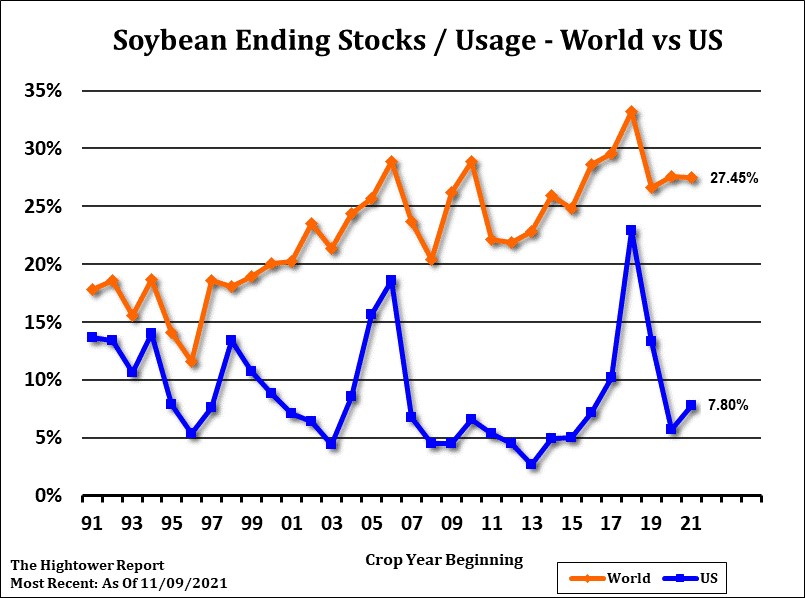

SOYBEANS

Soybeans ended higher. This due in part due to strong US domestic basis and fact hedge funds may be back buying recently sold contracts. Some link this to hope that Omicron virus will not be as harmful as feared Tuesday. US stocks and Crude loss most of the day gains due to word of first US Omicron virus case. Trade still worried about favorable South America weather to date. There is no South America weather premium in prices. Long range weather maps hint of drier weather across South Brazil and Argentina. Weekly US soybean export sales are estimated near 800-1,500 mt. Some still fear lower China demand and higher Brazil supply could reduce US exports and raise carryout. USDA est World soybean trade near 172 mmt vs 164 ly. China imports 100 mmt vs 100 ly. US exports 56 mt vs 62, Brazil 94 vs 81 ly.

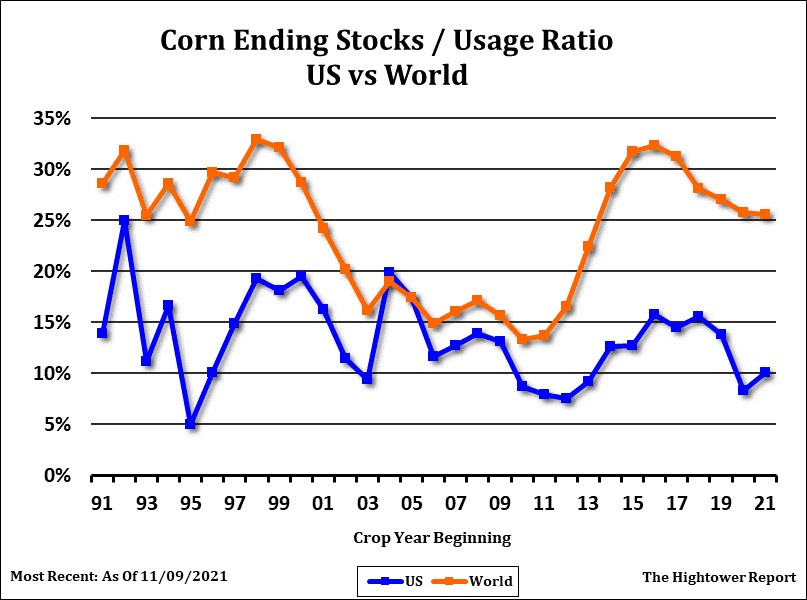

CORN

Corn futures ended higher. CH is near 5.71. Range was 5.67-5.76. CZ is near 5.72. Strong domestic cash basis supports CZ. CZ22 is near 5.48. CZ23 is near 5.07. Over the last 3 days, Corn open interest has dropped173,000 contracts. This due to concern and new virus could lower demand. Funds had added to net longs on hopes of higher demand lowering US 2021/22 carryout. Funds also bought on fears of lower US 2022 corn crop due to higher cost of planting. Argentina and Ukraine export corn prices are a discount to US. Weekly US corn export sales are estimated near 600-1,200 mt. Weekly ethanol production was up 6 pct from last year. Stocks were down 4 pct from last year. Margins remain positive. There is no South America weather premium in prices. Long range weather maps hint of drier weather across South Brazil and Argentina. Some still fear higher Ukraine, Argentina and Brazil supply could reduce US exports and raise carryout. USDA est World corn trade near a record 203 mmt vs 176 ly. China imports 26 mmt vs 29 ly. Mexico 17 vs 16. EU 15 vs 14. Japan 15 vs 15. Canada 5 vs 1. US exports 63 mt vs 70, Brazil 43 vs 17, Argentina 39 vs 38, Ukraine 31 vs 23.

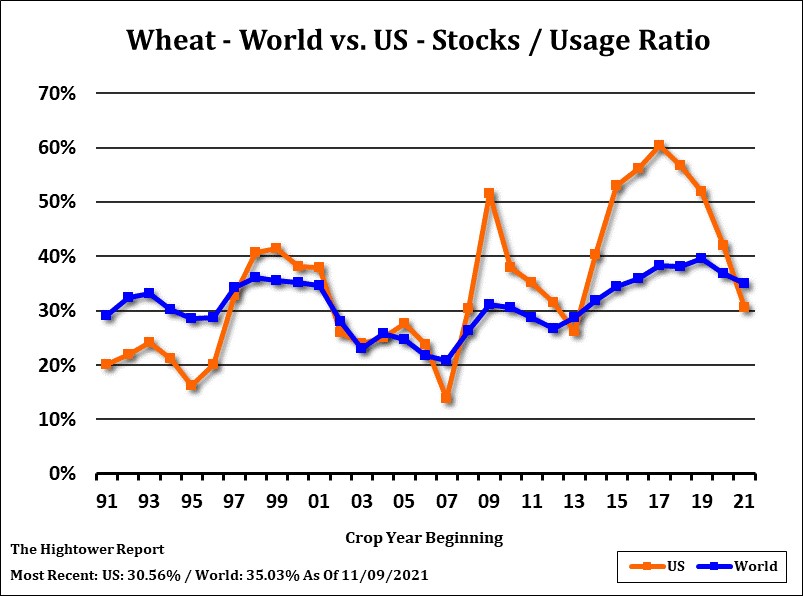

WHEAT

Wheat futures ended mixed. Chicago is following corn. KC is seeing pressure from record high Australia crop estimate. Minneapolis spring wheat futures are higher on lower wheat milling wheat supplies. Drier US 2022 weather forecast should support prices. Trade estimates weekly US wheat export sales near 250-600 mt. USDA estimates World wheat trade near 203 mmt vs 201 last year. US exports 23 mmt vs 27 ly. EU 36 vs 29, Russia 35 vs 38,Australia 23 vs 24 but crop could be 3 mmt higher. Ukraine 24 mmt vs 21 and Canada 15 mmt vs 25. Trade est Canada crop near 21 mmt vs USDA 21 and 35 ly. USDA estimates World wheat end stocks near 275 mmt vs 287 last year. Some feel on Dec 9, USDA could drop World wheat end stocks 4-5 mmt. Some feel Russia Dec exports could drop and there are no sellers for January.

Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. The information and comments contained herein is provided by ADMIS and in no way should be construed to be information provided by ADM. The author of this report did not have a financial interest in any of the contracts discussed in this report at the time the report was prepared. The information provided is designed to assist in your analysis and evaluation of the futures and options markets. However, any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to ADMIS. Copyright ADM Investor Services, Inc.