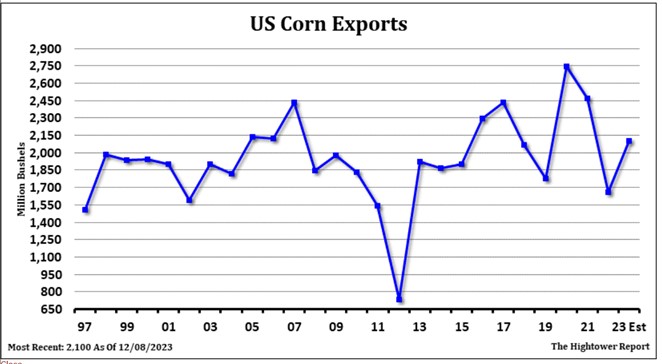

CORN

Corn futures bounced back to near 4.80. There was no real new news except Managed funds are short corn and could have seen some short covering before month end, quarter end and year end. Weekly US corn exports were 42 mil bu vs 36 last year. Season to date exports are near 442 vs 351 last year. One crop scout est Brazil corn crop at 117 mmt vs USDA 129 and 137 ly. Same group est Argentina corn crop at 53 mmt vs USDA 55 and 34 last year. Commercials are cheering the reopening of rail to and from Mexico. Corn and wheat could be supported by escalation in tension in the Red Sea.

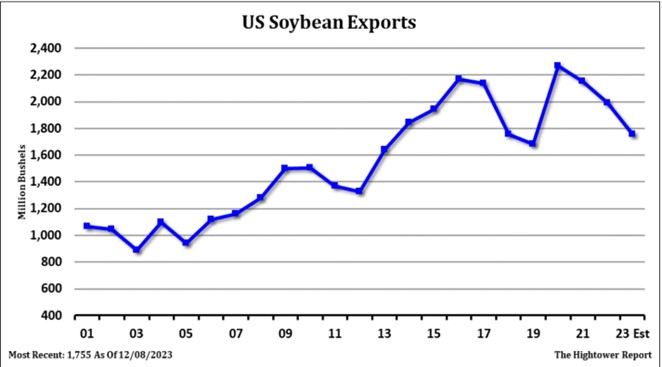

SOYBEANS

Soybean futures ended higher. SH retested the 200 day moving average. There were no new US soybean sales to China or unknown. Weekly US soybean exports were 39 mil bu vs 65 last year. Season to date exports are near 817 mil bu vs 1,003 last year. USDA est exports at 1,755 mil bu vs 1,992 Last year. One crop scout est Brazil soybean crop down 2 mmt to 153 vs USDA 161 and 160 ly. Same group est Argentina soybean crop at 50 mmt vs USDA 48 and 25 ly. USDA est World soybean trade near 170 mmt vs 171 ly. Brazil is 99 mmt vs 95 ly, Argentina 4 mmt vs 4 ly, US is est at 48 mmt vs 54. World soybean ending stocks are expected to increase to 114 mmt vs 102 ly.

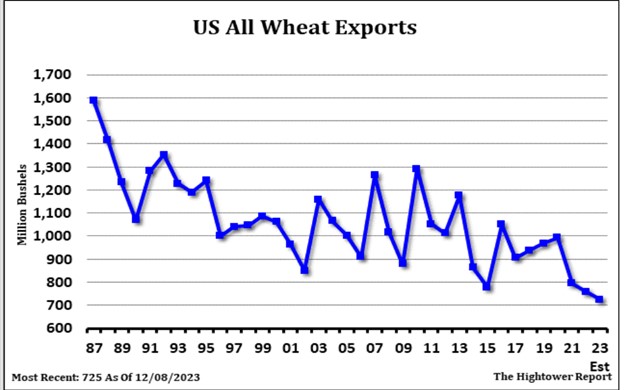

WHEAT

Wheat futures ended higher on month end, quarter end, yearend short covering. WH ended up 20 cents and near 6.36. KWH ended up 20 cents and near 6.43. MWH ended up 15 cents and near 7.29. Wheat and corn could be supported by escalation in tension in the Red Sea. Weekly US wheat exports were 15 mil bu vs 13 last year. Season to date exports are near 342 mil bu vs 433 last year. Trade est exports at 825 mil bu vs 725 last year. World trade is est at 207 mmt vs 219 ly. Russia is 50 mmt, Ukraine 12, Canada 23, Australia 18 and US 19. Last years breakdown was Russia 47, Ukraine 17, Canada 25, Australia 32 and US 20.

See more market commentary here.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.