Soybeans, soymeal and corn traded higher and near session highs. Soyoil slipped lower. Wheat managed late gains. US stocks were higher. US Dollar was higher but ended unchanged and well off overnight highs. Crude was lower. Copper was lower.

SOYBEANS

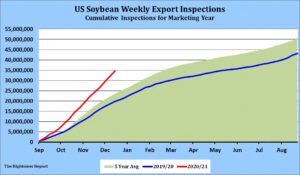

Soybean futures ended higher and at new highs. Crazy, crazy, crazy grain trading day. First, the overnight trade was higher on some follow through buying after last week’s higher closes and less than expected rains across north Brazil and most of Argentina. Market then broke hard following news that a new mutant strain of the virus was detected in the UK and that most Europe countries were restricting travel into and out of UK. Weekly US soybean exports were near 93 mil bu versus 90 last week and 40 last year. Season to date exports are 1,275 mil bu versus 727 last year. USDA goal is 2,200 versus 1,676 last year. Some feel USDA will need to add 100 mil bu to their export forecast. This and a higher US crush could drop US 2020/21 soybean carryout below 100. Some feel this could rally nearby soybean futures closer to 14.00. Dry Argentina weather and ongoing dock strike could also increase demand for US soymeal exports/crush.

CORN

Corn futures tended to follow most commodity and financial markets Wild trade. Corn traded higher overnight on less than expected rains in parts of Argentina and N Brazil. Long range forecast suggest S Brazil and most of Argentina will see less than normal rains over the next few week’s. Argentina corn and first Brazil crops is now pollinating and dry Weather could reduce yields. Word of a new strain of the Covid virus in UK sent markets lower and US Dollar sharply higher. Talk that the new virus may be able to be controlled by current vaccines. Weekly US corn exports were near 30 mil bu versus 16 last year. Season to date exports are near 501 mil bu versus 301 last year. USDA goal is 2,650 versus 1,778 last year. Some feel final exports could be closer to 2,800-3,000 mil bu. US corn export prices are lowest in World. Lower 2021 South America 2021 crops could drop US carryout and push 2021 prices higher. Some feel higher soybean prices could suggest nearby corn may need to trade closer to 4.65 to insure higher US 2021 acres.

WHEAT

Wheat futures managed small gains after trading most of the session lower. Crazy, crazy, crazy grain trading day. First, the overnight trade was higher on some follow through buying after last week’s higher closes. Market then broke hard following news that a new mutant strain of the virus was detected in the UK and that most Euro countries were restricting travel into and out of UK. France is blocking all truck activity into the UK including food shipments. Strong rally in Dollar may have also weighed on wheat futures. Hope that the vaccines will still be successful against the virus may have brought prices back. Some still feel lower US/Russia 2012 crops could support prices. Weekly US wheat exports were 14 mil bu versus 22 last year. Season to date exports are 519 versus 521 last year. USDA goal is 985 versus 965 last year. Uncertainty concerning Russia 2021 export policy could offer support to World wheat prices.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.