Soybeans, soyoil, soymeal and wheat traded lower. Corn traded higher. US stocks were higher. Crude was lower.

SOYBEANS

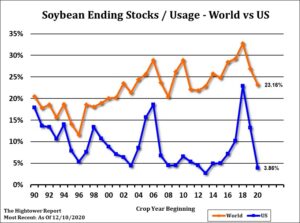

Overnight soybean calls were higher due to less than needed rains across South Brazil and Argentina and dry forecast for those areas. Talk that technically, soybean prices were overbought and that the ongoing Argentina strike may end this week triggered long liquidation. SH range was 12.47-12.80. Most feel continued South America dryness and increase demand for US export and crush should push soybean over last night high. USDA announced 233.7 mt US soybean to unknown and 125 mt US soybean to unknown. Weekly US soybean exports were near 53 mil bu vs 103 last week and 36 last year. Season to date exports are near 1,340 mil bu vs 763 last year. USDA goal is 2,200 versus 1,676 last year. USDA estimates US 2020/21 soybean demand near 4,534 mil bu versus 3,953 last year. This suggest a carryout near 175. Many could see higher US export and crush demand and carryout only at 100 mil bu.

CORN

Corn futures traded higher. Overnight trade was higher on talk that weekend rains across S Brazil and Argentina were less than needed and the forecast was for drier than normal rains there. Talk that futures were overbought triggered some long liquidation. Commercials were net buyers in the break in prices. Managed funds were net buyers of 10,000 corn. Managed funds are estimated to be net long 365,000 corn. USDA 149.5 mt US corn to unknown. Weekly US corn exports were near 39 mil bu vs 30 last week and 16 last year. Season to date exports are near 541 mil bu vs 317 last year. USDA goal is 2,650 versus 1,778 last year. USDA estimates US 2020/21 corn demand near 14,825 mil bu versus 13,887 last year. This suggest a carryout near 1,702. Many could see higher US exports and carryout closer to 1,460 mil bu. This should push prices higher. Corn futures may need to trend higher to encourage more US farmer selling and higher US 2021 planted acres.

WHEAT

Wheat futures traded lower. Talk of needed snow/moisture across parts of Russia and lack of new global wheat export demand offered resistance near key price levels. There was also some new buying of corn and selling of wheat spreading due to talk of tighter US corn supplies. Managed funds are net sellers of 5,000 wheat. Managed funds are estimated to be net long 15,000 wheat contracts. Weekly US wheat exports were near 11 mil bu vs 14 last week and 11 last year. Season to date exports are near 530 mil bu vs 532 last year. USDA goal is 985 versus 965 last year. USDA estimates US 2020/21 wheat demand near 2,112 mil bu versus 2,089 last year. This suggest a carryout near 862. Most do not look for much changes in this estimate. Some estimate US 2021 wheat crop near 1,900 and carryout near 850.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.