5 mil. to Colombia. For now export sales remain robust. The market still remains skeptical of the USDA feed usage forecast at 6.10 bil. bu., up 11.6% from YA as cattle on feed figures continue to run 1-2% below YA. Today’s CFTC report shows in the week ended Nov. 25th MM’s were net sellers of 49k contracts flipping their net position back to net short 11k contracts. Index funds were net buyers for a 5th consecutive week adding 11,431 contracts.

SOYBEANS

Prices were mixed across the complex with beans steady to $.05 lower, meal was up $1 while oil was down 60 points. Bean and oil spreads weakened while meal spreads were steady. Jan-26 beans slipped to a fresh 7 week low trading into the gap from late Oct-25 between $10.63-$10.70. So far the gap hasn’t been filled with prices moving back above the 100 day MA at $10.68 ½. Jan-26 meal has had 3 consecutive sessions of higher highs. Jan-26 oil fell to a fresh 6 week lows. Export sales for the week ended Nov. 20th at 85 mil. bu. were a MY high bringing commitments to 761 mil. down 38% from YA, vs. the USDA forecast of down 13%. There were 78 mil. bu. sold to China. Meal sales at 151k tons brought YTD commitments to 7,157k tons up 2% YOY vs. the USDA export forecast of up 5%. Bean oil sales at 16.5 mil. lbs. brought YTD exports to 382 mil. down 56% YOY vs. USDA down 64%. Export inspections at 29 mil. bu. were below expectations while bringing YTD inspections to 503 mil. down 46% from YA. Biggest takers were China with 7.4 mil. and Germany with 5 mil. NOPA crush for Nov-25 at 216 mil. bu. was below the Ave. trade guess of 220 mil. bu. however was within the range of est. and still the 2nd highest figure ever recorded. Implied census crush for Nov-25 at 225 mil. bu. would bring cumulative crush in the first 3 months of the 25/26 MY to 667 mil. up 9% from YA, vs. the USDA forecast of up 4.5%. This afternoon’s CFTC update as of Nov. 25th showed MM’s were net sellers of just over 15k contracts of soybeans, nearly 11k contracts of bean oil while buying just over 4k contracts of meal. Index funds were lite sellers in soybeans and soybean meal while a net buyer of just over 5k contracts of bean oil.

WHEAT

Prices were $.06-$.09 lower across the 3 classes today with all 3 falling to new lows for the month. Pressure was fueled by news that China bought a cargo of wheat from Argentina for the first time in decades. This after the Argentine Govt. lowered their export tax on the feed grain 2% to 7.5% in an effort to increase global share. Farmers there are nearing the completion of a record harvest following a near perfect growing season. US export sales the week ended Nov. 20th at 13 mil. bu. brought YTD commitments to 679 mil. bu. up 23% from YA, vs. the USDA forecast of up 9%. Export inspections at 18 mil. bu. were at the high end of expectations and just above the 16 mil. bu. needed per week to reach the USDA forecast. YTD inspections at 519 mil. bu. are up 22% from YA. This afternoon’s CFTC update as of Nov. 25th showed MM’s were net sellers of 5k contracts of CGO wheat, 2k KC while buying 4,503 contracts in MIAX. The combined short position is back out to nearly 98k contracts.

Charts provided by QST.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.